Get the free Mandatory Provident Fund Schemes Authority (MPFA)'s Post

Show details

Guidelines VI.1MANDATORY PROVIDENT FUND SCHEMES AUTHORITY VI.1Guidelines on MPF Intermediary Registration and Notification of ChangesINTRODUCTION Application for Registration as Principal Intermediary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mandatory provident fund schemes

Edit your mandatory provident fund schemes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mandatory provident fund schemes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mandatory provident fund schemes online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mandatory provident fund schemes. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mandatory provident fund schemes

How to fill out mandatory provident fund schemes

01

To fill out a mandatory provident fund scheme, follow these steps:

02

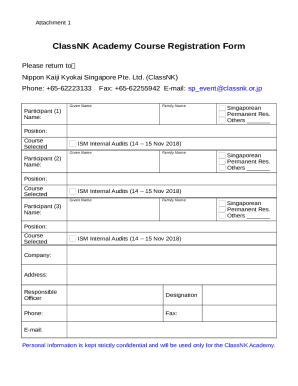

Obtain the necessary application forms from the relevant authority or company offering the scheme.

03

Fill in your personal details, including your full name, date of birth, and contact information.

04

Provide your employment details, such as your company name, job title, and employment dates.

05

Nominate your beneficiaries, who will receive the fund in case of your death.

06

Choose your investment options for the scheme, based on your risk tolerance and financial goals.

07

Review the terms and conditions of the scheme and ensure you understand them fully.

08

Sign and date the application form.

09

Submit the completed form along with any required supporting documents to the relevant authority or company.

10

Keep a copy of the completed form for your records.

11

Regularly review and update your mandatory provident fund scheme as necessary.

Who needs mandatory provident fund schemes?

01

Anyone who is employed in Hong Kong and is aged between 18 and 65 is required by law to have a mandatory provident fund scheme.

02

This includes both permanent and part-time employees, as well as self-employed individuals.

03

It is a mandatory requirement to ensure that employees have a retirement savings plan and financial security for their future.

04

Even if an individual is not currently employed, they may still need a mandatory provident fund scheme if they have previously contributed to one and want to continue receiving retirement benefits.

05

It is best to consult with a financial advisor or the relevant authority to determine if you need to have a mandatory provident fund scheme.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mandatory provident fund schemes without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including mandatory provident fund schemes, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get mandatory provident fund schemes?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific mandatory provident fund schemes and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit mandatory provident fund schemes on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share mandatory provident fund schemes from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is mandatory provident fund schemes?

Mandatory provident fund schemes are government-mandated retirement savings plans that require both employers and employees to contribute a certain percentage of employees' earnings to a retirement account. The funds accumulated in these accounts provide financial security for employees after retirement.

Who is required to file mandatory provident fund schemes?

Employers who employ workers in jurisdictions where mandatory provident fund schemes are established are required to file. This includes both private and public sector employers, as well as self-employed individuals who fall under the defined contribution plans.

How to fill out mandatory provident fund schemes?

To fill out mandatory provident fund schemes, employers must complete specific forms provided by the provident fund authority, detailing employee contributions and personal information. Relevant documents such as identification and proof of earnings may also be required.

What is the purpose of mandatory provident fund schemes?

The purpose of mandatory provident fund schemes is to ensure that employees save enough money to support themselves financially during retirement, thereby reducing old-age poverty and ensuring economic security.

What information must be reported on mandatory provident fund schemes?

Information that must be reported includes employee identification details, salary information, contributions made by both the employer and employee, and any changes in employment status or other relevant data.

Fill out your mandatory provident fund schemes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mandatory Provident Fund Schemes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.