Get the free CREDIT HISTORY (if applicable)

Show details

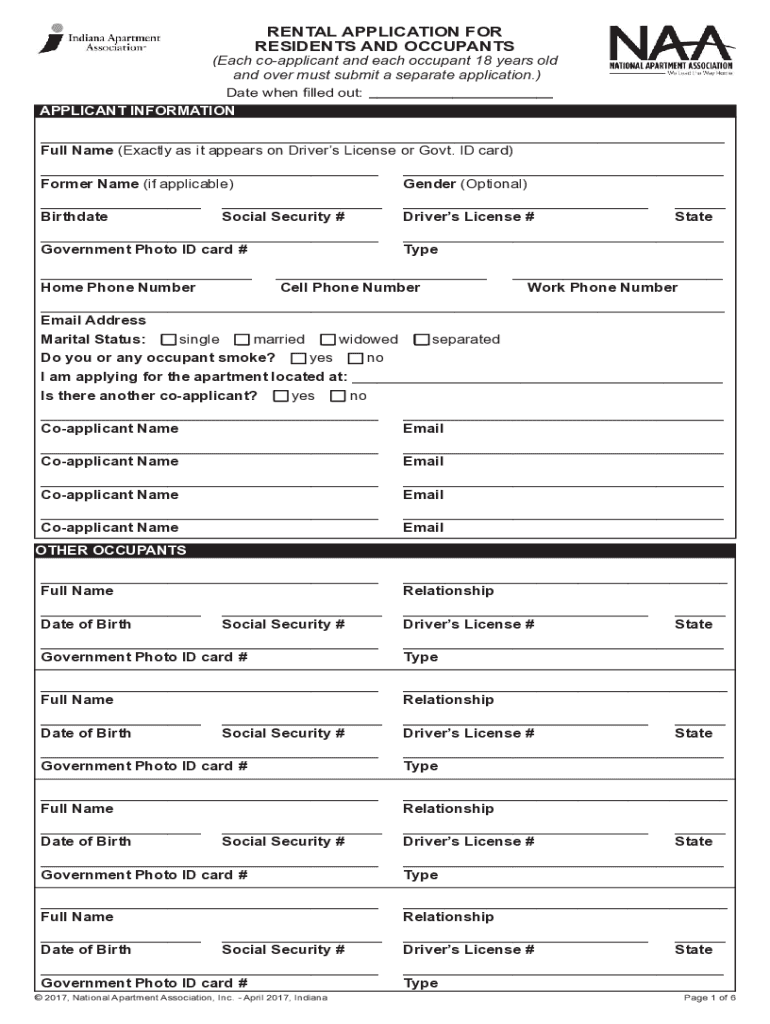

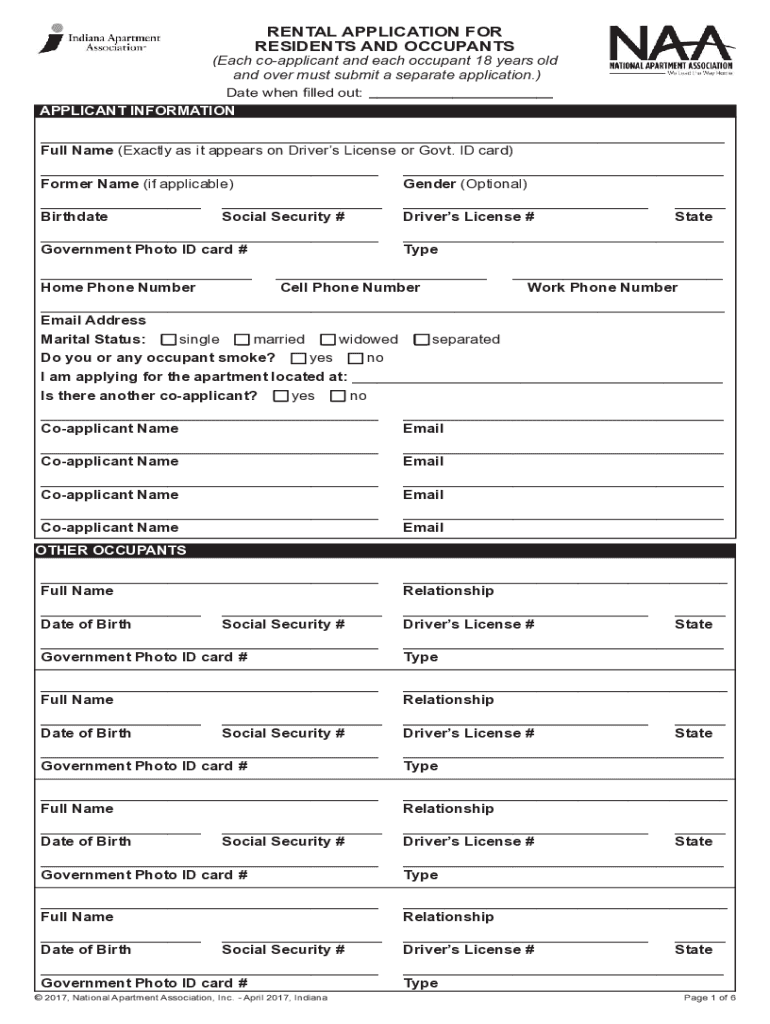

RENTAL APPLICATION FOR RESIDENTS AND OCCUPANTS(Each coapplicant and each occupant 18 years old and over must submit a separate application.) Date when filled out: ___ APPLICANT INFORMATION ___ Full

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit history if applicable

Edit your credit history if applicable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit history if applicable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit history if applicable online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit history if applicable. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit history if applicable

How to fill out credit history if applicable

01

To fill out your credit history, you need to follow these steps:

02

Obtain a copy of your credit report from one or more credit bureaus.

03

Review the report carefully and note any errors or discrepancies.

04

If you find any errors, contact the credit bureau to dispute and request corrections.

05

If there are no errors, gather supporting documents to back up your credit history.

06

Ensure you have records of your loans, credit card statements, mortgage payments, etc.

07

Organize the documents chronologically and list them on your credit history.

08

Include any positive financial information such as on-time payments and low credit utilization.

09

Be thorough and include all relevant information that showcases your responsible credit behavior.

10

Submit your credit history to the appropriate institutions or lenders when required.

11

Keep a copy of your credit history for your records and update it periodically.

Who needs credit history if applicable?

01

Credit history is needed by various people or entities, including:

02

- Lenders: They rely on credit history to assess the creditworthiness of applicants.

03

- Banks: They utilize credit history to determine the interest rates and loan terms offered to customers.

04

- Landlords: They use credit history to evaluate the financial responsibility of potential tenants.

05

- Insurance companies: They consider credit history when determining insurance premiums.

06

- Employers: Some employers check credit history to assess the financial stability and responsibility of job applicants.

07

- Utility companies: They may require credit history to determine whether a deposit is needed for services.

08

- Individuals: It can be useful for individuals to have a positive credit history when applying for loans, mortgages, or credit cards, as it can lead to better terms and interest rates.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit history if applicable?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific credit history if applicable and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit credit history if applicable online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your credit history if applicable to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit credit history if applicable on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share credit history if applicable from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is credit history if applicable?

Credit history is a record of an individual's or business's borrowing and repaying activities, including the number of accounts, payment history, and defaults.

Who is required to file credit history if applicable?

Individuals and businesses that apply for loans, credit cards, or other forms of credit may be required to file their credit history.

How to fill out credit history if applicable?

To fill out credit history, gather all relevant financial documents, including loan agreements and payment records, then accurately report this information to the credit reporting agencies.

What is the purpose of credit history if applicable?

The purpose of credit history is to provide lenders with information to assess the creditworthiness of applicants.

What information must be reported on credit history if applicable?

Information that must be reported includes personal identification details, account numbers, loan amounts, payment history, and any bankruptcies or defaults.

Fill out your credit history if applicable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit History If Applicable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.