Canada Form 4 - Alberta 2014-2025 free printable template

Show details

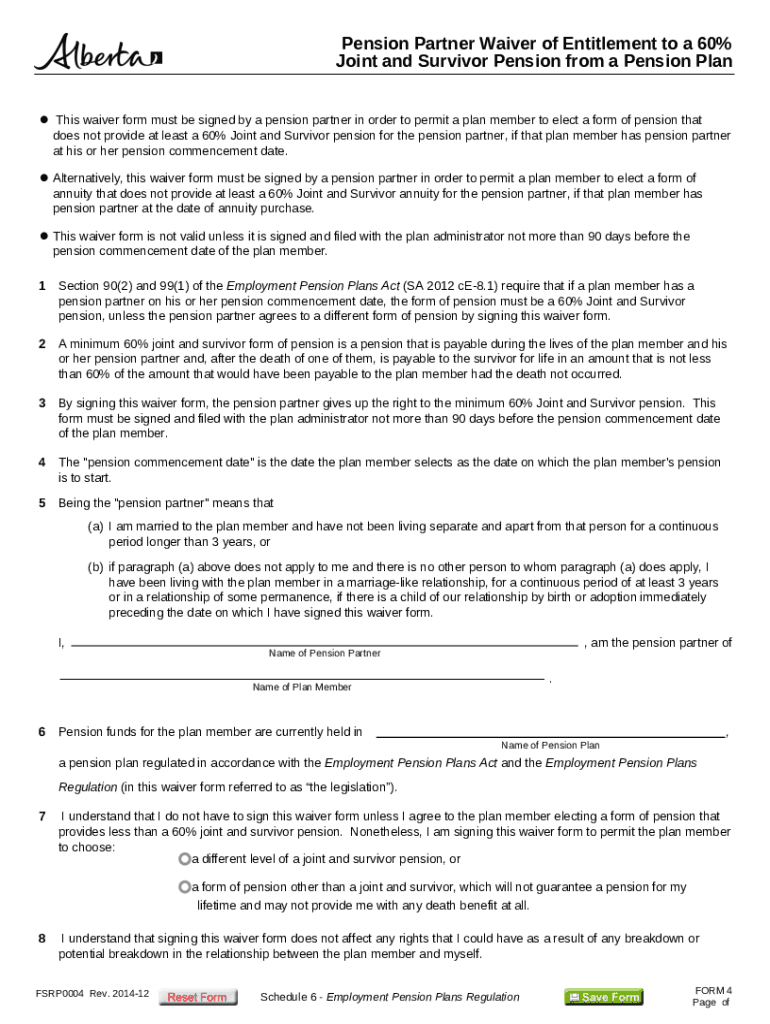

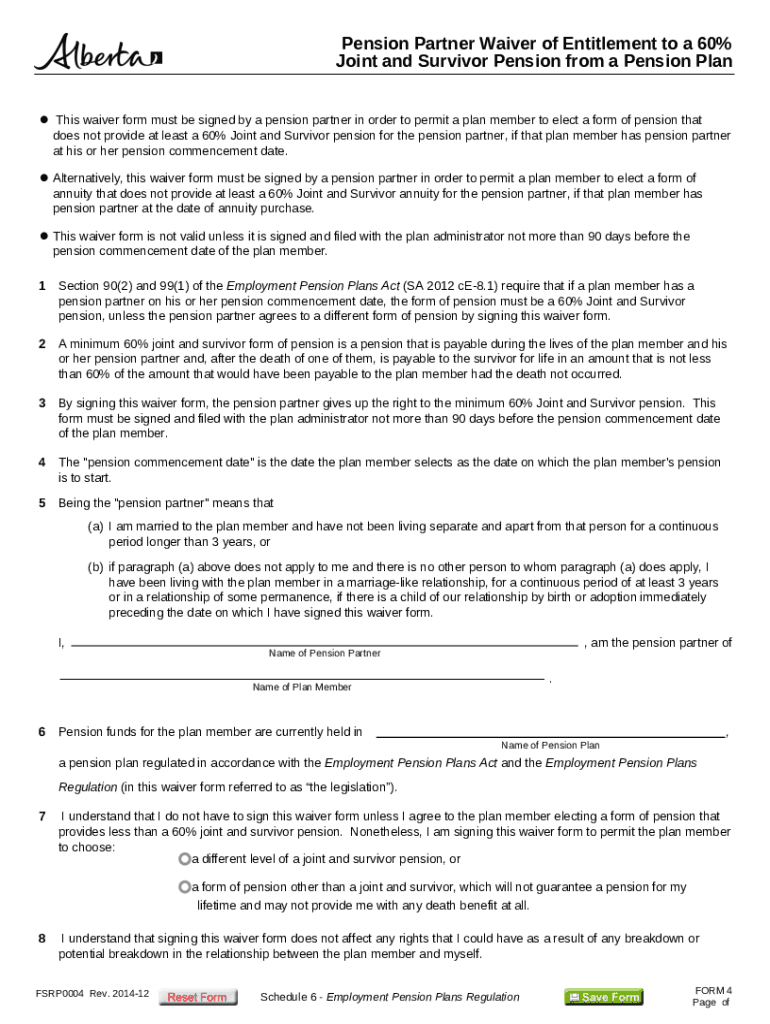

Pension Partner Waiver of Entitlement to a 60%

Joint and Survivor Pension from a Pension Plan

This waiver form must be signed by a pension partner in order to permit a plan member to elect a form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pension partner waiver form

Edit your pension partner waiver form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pension partner waiver alberta form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pension partner waiver alberta online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pension partner waiver alberta. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada Form 4 - Alberta Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pension partner waiver alberta

How to fill out Canada Form 4 - Alberta

01

Gather all required personal information, including full name, address, and contact details.

02

Provide details of your current employment, including employer's name and job title.

03

Complete the sections related to your financial information, ensuring accuracy in reporting income.

04

Review the instructions for any additional documentation or forms that need to be submitted with Form 4.

05

Sign and date the form to certify that all information provided is true and accurate.

06

Submit the completed Canada Form 4 to the appropriate Alberta government office.

Who needs Canada Form 4 - Alberta?

01

Individuals applying for certain grants or financial assistance in Alberta.

02

Residents who are required to report income or verify financial status for eligibility purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a pension waiver?

The waiver is required by federal law as a way of letting you and your spouse know that the survivor would be left without any income from that pension if the benefit is waived.

How do pensions work for surviving spouse?

If death is before retirement, the spouse usually is eligible for an annuity if the employee had sufficient age and service to qualify for early retirement benefits; the size of the annuity depends on the pension the worker would have received if he or she had opted for early retirement.

What is a waiver of joint and survivor pension?

By completing this Waiver, the spouse is giving up the right to receive a survivor pension that would be payable under any future life annuity that may be purchased with funds transferred out of the variable benefit account by the retired member.

