Get the free Tax Year-End Planning Tid Bits

Show details

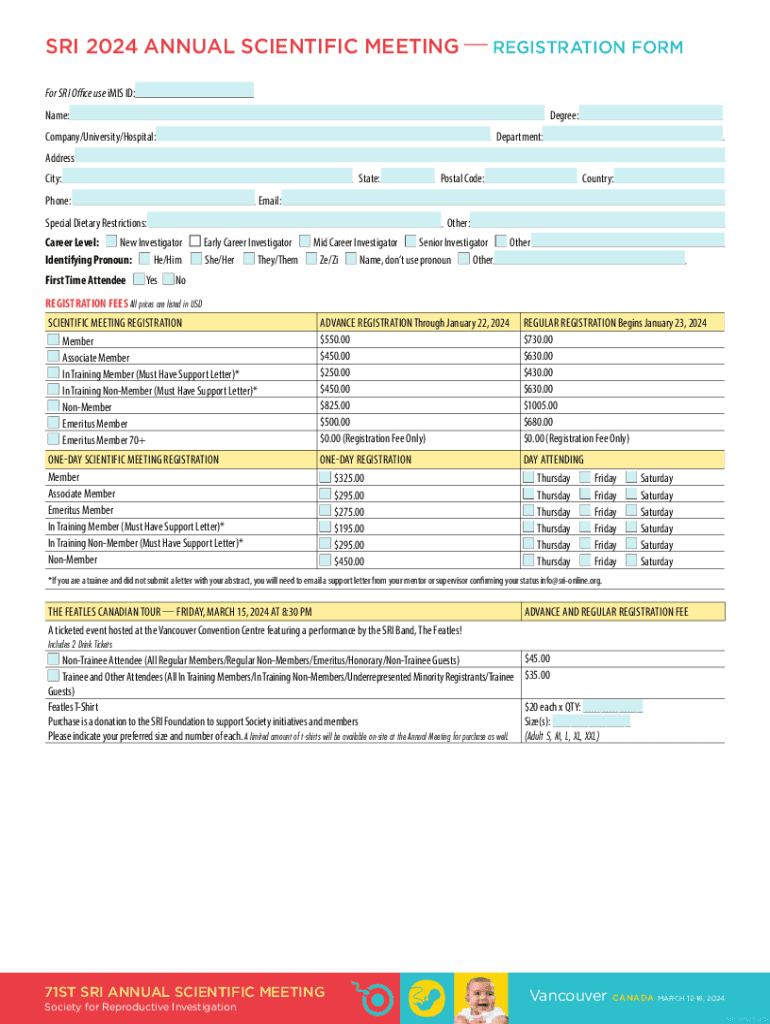

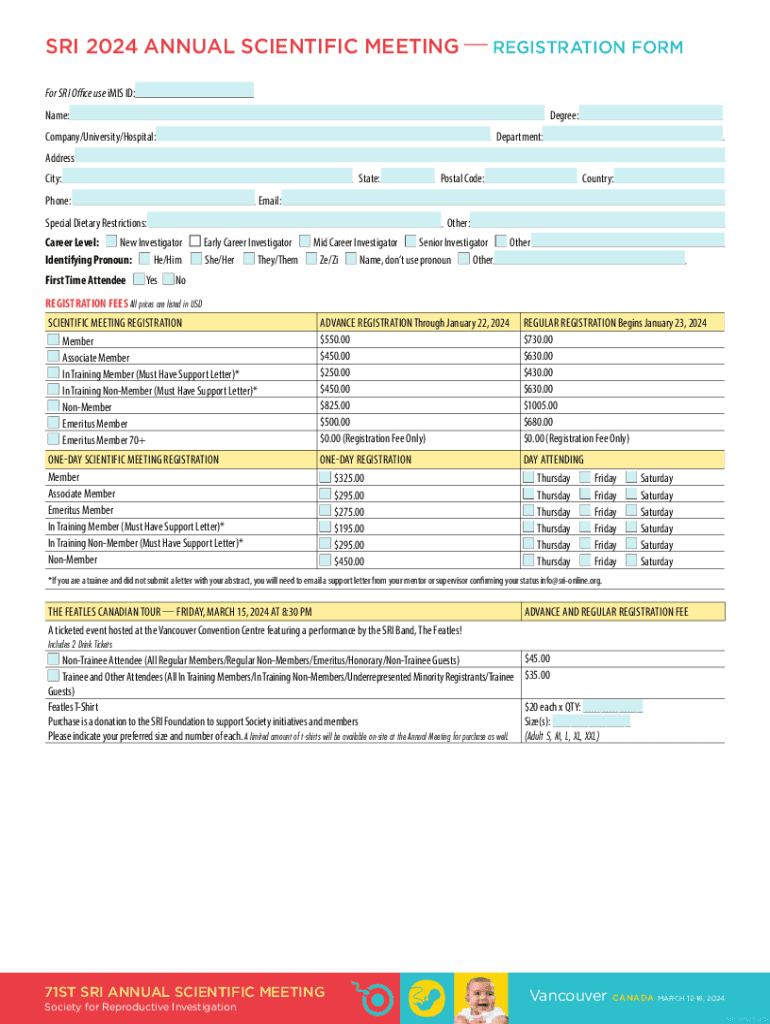

SRI 2024 ANNUAL SCIENTIFIC MEETING REGISTRATION FORM For SRI Office use iMIS ID: Name:Degree: Department:Company/University/Hospital: Address: State:City: Phone:Country:Email:Special Dietary Restrictions:Other:Career

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax year-end planning tid

Edit your tax year-end planning tid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax year-end planning tid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax year-end planning tid online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax year-end planning tid. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax year-end planning tid

How to fill out tax year-end planning tid

01

To fill out tax year-end planning tid, follow these steps:

02

Gather all relevant financial information, including income statements, expense records, and documentation of any deductions or credits you may be eligible for.

03

Review your financial situation and assess any major changes that may impact your tax liability, such as buying or selling property, starting or closing a business, or experiencing a significant increase or decrease in income.

04

Consult with a tax professional or use tax preparation software to help calculate your tax liability for the year and identify any potential tax-saving strategies.

05

Consider making any necessary adjustments to your withholding or estimated tax payments to ensure you are not underpaying or overpaying your taxes.

06

Evaluate your eligibility for any tax deductions or credits and ensure you have the necessary documentation to support your claims.

07

Develop a tax planning strategy for the coming year, taking into account any changes in tax laws or regulations.

08

Implement your tax planning strategy by making any necessary financial decisions or adjustments before the end of the tax year.

09

Review your completed tax year-end planning tid and ensure all information is accurate and up to date.

10

File your tax return and submit any required forms or documentation by the deadline.

11

Keep a copy of your tax year-end planning tid, tax return, and supporting documents for future reference or in case of an audit.

Who needs tax year-end planning tid?

01

Tax year-end planning tid is beneficial for individuals and businesses of all sizes.

02

