Get the free Bond Referendum Tax Impact - ADM Community School District

Show details

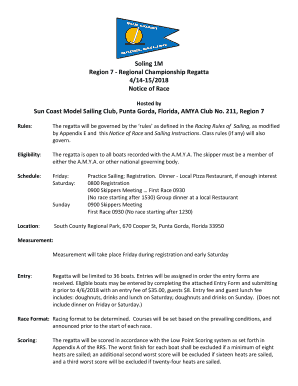

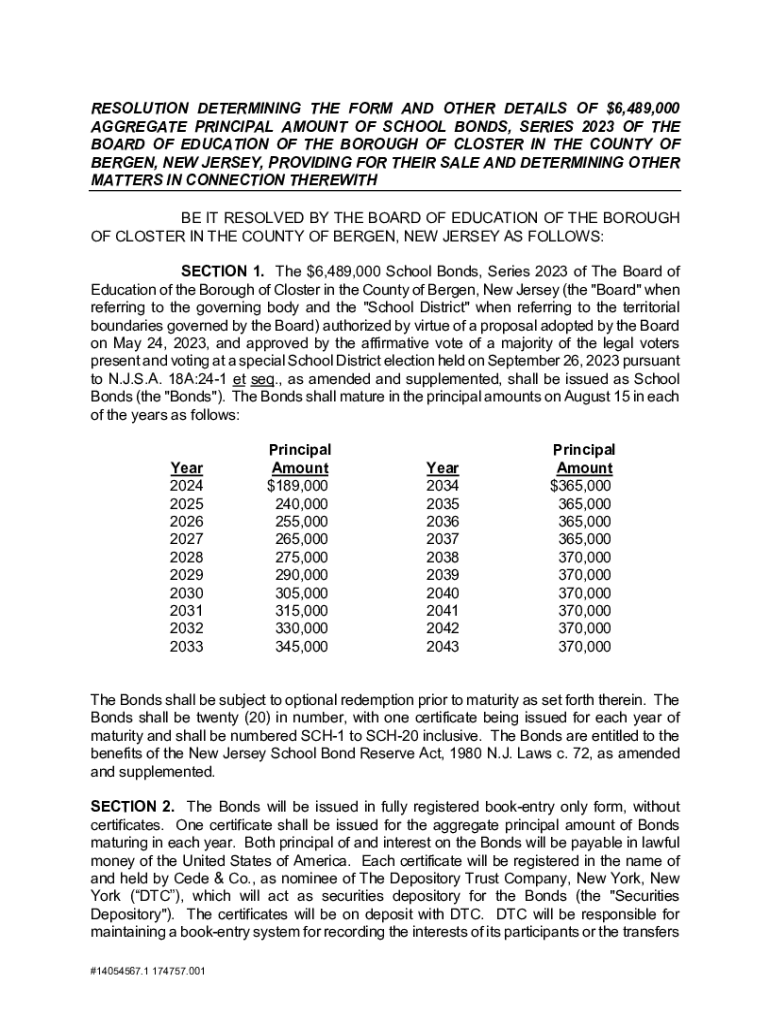

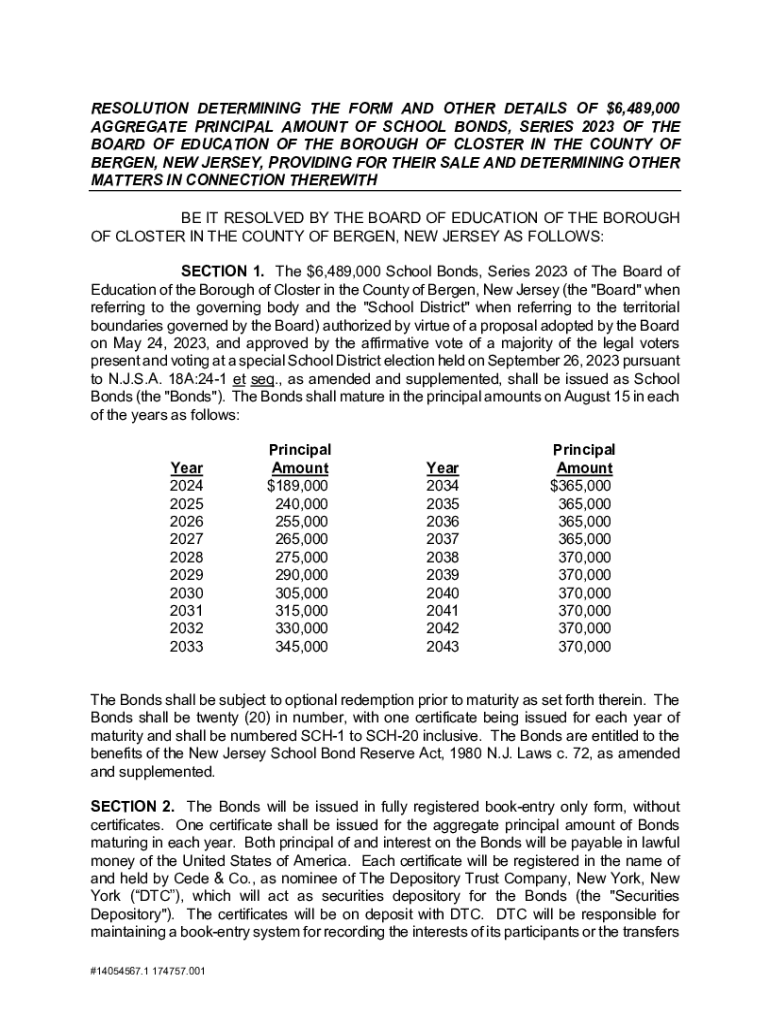

RESOLUTION DETERMINING THE FORM AND OTHER DETAILS OF $6,489,000 AGGREGATE PRINCIPAL AMOUNT OF SCHOOL BONDS, SERIES 2023 OF THE BOARD OF EDUCATION OF THE BOROUGH OF CLOSTER IN THE COUNTY OF BERGEN,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bond referendum tax impact

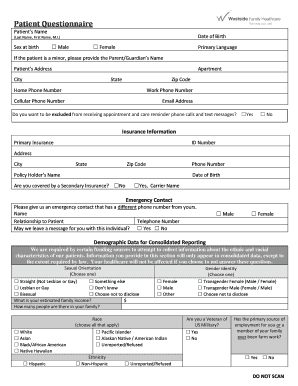

Edit your bond referendum tax impact form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bond referendum tax impact form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bond referendum tax impact online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bond referendum tax impact. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bond referendum tax impact

How to fill out bond referendum tax impact

01

Begin by gathering all the necessary information regarding the bond referendum and its tax impact. This may include the proposed bond amount, the estimated interest rate, and the duration of the bond.

02

Familiarize yourself with the current tax structure and rates within the community or jurisdiction where the bond referendum will take place.

03

Analyze the potential impact of the bond referendum on property taxes. This can be done by calculating the additional tax burden using the bond amount and interest rate.

04

Consider any exemptions or special provisions that may apply to certain groups or properties within the community. These can affect the tax impact and should be taken into account.

05

Prepare a clear and concise summary of the bond referendum tax impact, highlighting the key details and explaining the potential implications for taxpayers.

06

Communicate the bond referendum tax impact information to the relevant stakeholders, such as the general public, local government officials, and community organizations.

07

Be prepared to answer any questions or concerns raised by individuals or groups regarding the bond referendum tax impact. Provide accurate and transparent information to ensure clarity and understanding.

08

Update and revise the bond referendum tax impact information as necessary, especially if there are any changes in the bond amount, interest rate, or duration as the process unfolds.

Who needs bond referendum tax impact?

01

Anyone who is interested in understanding the financial implications of a bond referendum would benefit from knowing the bond referendum tax impact.

02

Government officials and policymakers responsible for making decisions regarding bond referendums would need to understand the tax impact in order to evaluate the feasibility and potential consequences of the proposed projects.

03

