Get the free Tax Site Locations

Show details

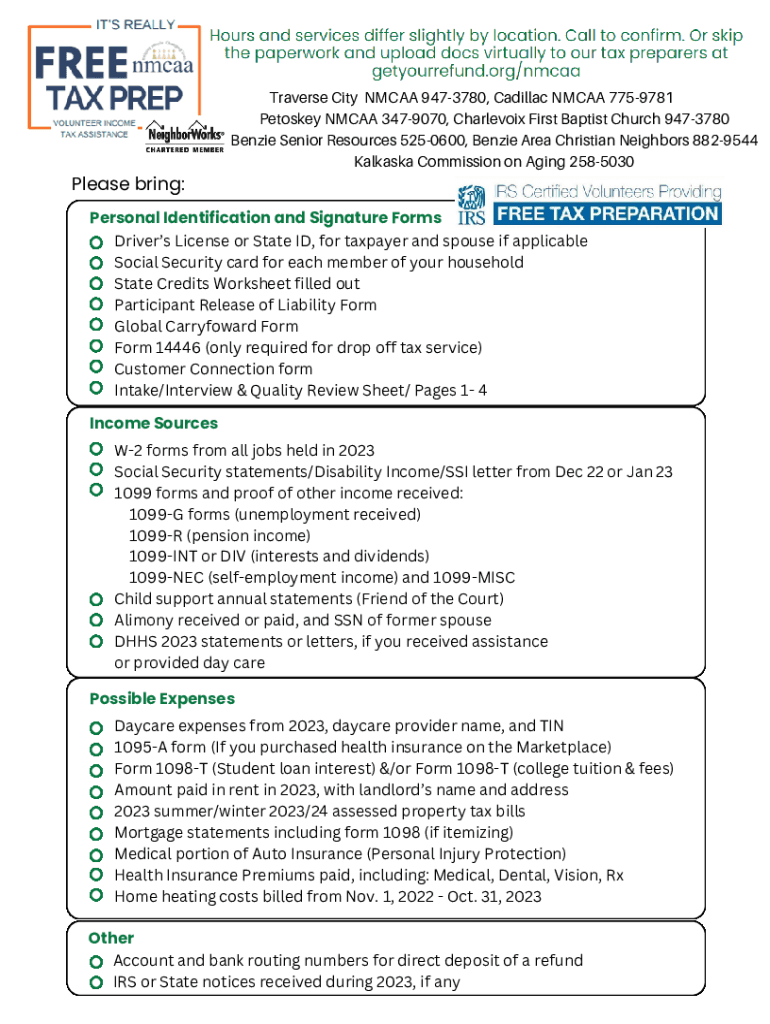

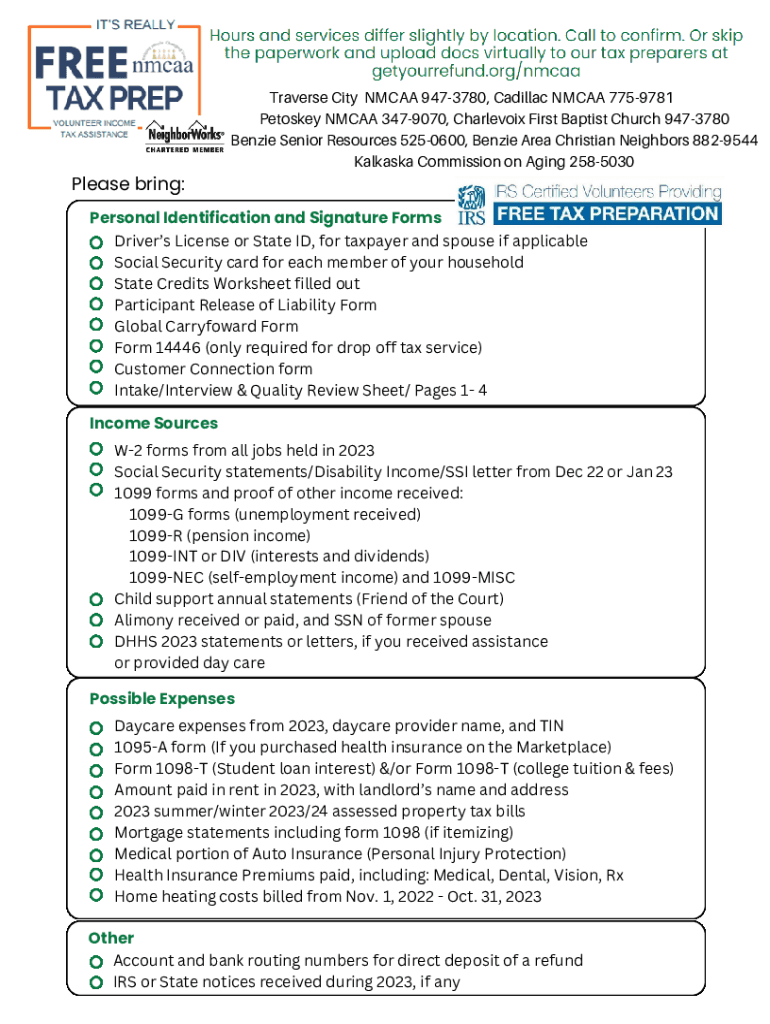

Traverse City NMCAA 9473780, Cadillac NMCAA 7759781 Petoskey NMCAA 3479070, Charlevoix First Baptist Church 9473780 Benzie Senior Resources 5250600, Benzie Area Christian Neighbors 8829544 Kalkaska

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax site locations

Edit your tax site locations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax site locations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax site locations online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax site locations. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax site locations

How to fill out tax site locations

01

Access the tax site location page on the website.

02

Enter your zip code or city to search for nearby tax site locations.

03

Filter the results based on the type of tax assistance you require (e.g., free tax preparation, tax counseling, etc.).

04

Click on a specific tax site for more information.

05

Check the operating hours and days for the tax site.

06

Make a note of any special requirements or documents needed for the tax assistance.

07

Plan your visit to the tax site accordingly.

08

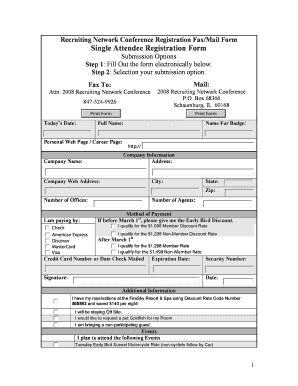

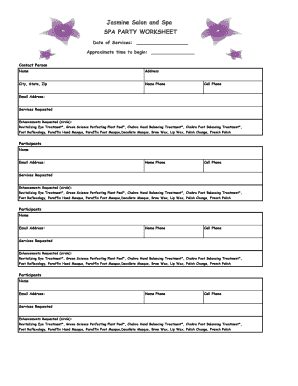

Fill out any required forms or documents at the tax site for tax preparation or counseling.

09

Bring all necessary documents, such as identification, Social Security card, W-2 forms, etc.

10

Follow the guidance of the tax site staff and provide any additional information or documentation as requested.

11

Wait for the tax preparation or counseling to be completed.

12

Review the prepared tax return or seek advice from the tax counselor.

13

Sign and submit the tax return if you are satisfied with the results.

14

Ask any relevant questions or clarify any doubts before leaving the tax site.

15

Keep a copy of the completed tax return and any associated documents for your records.

Who needs tax site locations?

01

Individuals who need assistance in filling out their tax returns.

02

People who are unsure about certain aspects of their tax situation.

03

