Get the free Available Credit Line

Show details

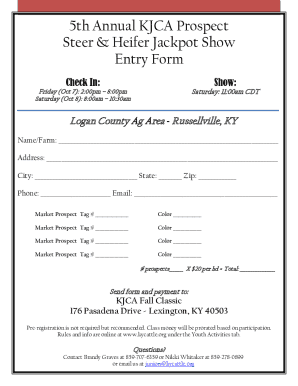

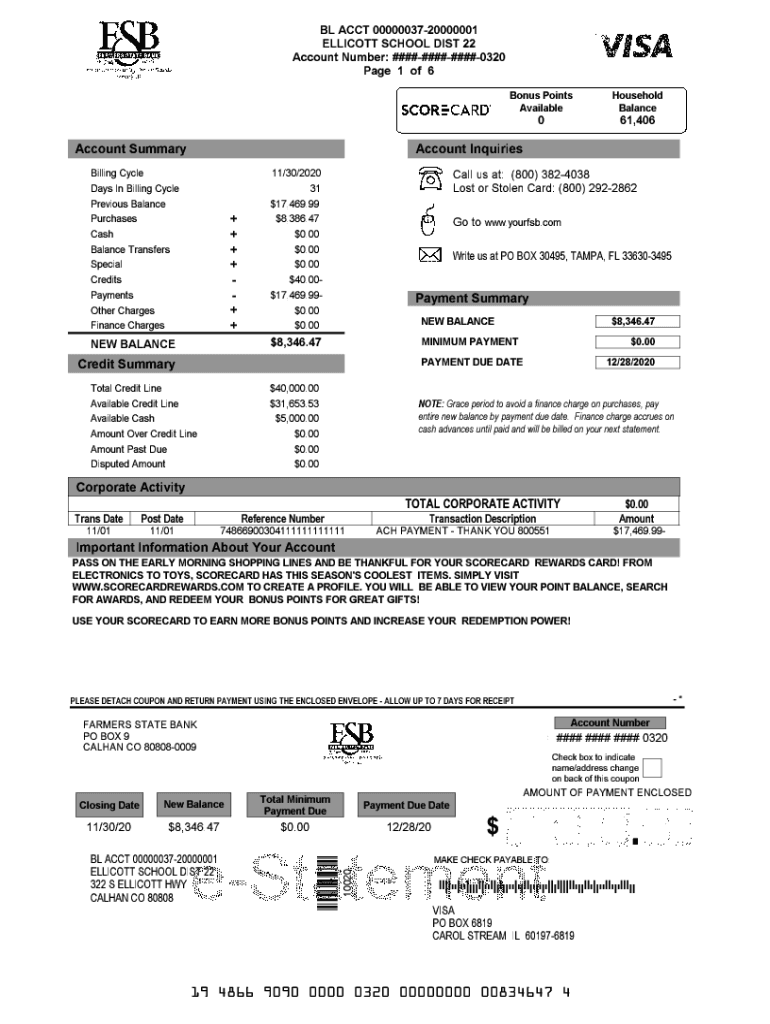

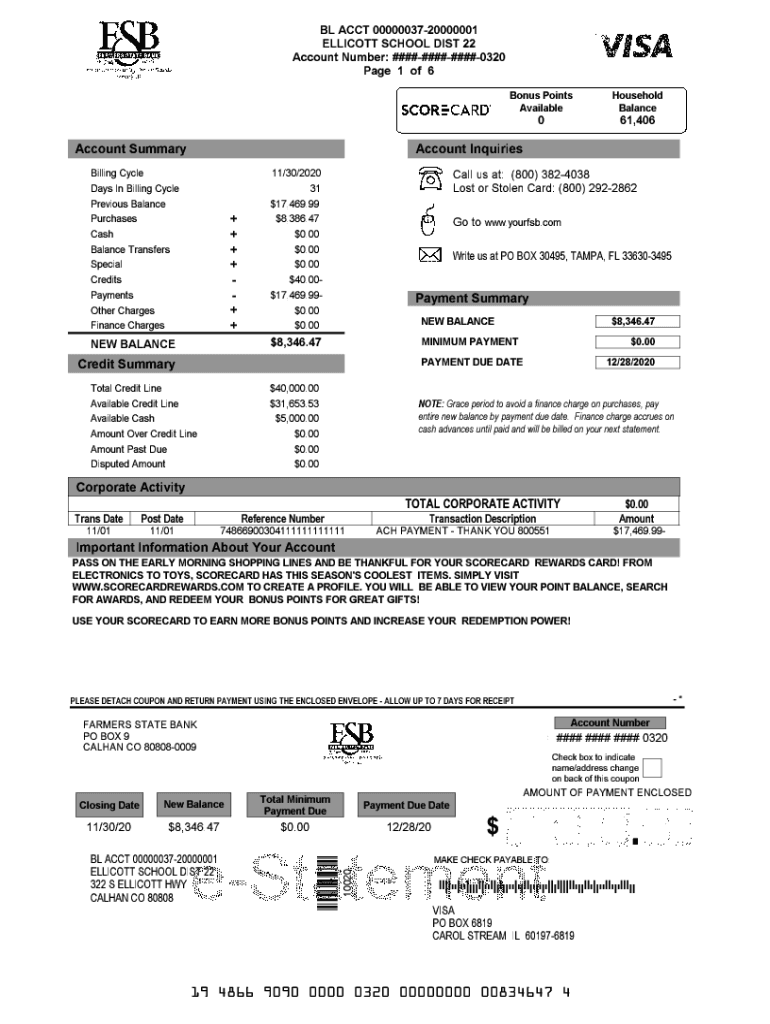

BL ACCT 0000003720000001 ELLICOTT SCHOOL DIST 22 Account Number: ############0320 #### #### #### 0320 Page 1 of 6 Bonus Points Available061,406Account InquiriesAccount Summary Billing Cycle Days In

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign available credit line

Edit your available credit line form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your available credit line form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing available credit line online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit available credit line. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out available credit line

How to fill out available credit line

01

To fill out an available credit line, follow these steps:

02

Gather all the necessary documents and information, such as your identification, income statements, and credit history.

03

Contact the financial institution or lender that offers the available credit line.

04

Schedule an appointment or visit their website to access the online application.

05

Provide accurate and up-to-date personal and financial information as requested in the application form.

06

Submit any required supporting documents, such as proof of income or identification.

07

Review the terms and conditions of the available credit line before finalizing the application.

08

Wait for the approval process, which may involve a credit check and verification of your information.

09

If approved, carefully read and understand the agreement or contract provided by the lender.

10

Sign the agreement or contract, indicating your acceptance of the terms and conditions.

11

Start using your available credit line responsibly by making purchases or borrowing funds within the approved limit.

12

Regularly monitor your credit line balance, payment due dates, and any associated fees or charges.

13

Make timely payments to maintain a good credit standing and avoid any negative impact on your credit score.

14

Note: It is important to exercise responsible borrowing and repayment habits to optimize the benefits of an available credit line.

Who needs available credit line?

01

Available credit line can be beneficial for various individuals or entities, including:

02

