Get the free Big Property Tax Savings - News & Alerts

Show details

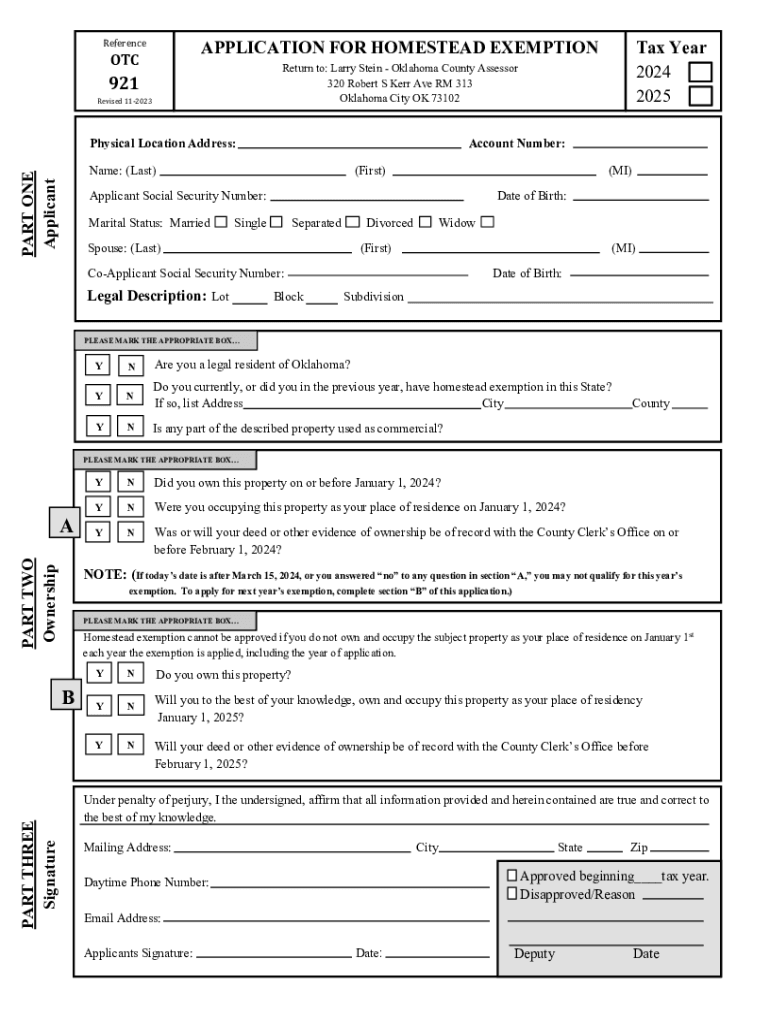

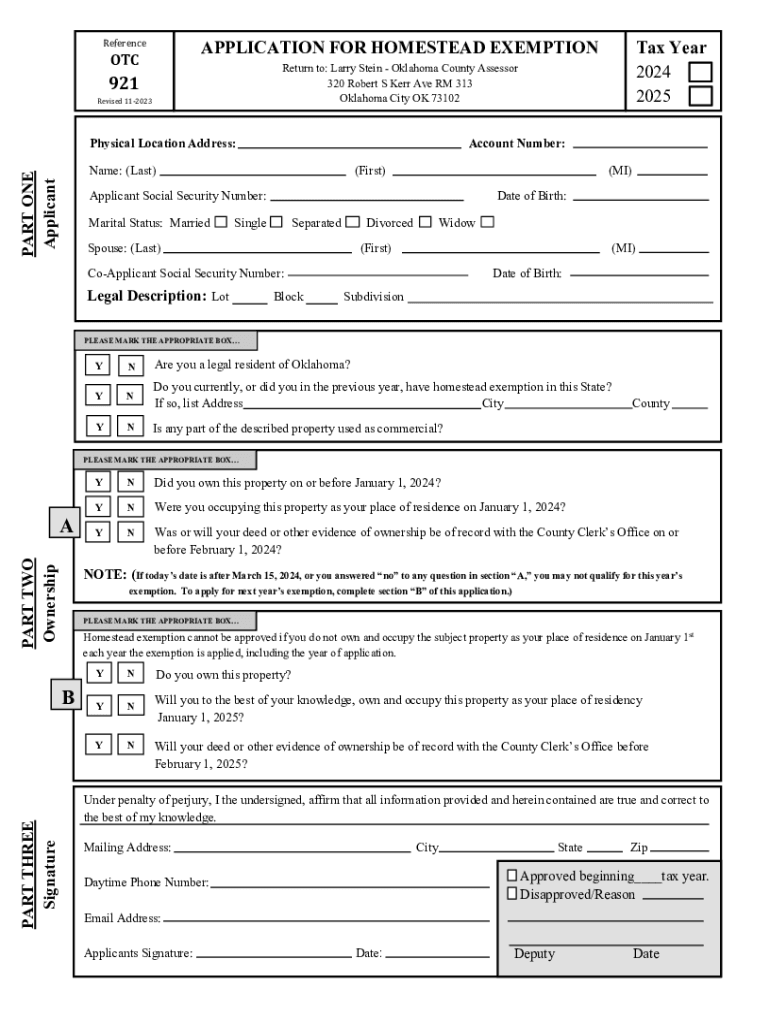

APPLICATION FOR HOMESTEAD EXEMPTIONReferenceOTC921Revised 112023Physical Location Address:Account Number:Name: (Last)PART ONE ApplicantTax Year 2024 2025Return to: Larry Stein Oklahoma County Assessor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign big property tax savings

Edit your big property tax savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your big property tax savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing big property tax savings online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit big property tax savings. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out big property tax savings

How to fill out big property tax savings

01

Step 1: Research property tax laws in your area to understand the potential savings opportunities.

02

Step 2: Identify any exemptions or deductions that you may qualify for, such as homestead exemptions or senior citizen discounts.

03

Step 3: Gather all necessary documentation, including property value assessments, income statements, and proof of eligibility for any exemptions.

04

Step 4: Consider appealing your property value assessment if you believe it is overestimated, as a lower assessed value can lead to lower property taxes.

05

Step 5: Consult with a tax professional or attorney specializing in property taxes for advice and guidance on maximizing your savings.

06

Step 6: Complete all required forms accurately and submit them to the appropriate tax authorities within the designated deadlines.

07

Step 7: Follow up on your application or appeal if necessary, providing any additional information requested by the authorities.

08

Step 8: Monitor your property tax bill each year to ensure accurate assessment and continued eligibility for savings opportunities.

09

Step 9: Stay informed about any changes in property tax laws or exemptions that may affect your savings strategy.

10

Step 10: Consider hiring a property tax consultant or analyst to help with ongoing assessment reviews and savings optimization.

Who needs big property tax savings?

01

Homeowners who want to reduce their financial burden and save money on property taxes.

02

