Get the Tax-free rollovers from 529 plans to Roth IRAs allowed as ...

Show details

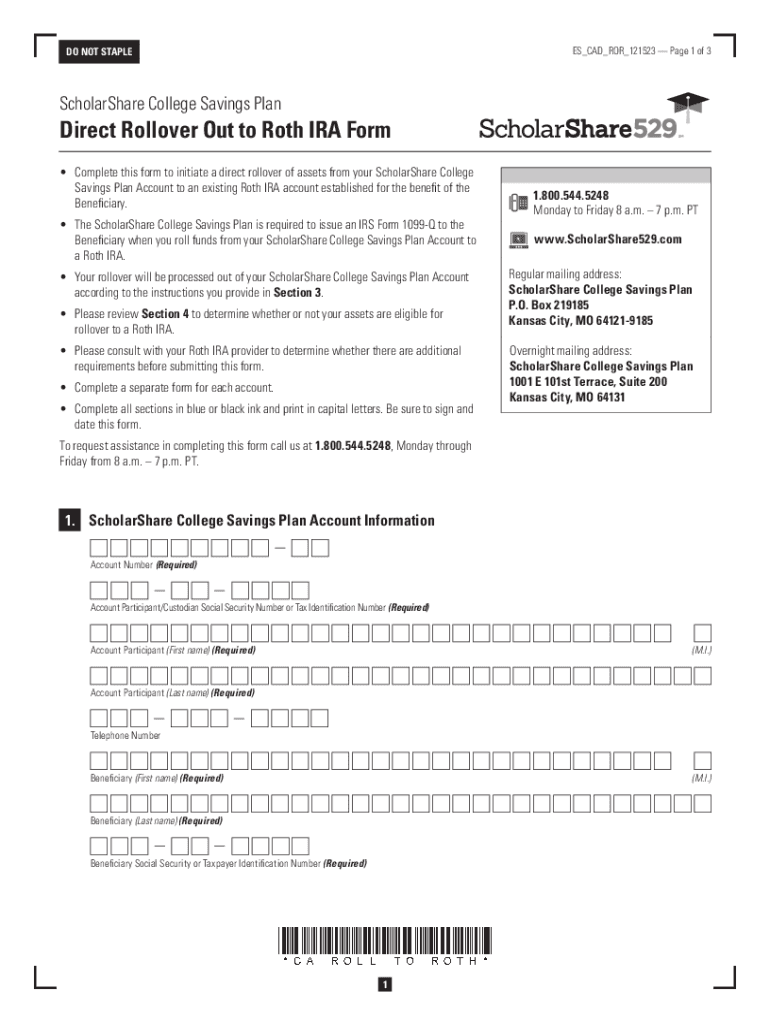

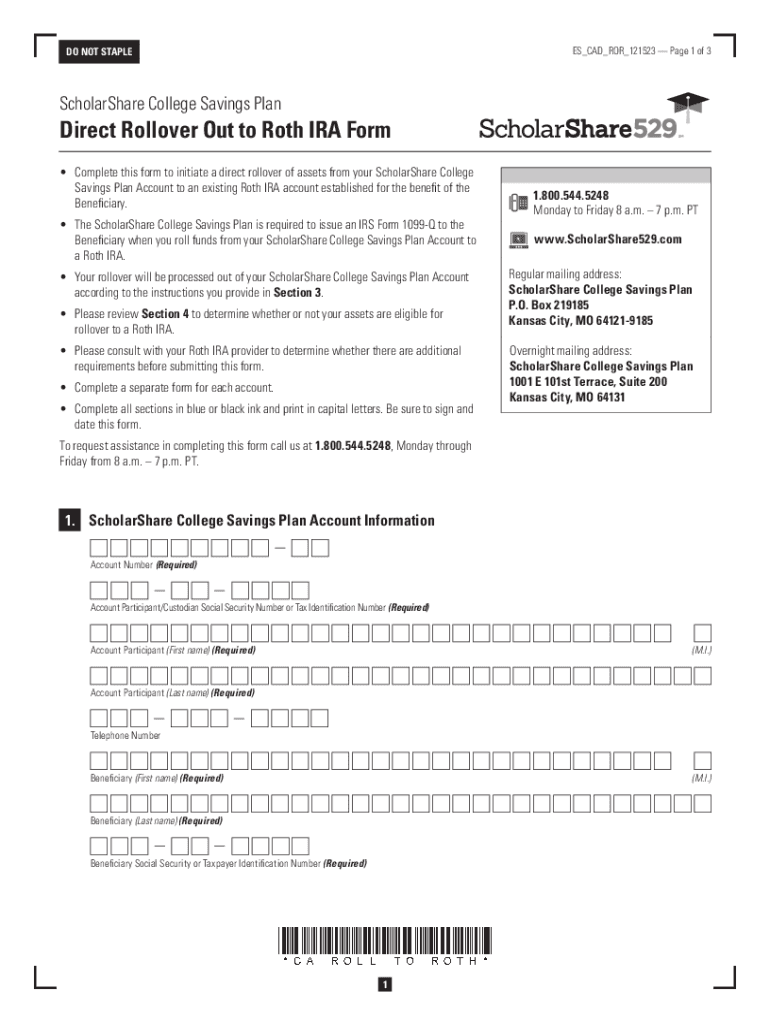

ES_CAD_ROR_121523 Page 1 of 3DO NOT STAPLEScholarShare529ScholarShare College Savings PlanDirect Rollover Out to Roth IRA Form Complete this form to initiate a direct rollover of assets from your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax- rollovers from 529

Edit your tax- rollovers from 529 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax- rollovers from 529 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax- rollovers from 529 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax- rollovers from 529. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax- rollovers from 529

How to fill out tax- rollovers from 529

01

Step 1: Gather all necessary documents such as your 529 plan statement and the tax form for reporting rollovers (typically Form 1098-T or similar).

02

Step 2: Determine the amount you want to rollover from your 529 plan. This can include the principal amount and any earnings.

03

Step 3: Complete the necessary sections on the tax form, providing accurate information about the rollover amount and the details of your 529 plan.

04

Step 4: Double-check all the information you have provided to ensure its accuracy.

05

Step 5: Submit the completed tax form along with any supporting documents to the appropriate tax authority.

06

Step 6: Keep a copy of the submitted documents for your records.

Who needs tax- rollovers from 529?

01

Individuals who have a 529 plan and wish to transfer the funds to another eligible education savings account or use them for qualified education expenses may need to utilize tax-rollovers from 529.

02

Tax-rollovers from 529 may be beneficial for parents saving for their children's education, as well as individuals looking to take advantage of tax advantages associated with 529 plans.

03