Taxpayers who are eligible for free tax preparation services.

04

Individuals who want to seek advice or guidance regarding tax-related matters.

05

Those who prefer to have their tax returns prepared by experts or professionals.

06

Anyone who wants to ensure accurate and compliant tax filing.

07

Taxpayers who may qualify for special tax credits or deductions and need assistance in claiming them.

08

Individuals who want to stay updated with changes in tax laws and regulations.

09

People seeking support or resources for tax-related issues and concerns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax site locations to be eSigned by others?

Once your tax site locations is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute tax site locations online?

pdfFiller has made it simple to fill out and eSign tax site locations. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit tax site locations on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share tax site locations on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is tax site locations?

Tax site locations refer to the physical or online places where individuals or businesses can file their tax returns or seek assistance in completing their tax obligations.

Who is required to file tax site locations?

Individuals and businesses that have income or tax obligations are required to file tax site locations. This typically includes employees, self-employed individuals, and corporations.

How to fill out tax site locations?

Filling out tax site locations typically involves completing tax forms provided at those locations, either digitally or on paper, and providing required documentation such as W-2s or 1099s.

What is the purpose of tax site locations?

The purpose of tax site locations is to facilitate the filing of tax returns, provide support and resources for taxpayers, and ensure compliance with tax laws.

What information must be reported on tax site locations?

Tax site locations must report information such as income earned, tax withheld, deductions claimed, and any credits or exemptions applicable.

Fill out your tax site locations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Site Locations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.