Property owners with large or valuable properties that incur substantial tax amounts.

03

Individuals or families with limited income who could benefit from exemptions or discounts.

04

Senior citizens or retirees on fixed incomes who may be eligible for age-related tax savings.

05

Investors or commercial property owners seeking to minimize their property tax expenses.

06

Anyone looking to optimize their tax planning strategies and maximize overall savings potential.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit big property tax savings in Chrome?

big property tax savings can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the big property tax savings in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your big property tax savings in seconds.

Can I edit big property tax savings on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share big property tax savings on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is big property tax savings?

Big property tax savings refer to significant reductions in property taxes owed by homeowners or property owners, often achieved through exemptions, deductions, or special programs designed to lessen the tax burden.

Who is required to file big property tax savings?

Property owners who qualify for tax relief programs or exemptions, such as veterans, senior citizens, or low-income families, are required to file for big property tax savings.

How to fill out big property tax savings?

To fill out big property tax savings, property owners typically need to complete an application form provided by their local tax authority, providing necessary documentation and information about their property and eligibility.

What is the purpose of big property tax savings?

The purpose of big property tax savings is to ease the financial burden on property owners and promote housing stability by making property ownership more affordable.

What information must be reported on big property tax savings?

Required information generally includes property details, the owner’s personal information, income information, and any supporting documentation that verifies eligibility for tax savings.

Fill out your big property tax savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Big Property Tax Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.