Get the free Heritage Law: Estate Planning and Elder Law Attorneys NC

Show details

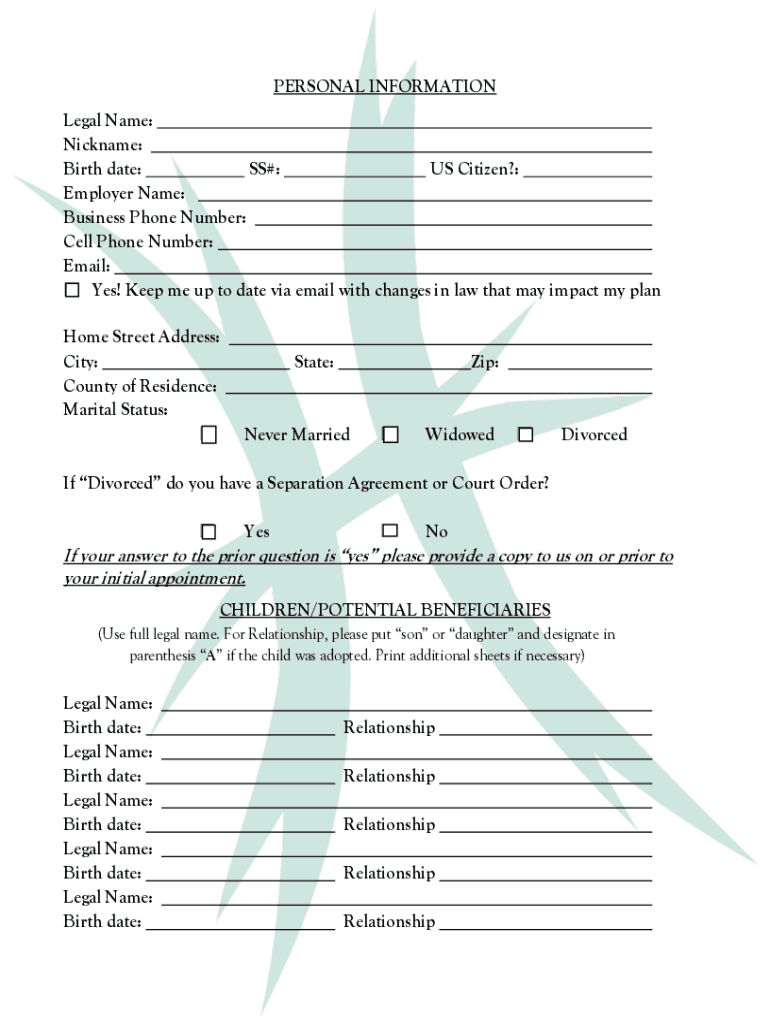

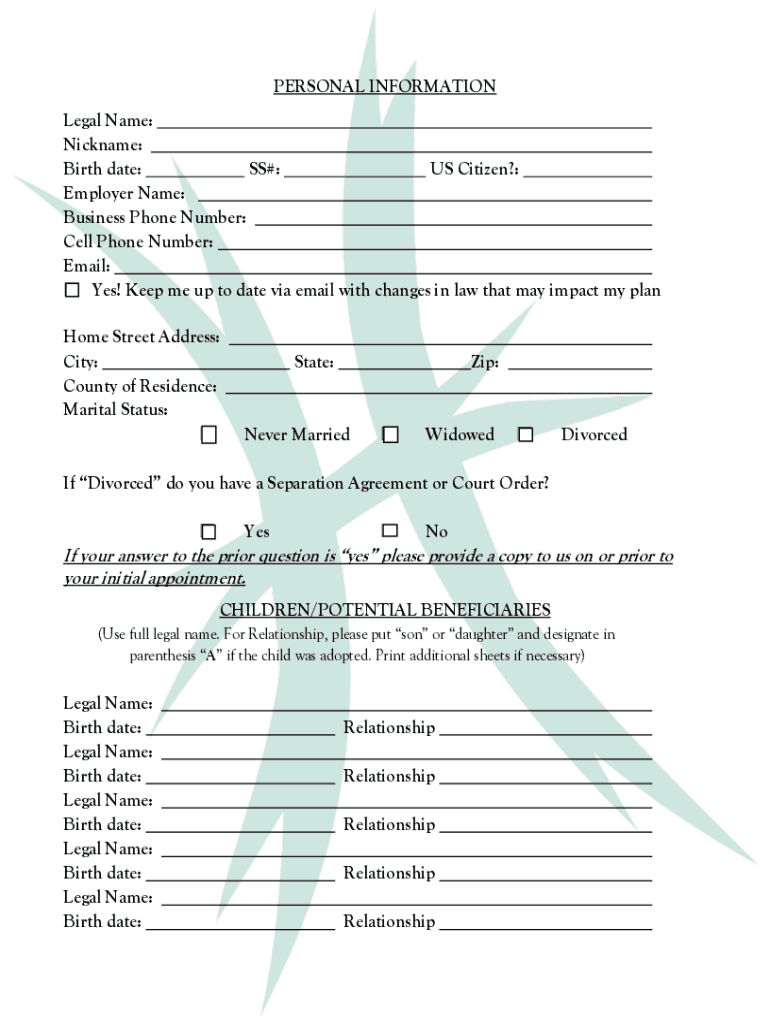

ESTATE PLANNING WORKSHEETHeritage Law Firm PO Box 974 Fort Mill, SC 29716 (704) 2333550 main office (704) 2346598 main fax www.heritage.law info@heritage.lawUSING THE INFORMATION ON THIS PAGE, PLEASE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign heritage law estate planning

Edit your heritage law estate planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your heritage law estate planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit heritage law estate planning online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit heritage law estate planning. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out heritage law estate planning

How to fill out heritage law estate planning

01

To fill out heritage law estate planning, follow these steps:

02

Start by identifying all the assets you own, including real estate, investments, bank accounts, vehicles, and valuable possessions.

03

Determine how you want your assets to be distributed after your passing. Consider who should inherit your property and any specific instructions you may have.

04

Consult with an attorney who specializes in estate planning to ensure all legal requirements are met. They can guide you through the process and help you create necessary legal documents.

05

Create a will to outline your wishes regarding asset distribution and appoint an executor to carry out your instructions.

06

Consider establishing a trust to protect your assets and minimize estate taxes. This can be especially beneficial if you have minor children or dependent family members.

07

Update your beneficiaries on insurance policies, retirement accounts, and other financial accounts to ensure they align with your estate plan.

08

Review your estate plan periodically and make updates as needed. Life events such as marriage, divorce, births, or deaths may necessitate changes to your plan.

09

Communicate your estate plan with your loved ones and make sure they understand your wishes and who to contact in case of your passing.

10

Keep important documents related to your estate plan organized and easily accessible.

11

Consider seeking financial and tax advice to better understand the implications of your estate plan and any potential tax strategies.

Who needs heritage law estate planning?

01

Heritage law estate planning is beneficial for anyone who wants to ensure their assets are distributed according to their wishes after their passing.

02

Specific individuals who may benefit from heritage law estate planning include:

03