- Individuals who require financial flexibility and want access to funds beyond their regular income.

03

- Business owners or entrepreneurs who need working capital or funds for business-related expenses.

04

- Consumers who want to make larger purchases or investments but prefer to pay over time.

05

- Individuals with an unpredictable income or irregular cash flow, as it can provide a safety net during lean periods.

06

- Those looking to build or improve their credit history and score through responsible credit usage and repayment.

07

- Anyone who wants to have a financial backup or emergency fund in case of unexpected expenses or financial hardships.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my available credit line in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your available credit line and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit available credit line from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including available credit line. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I edit available credit line on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign available credit line right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is available credit line?

An available credit line refers to the amount of credit a borrower can access on a revolving credit account, such as a credit card, at any given time.

Who is required to file available credit line?

Entities that utilize revolving credit lines and need to report their available credit, such as businesses and individuals with credit lines, are generally required to file.

How to fill out available credit line?

To fill out the available credit line, individuals or businesses should provide the total amount of credit received, the amount currently utilized, and the remaining credit available accurately on the required forms.

What is the purpose of available credit line?

The purpose of the available credit line is to provide lenders and financial institutions with information about a borrower’s current credit utilization and financial health.

What information must be reported on available credit line?

Information such as total credit limit, current balance, and available credit must be reported when filing the available credit line.

Fill out your available credit line online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Available Credit Line is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.