Get the free Large Financial Institution Rating System; Regulations K ...

Show details

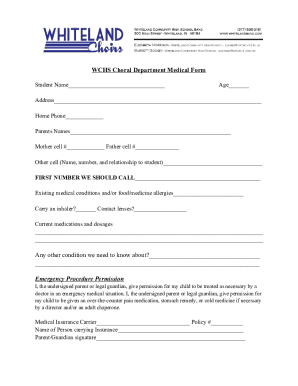

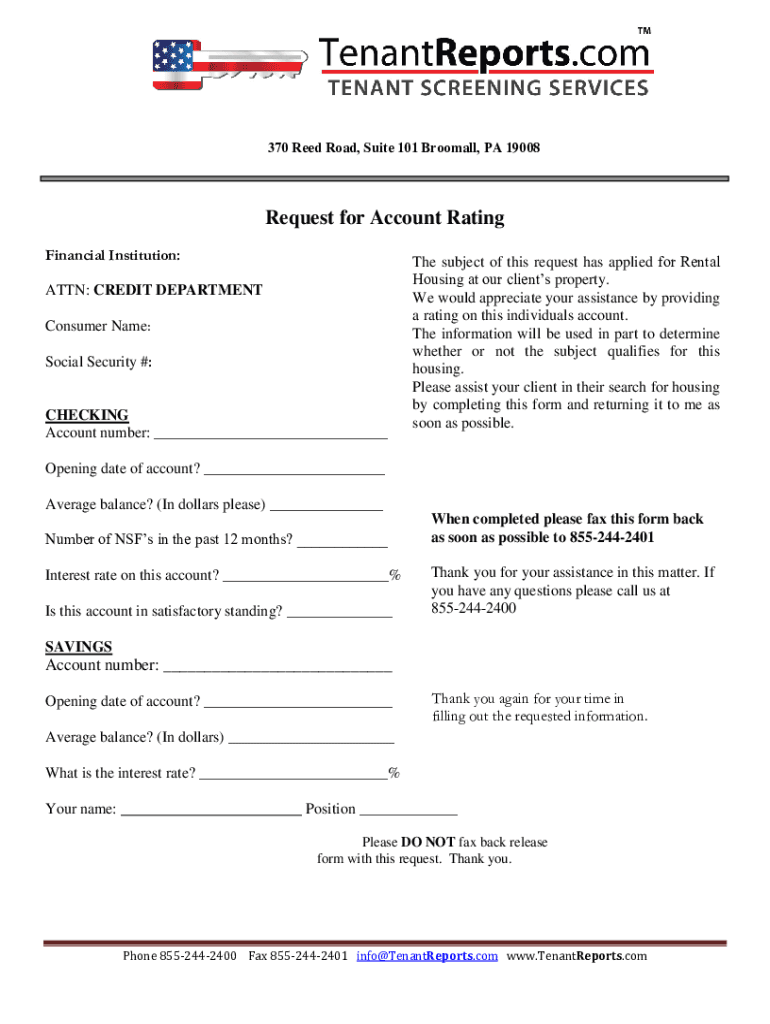

370 Reed Road, Suite 101 Broom all, PA 19008Request for Account Rating

Financial Institution:

ATTN: CREDIT DEPARTMENT

Consumer Name:

Social Security #:CHECKING

Account number: ___The subject of this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign large financial institution rating

Edit your large financial institution rating form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your large financial institution rating form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit large financial institution rating online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit large financial institution rating. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out large financial institution rating

How to fill out large financial institution rating

01

Start by gathering all the necessary financial information of the institution, including its financial statements, balance sheets, income statements, and cash flow statements.

02

Analyze the financial data to assess the institution's financial performance, stability, liquidity, profitability, and other key financial indicators.

03

Evaluate the institution's risk management practices, including its risk assessment processes, risk mitigation strategies, and regulatory compliance.

04

Conduct a thorough assessment of the institution's governance structure, including its board of directors, executive management, and internal control systems.

05

Consider the institution's market presence, competitive position, and market share to assess its overall strength and market reputation.

06

Evaluate the institution's customer base, including the size, diversity, and stability of its customer relationships.

07

Assess the institution's technological capabilities and digital transformation efforts, including its ability to adapt and innovate in the rapidly evolving financial industry.

08

Consider any additional factors specific to the institution or the industry it operates in that may impact its overall rating.

09

Summarize the findings and assign a rating to the institution based on the rating scale or criteria set by the rating agency or regulatory body.

10

Communicate the rating to the relevant stakeholders, including the institution itself, investors, regulators, and the general public.

11

Periodically review and update the rating based on new financial information or significant developments in the institution's operations.

Who needs large financial institution rating?

01

Large financial institution ratings are typically needed by various stakeholders, such as:

02

- Investors: who use the ratings to assess the financial strength and stability of the institution before making investment decisions.

03

- Regulators: who rely on the ratings to evaluate the safety and soundness of the institution and determine the level of regulatory oversight required.

04

- Banks and financial institutions: who consider the ratings when assessing the creditworthiness and risk exposure of the institution for interbank transactions.

05

- Insurance companies: who use the ratings to determine the financial strength and stability of the institution before entering into reinsurance agreements or issuing policies.

06

- Government agencies and policymakers: who consider the ratings when formulating financial regulations and policies to ensure the stability of the financial system.

07

- Researchers and analysts: who utilize the ratings to conduct studies, perform comparative analysis, and evaluate the overall health of the financial industry.

08

- General public: who may be interested in the ratings to gain insights into the financial strength and reputation of the institution for various purposes, such as choosing a banking partner.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my large financial institution rating in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your large financial institution rating and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit large financial institution rating on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing large financial institution rating, you need to install and log in to the app.

How do I edit large financial institution rating on an iOS device?

You certainly can. You can quickly edit, distribute, and sign large financial institution rating on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

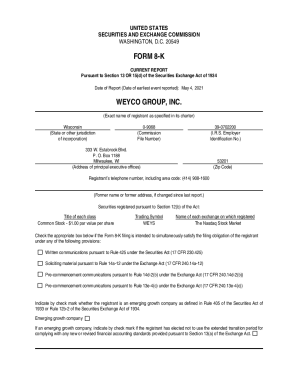

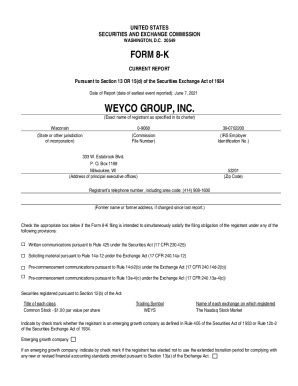

What is large financial institution rating?

Large financial institution rating refers to the assessment and rating of the financial health and stability of large financial organizations, typically conducted by regulatory bodies to evaluate risk and compliance.

Who is required to file large financial institution rating?

Large financial institutions, such as banks and credit unions with assets exceeding a specific threshold set by regulatory authorities, are required to file large financial institution ratings.

How to fill out large financial institution rating?

To fill out a large financial institution rating, organizations should provide accurate financial data, risk assessments, compliance information, and any other relevant documentation as specified by the regulatory authority.

What is the purpose of large financial institution rating?

The purpose of large financial institution rating is to ensure the stability and soundness of financial institutions, protect consumers, and prevent systemic risks in the financial system.

What information must be reported on large financial institution rating?

Organizations must report detailed financial statements, capital adequacy ratios, risk management strategies, compliance histories, and any material changes affecting their financial position.

Fill out your large financial institution rating online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Large Financial Institution Rating is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.