Get the free Assessment Tax Rebate Scheme for Eco-Friendly House ...

Show details

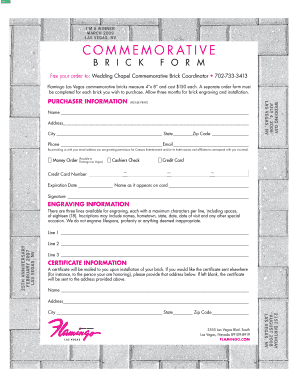

APPLICATION FORM ASSESSMENT TAX REBATE FOR ECOFRIENDLY HOUSE OWNERS LOW CARBON GREEN CITY OF PETALING JAYA YEAR 2023Content: Section I:Application Guidelines and ConditionsSection II:Applicant DetailsSection

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign assessment tax rebate scheme

Edit your assessment tax rebate scheme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your assessment tax rebate scheme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit assessment tax rebate scheme online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit assessment tax rebate scheme. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out assessment tax rebate scheme

How to fill out assessment tax rebate scheme

01

Gather all your relevant financial documents such as income statements, receipts, and tax forms.

02

Check if you are eligible for the assessment tax rebate scheme by reviewing the criteria provided by your government or tax authority.

03

Fill out the assessment tax rebate form accurately and completely. Provide all the requested information, including personal details, income sources, and expenses.

04

Attach all the required supporting documents to your application, such as proof of income, receipts for expenses, and any other relevant paperwork.

05

Double-check your form and attachments for any errors or omissions to ensure accuracy.

06

Submit your completed application and supporting documents to the designated tax authority or government office. Follow the given instructions for submission.

07

Keep copies of all the documents you submitted for your own records.

08

Wait for the processing of your application. The time it takes may vary, so consult the relevant authority for any specific timelines or updates.

09

If approved, you will receive notification of your tax rebate and the amount you are entitled to.

10

If your application is rejected or you have concerns, consult the tax authority or seek professional advice to understand the reasons and explore any possible further actions.

Who needs assessment tax rebate scheme?

01

Anyone who has paid excess taxes during a specific period and meets the eligibility criteria set by the government or tax authority.

02

Individuals or businesses that have incurred deductible expenses or have qualified exemptions as per the tax laws and regulations.

03

Taxpayers who want to claim rebates or refunds for overpayments made in previous assessment years.

04

People who have experienced changes in their income, such as a decrease due to job loss or an increase in eligible deductions, may benefit from the assessment tax rebate scheme.

05

Individuals or entities residing or operating within the jurisdiction where the assessment tax rebate scheme is applicable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find assessment tax rebate scheme?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific assessment tax rebate scheme and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out the assessment tax rebate scheme form on my smartphone?

Use the pdfFiller mobile app to complete and sign assessment tax rebate scheme on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out assessment tax rebate scheme on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your assessment tax rebate scheme. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is assessment tax rebate scheme?

The assessment tax rebate scheme is a financial program designed to provide tax relief to individuals or businesses by allowing them to claim rebates on certain taxes paid.

Who is required to file assessment tax rebate scheme?

Individuals or entities that have paid applicable taxes and meet specific criteria set by the tax authority are required to file for the assessment tax rebate scheme.

How to fill out assessment tax rebate scheme?

To fill out the assessment tax rebate scheme, taxpayers must obtain the appropriate forms from the tax authority, provide necessary documentation, and accurately report their tax payments and eligible deductions.

What is the purpose of assessment tax rebate scheme?

The purpose of the assessment tax rebate scheme is to reduce the overall tax burden on taxpayers and to stimulate economic activity by providing financial relief.

What information must be reported on assessment tax rebate scheme?

Taxpayers must report personal or business identification details, total taxes paid, eligible deductions, and any other required financial information as specified by the tax authority.

When is the deadline to file assessment tax rebate scheme in 2024?

The deadline to file the assessment tax rebate scheme in 2024 is typically set by the tax authority, commonly at a specified date in April or May; taxpayers should check for specific dates for the current year.

What is the penalty for the late filing of assessment tax rebate scheme?

The penalty for late filing of the assessment tax rebate scheme may include financial fines, interest on unpaid taxes, and potential restrictions on future filings as determined by the tax authority.

Fill out your assessment tax rebate scheme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Assessment Tax Rebate Scheme is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.