Taxpayers in the community or jurisdiction where the bond referendum is taking place would also be interested in knowing the tax impact as it directly affects their financial obligations and property values.

04

Local organizations and community groups advocating for or against the bond referendum would want to know the tax impact to inform their positions and arguments.

05

Financial analysts and professionals involved in municipal finance or economic development may also need the bond referendum tax impact information to assess the potential economic and fiscal implications of the proposed projects.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete bond referendum tax impact online?

pdfFiller makes it easy to finish and sign bond referendum tax impact online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for the bond referendum tax impact in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your bond referendum tax impact in seconds.

How do I fill out the bond referendum tax impact form on my smartphone?

Use the pdfFiller mobile app to fill out and sign bond referendum tax impact on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is bond referendum tax impact?

The bond referendum tax impact refers to the effect on local property taxes that results from the approval of a bond measure by voters. When voters approve a bond, the municipality typically raises funds through issuing bonds, which can lead to an increase in property taxes to repay the bond debt.

Who is required to file bond referendum tax impact?

Typically, local government entities such as school districts, municipalities, or other public agencies that hold a bond referendum are required to file the bond referendum tax impact. They must report the estimated tax implications for property owners.

How to fill out bond referendum tax impact?

To fill out the bond referendum tax impact form, the filing entity must calculate the estimated increase in property taxes per $1,000 of assessed property value, disclose the total estimated costs of the bonds, and provide information related to the duration of the bond repayment.

What is the purpose of bond referendum tax impact?

The purpose of the bond referendum tax impact is to inform voters about how the approval of the bond measure will affect their property taxes. It is meant to ensure transparency and help voters make an informed decision during the referendum.

What information must be reported on bond referendum tax impact?

The report must include the estimated tax rate increase, total bond amount, duration of the bond repayment period, and any other relevant financial information that helps voters understand the impact on property taxes.

Fill out your bond referendum tax impact online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bond Referendum Tax Impact is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.