What is the disadvantage of joint and survivor annuity?

Joint and survivor annuity downsides: The downside to the joint and survivor annuity option is that you will give up a portion of your monthly income in order to ensure that the regular payment installments won't end upon your death. You will need to sacrifice now in order to benefit later.

What does 100 joint and survivor pension mean?

A joint-and-survivor annuity provides a benefit for the rest of your life at an amount reduced from the straight-life annuity amount, with your choice of 50%, 75%, or 100% of that reduced amount to be paid to your beneficiary if you die before that person.

What is a joint and survivor pension?

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pension partner waiver alberta directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your pension partner waiver alberta and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete pension partner waiver alberta on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your pension partner waiver alberta, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out pension partner waiver alberta on an Android device?

On an Android device, use the pdfFiller mobile app to finish your pension partner waiver alberta. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Canada Form 4 - Alberta?

Canada Form 4 - Alberta is a reporting form used by individuals and businesses in Alberta to declare certain types of income and deductions for tax purposes.

Who is required to file Canada Form 4 - Alberta?

Individuals, partnerships, and corporations that earn income in Alberta and meet specific criteria set by the Canada Revenue Agency are required to file Canada Form 4.

How to fill out Canada Form 4 - Alberta?

To fill out Canada Form 4 - Alberta, you need to provide your personal or business information, report your income sources, and claim any deductions you are eligible for based on the form's guidelines.

What is the purpose of Canada Form 4 - Alberta?

The purpose of Canada Form 4 - Alberta is to ensure accurate reporting of income and deductions to calculate provincial taxes owed by individuals and businesses in Alberta.

What information must be reported on Canada Form 4 - Alberta?

Canada Form 4 - Alberta requires reporting of personal identification details, total income earned, specific income sources, allowable deductions, and any relevant tax credits.

Fill out your pension partner waiver alberta online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pension Partner Waiver Alberta is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.