Get the free Subtotal - Charges for Service (lines 21 thru 33)

Show details

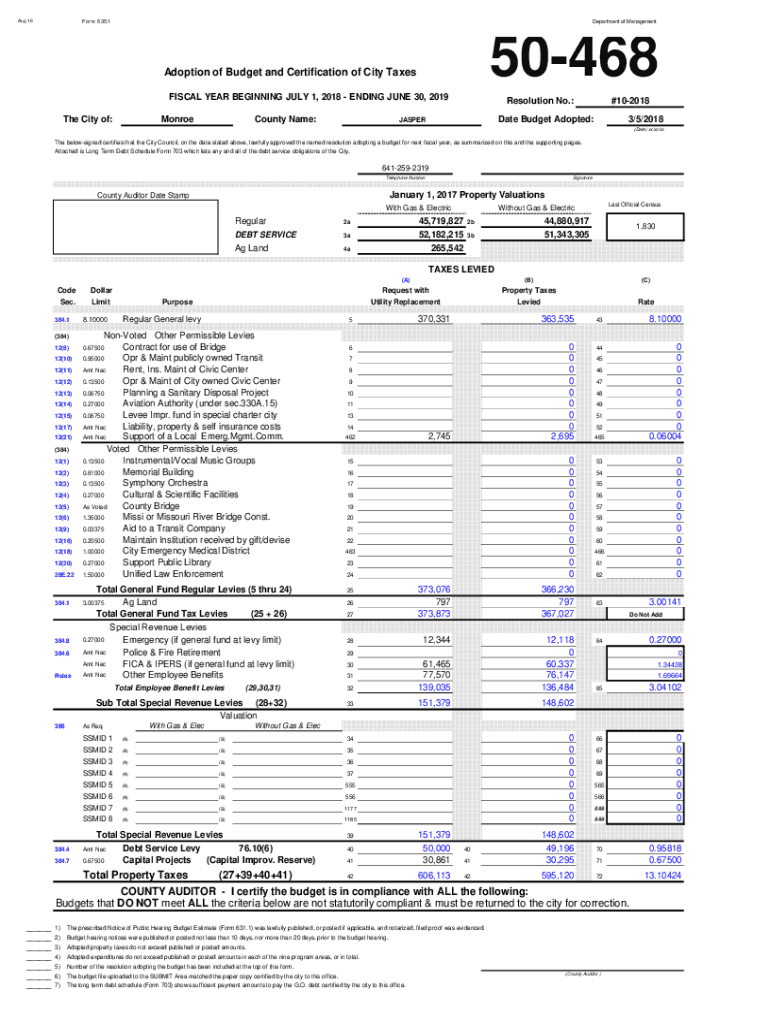

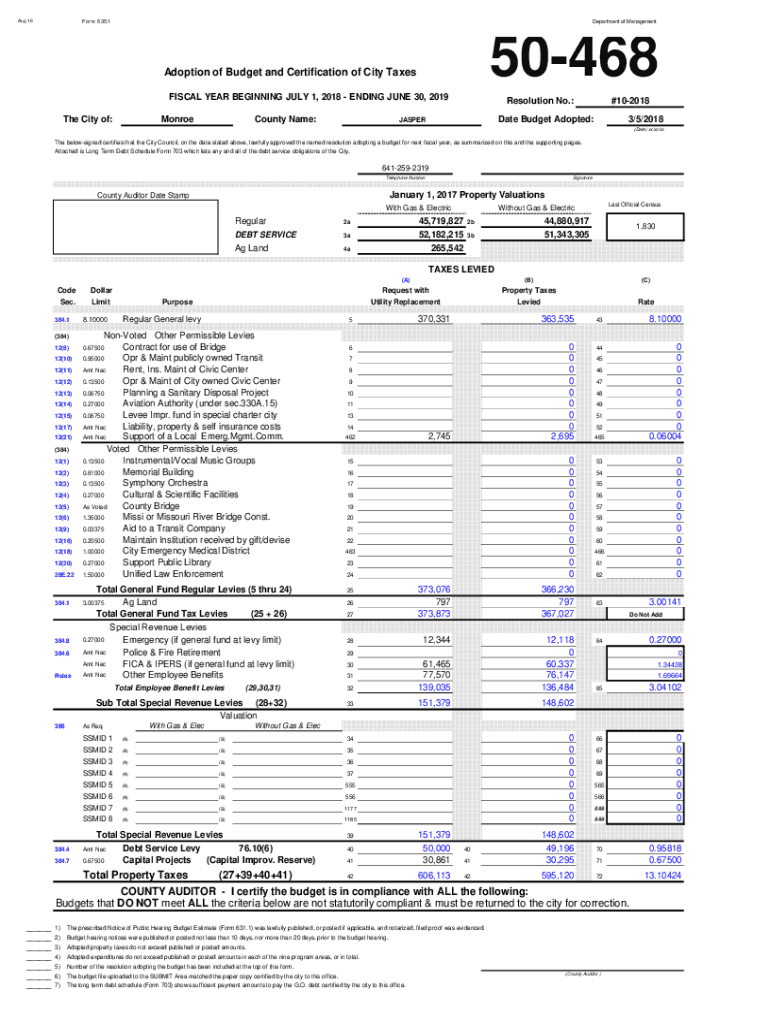

Aug16Form 635.1Department of Management150468Adoption of Budget and Certification of City Taxes FISCAL YEAR BEGINNING JULY 1, 2018 ENDING JUNE 30, 2019 The City of:County Name:MonroeResolution No.:#102018Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign subtotal - charges for

Edit your subtotal - charges for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your subtotal - charges for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit subtotal - charges for online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit subtotal - charges for. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out subtotal - charges for

How to fill out subtotal - charges for

01

To fill out subtotal - charges for, follow these steps:

02

Begin by identifying the charges that need to be included in the subtotal.

03

Determine the amount or quantity of each charge.

04

Multiply the amount or quantity by the corresponding rate or price for each charge.

05

Add up the results of the calculations for each charge to calculate the subtotal.

06

Record the subtotal amount in the designated field or column on the form or document.

Who needs subtotal - charges for?

01

Subtotal - charges for is needed by individuals or organizations that want to track and calculate the total charges for a specific set of items or services.

02

It is commonly used in financial and accounting processes to determine subtotals for invoices, receipts, bills, or other financial documents.

03

Businesses or individuals who provide multiple products or services may need to use subtotal - charges for to calculate the total cost or amount of each item or service before applying additional taxes, fees, or discounts.

04

By using subtotal - charges for, they can have a clear breakdown of the individual charges to facilitate accurate tracking, invoicing, or reporting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify subtotal - charges for without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including subtotal - charges for, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out subtotal - charges for using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign subtotal - charges for and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit subtotal - charges for on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign subtotal - charges for. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is subtotal - charges for?

Subtotal - charges for refers to the total amount of specific charges or costs that are grouped together before taxes, fees, or final adjustments are applied.

Who is required to file subtotal - charges for?

Businesses and entities that have transactions or activities requiring the reporting of specific charges are typically required to file subtotal - charges for.

How to fill out subtotal - charges for?

To fill out subtotal - charges for, you should gather all relevant charge data, categorize them appropriately, and input the total amounts in the designated fields of the form.

What is the purpose of subtotal - charges for?

The purpose of subtotal - charges for is to provide a clear breakdown of specific costs incurred, helping to ensure accurate record-keeping and tax reporting.

What information must be reported on subtotal - charges for?

The information typically reported includes the types of charges, amounts for each category, and any relevant dates or identification numbers associated with the transactions.

Fill out your subtotal - charges for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Subtotal - Charges For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.