Additionally, individuals who have excess funds in their 529 plans or want to consolidate multiple 529 accounts may find tax-rollovers useful.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tax- rollovers from 529?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the tax- rollovers from 529. Open it immediately and start altering it with sophisticated capabilities.

How do I edit tax- rollovers from 529 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your tax- rollovers from 529, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete tax- rollovers from 529 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your tax- rollovers from 529. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is tax- rollovers from 529?

Tax rollovers from a 529 plan allow the account holder to transfer funds from one 529 plan to another without incurring taxes, provided the rollover is completed within a specific timeframe and follows IRS guidelines.

Who is required to file tax- rollovers from 529?

The account holder of the 529 plan who initiates the rollover is required to report the rollover on their tax return, although they may not owe any taxes on it.

How to fill out tax- rollovers from 529?

To report a 529 plan rollover, individuals need to complete Form 1040 and include any necessary information about the rollover on the appropriate lines or forms, indicating it was a tax-free rollover.

What is the purpose of tax- rollovers from 529?

The purpose of tax rollovers from a 529 plan is to allow account holders the flexibility to change their investment to different plans or providers, making it easier to manage educational savings while avoiding tax penalties.

What information must be reported on tax- rollovers from 529?

Account holders must report the amount rolled over, the original 529 plan and the receiving 529 plan, and confirm that the rollover was done according to IRS rules to avoid taxation.

Fill out your tax- rollovers from 529 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax- Rollovers From 529 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.