Anyone who wants to minimize their tax liability, maximize their tax deductions and credits, or optimize their financial situation can benefit from tax year-end planning tid.

03

It is particularly important for individuals or businesses with complex financial situations, significant investments, or major life changes that may affect their tax situation.

04

Tax year-end planning tid can also help individuals and businesses better prepare for the coming year and make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax year-end planning tid for eSignature?

To distribute your tax year-end planning tid, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my tax year-end planning tid in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your tax year-end planning tid and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the tax year-end planning tid form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign tax year-end planning tid and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is tax year-end planning tid?

Tax year-end planning tid refers to the strategic efforts and considerations by individuals and businesses to optimize their tax situation before the end of the calendar year or the financial year, including accounting for deductions, credits, and other tax-saving opportunities.

Who is required to file tax year-end planning tid?

Individuals, businesses, and any entities that are subject to taxation are required to file tax year-end planning tid, particularly if they wish to manage their tax liabilities effectively.

How to fill out tax year-end planning tid?

To fill out tax year-end planning tid, one must gather relevant financial documents, assess income, explore potential deductions and credits, and complete the necessary tax forms while consulting a tax professional if needed.

What is the purpose of tax year-end planning tid?

The purpose of tax year-end planning tid is to minimize tax liabilities, maximize available deductions and credits, and ensure compliance with tax laws by making informed financial decisions before the year ends.

What information must be reported on tax year-end planning tid?

Information that must be reported includes income, applicable deductions, credit claims, and any relevant documentation supporting tax positions taken during the year.

Fill out your tax year-end planning tid online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Year-End Planning Tid is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.