Get the free Securing your financial future today

Show details

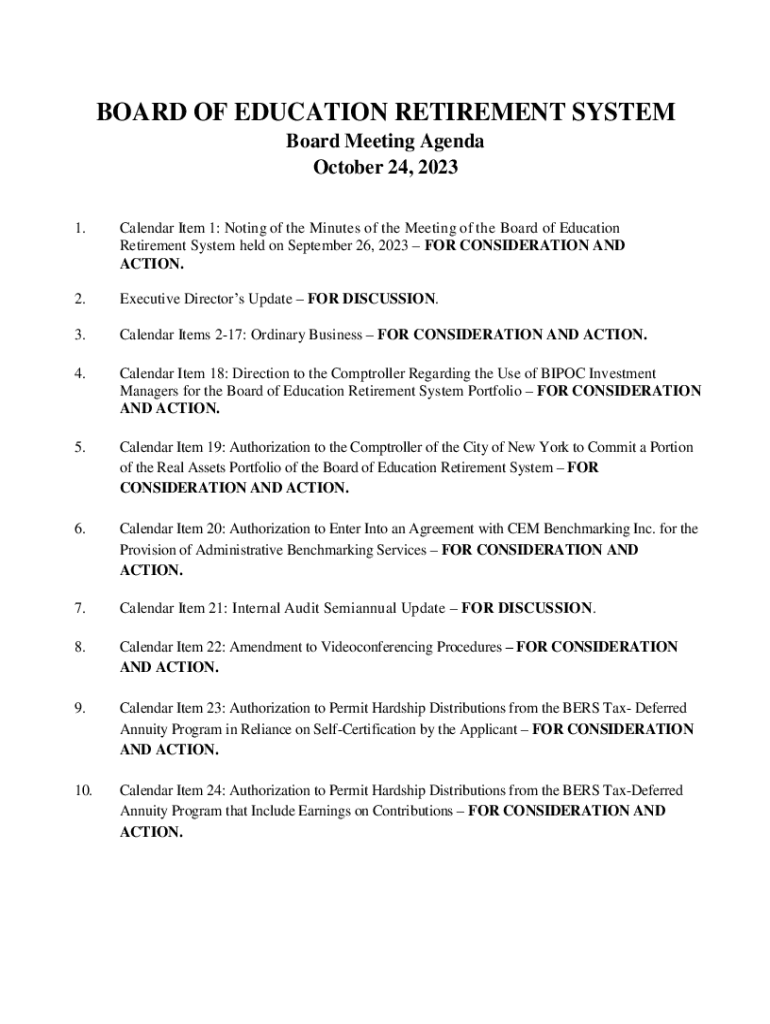

BOARD OF EDUCATION RETIREMENT SYSTEM Board Meeting Agenda October 24, 2023 1.Calendar Item 1: Noting of the Minutes of the Meeting of the Board of Education Retirement System held on September 26,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign securing your financial future

Edit your securing your financial future form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your securing your financial future form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit securing your financial future online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit securing your financial future. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out securing your financial future

How to fill out securing your financial future

01

Start by setting specific financial goals for yourself. Determine what you want to achieve in terms of savings, investments, and debt reduction.

02

Create a budget to track your income and expenses. This will help you understand your financial situation and identify areas where you can cut back on spending.

03

Build an emergency fund to cover unexpected expenses. Aim to save three to six months' worth of living expenses in a separate savings account.

04

Pay off high-interest debt as quickly as possible. Focus on clearing credit card balances and loans with high interest rates to save on interest payments.

05

Start investing for the future. Consider opening a retirement account and contribute regularly to take advantage of compound interest and potential tax benefits.

06

Diversify your investments to reduce risk. Spread your money across different asset classes, such as stocks, bonds, and real estate, to minimize the impact of a single investment's performance.

07

Stay informed about personal finance and investment strategies. Attend seminars, read books, and seek advice from financial professionals to expand your knowledge and make informed decisions.

08

Review and adjust your financial plan periodically. Life circumstances and goals change over time, so it's essential to reassess and make necessary adjustments to stay on track.

Who needs securing your financial future?

01

Securing your financial future is important for everyone, regardless of age or income level.

02

Young adults who are just starting their careers can benefit from early planning to achieve long-term financial stability.

03

Families with dependents should prioritize securing their financial future to protect their loved ones from financial hardships in case of emergencies.

04

Individuals approaching retirement age need to ensure they have enough savings and investments to support their desired lifestyle during retirement.

05

Even high net worth individuals should focus on securing their financial future to preserve and grow their wealth for future generations.

06

Ultimately, anyone who wants financial independence, peace of mind, and the ability to achieve their goals needs to prioritize securing their financial future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit securing your financial future on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing securing your financial future right away.

How can I fill out securing your financial future on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your securing your financial future. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit securing your financial future on an Android device?

With the pdfFiller Android app, you can edit, sign, and share securing your financial future on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is securing your financial future?

Securing your financial future refers to the practices and strategies one employs to ensure long-term financial stability and independence, often involving saving, investing, and prudent financial planning.

Who is required to file securing your financial future?

Individuals who are interested in tracking their financial health, planning for retirement, or seeking to establish a clear financial roadmap are typically required to file securing their financial future.

How to fill out securing your financial future?

Filling out securing your financial future involves gathering your financial data, including income, expenses, assets, and liabilities, and then using this information to create a comprehensive financial plan or statement.

What is the purpose of securing your financial future?

The purpose of securing your financial future is to create a solid financial foundation that allows for growth, ensures you can meet future obligations, and provides peace of mind regarding financial security.

What information must be reported on securing your financial future?

Key information includes income sources, total expenses, savings, investments, debts, and any other financial assets or liabilities that impact your financial standing.

Fill out your securing your financial future online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Securing Your Financial Future is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.