- Individuals with significant assets, such as real estate, investments, or business interests.

04

- Parents or guardians of minor children who want to establish guardianship and ensure their care.

05

- Individuals with specific wishes for asset distribution or concerns about potential family disputes.

06

- Individuals who want to minimize estate taxes and protect their assets from creditors or lawsuits.

07

Ultimately, heritage law estate planning provides peace of mind and ensures your assets are handled according to your wishes, regardless of your net worth or family situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find heritage law estate planning?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the heritage law estate planning in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I fill out heritage law estate planning on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your heritage law estate planning. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit heritage law estate planning on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as heritage law estate planning. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is heritage law estate planning?

Heritage law estate planning refers to the legal framework and processes involved in managing and distributing an individual's assets and liabilities upon their death. It ensures that an individual's wishes regarding their estate are honored and provides tax advantages.

Who is required to file heritage law estate planning?

Individuals who own significant assets, have dependents, or wish to ensure that their estate is handled according to their wishes are generally required to engage in heritage law estate planning.

How to fill out heritage law estate planning?

Filling out heritage law estate planning typically involves gathering personal information, listing assets and liabilities, choosing beneficiaries, and possibly working with an attorney to create documents like wills or trusts.

What is the purpose of heritage law estate planning?

The purpose of heritage law estate planning is to provide a clear plan for asset distribution, minimize taxes, avoid probate, and protect heirs by legally designating how one's estate will be managed after death.

What information must be reported on heritage law estate planning?

Information that must be reported includes details about assets (like real estate, bank accounts, investments), liabilities, beneficiaries, and any specific wishes regarding funeral arrangements and asset distribution.

Fill out your heritage law estate planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Heritage Law Estate Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.