Get the free Multifamily Tax-Exempt Bond Financing (TEB)

Show details

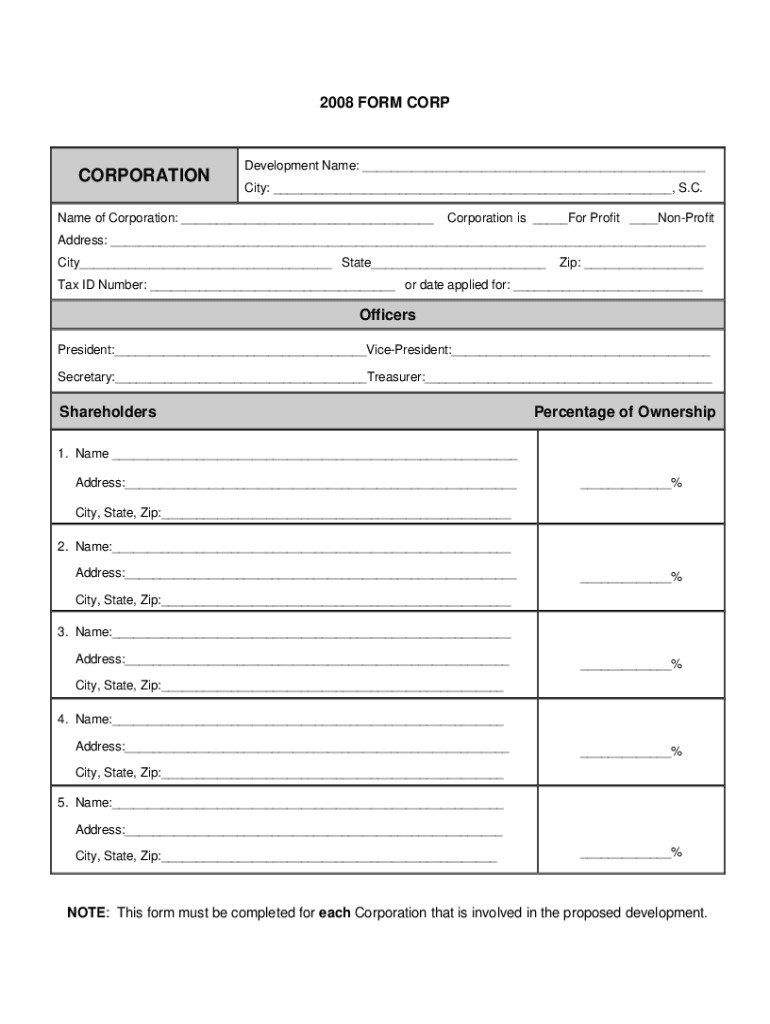

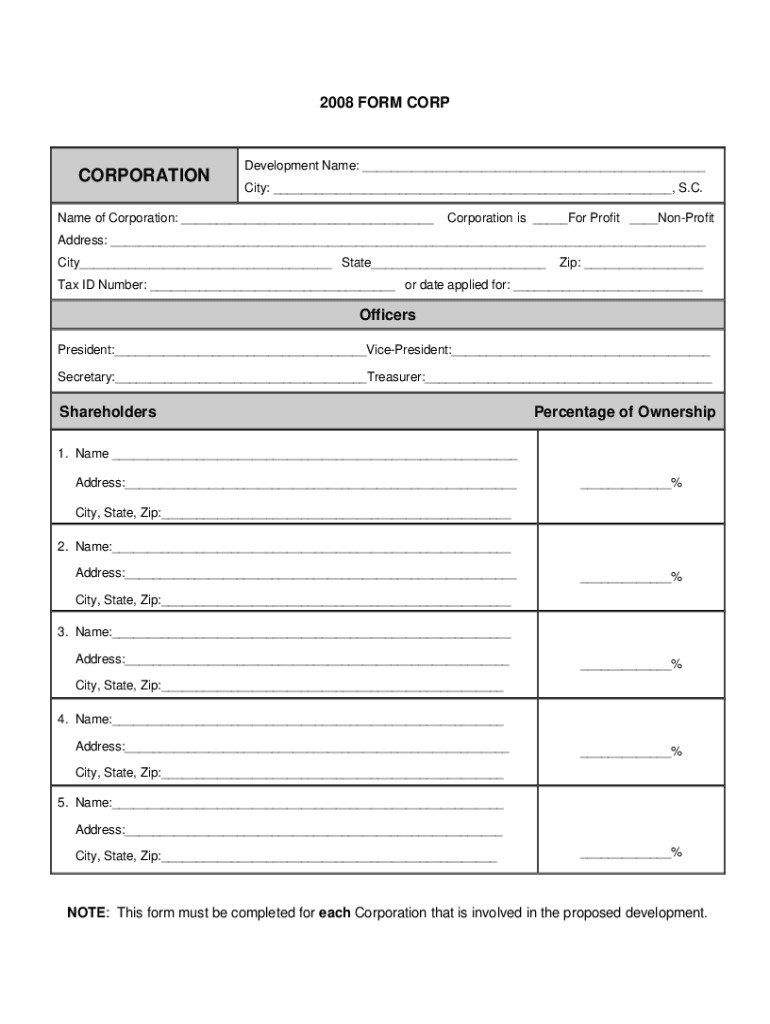

2008 FORM CORPCORPORATIONDevelopment Name: ___

City: ___, S.C. Name of Corporation: ___Corporation is ___For Profit ___NonProfitAddress: ___

City___ State___Zip: ___Tax ID Number: ___ or date applied

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign multifamily tax-exempt bond financing

Edit your multifamily tax-exempt bond financing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your multifamily tax-exempt bond financing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit multifamily tax-exempt bond financing online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit multifamily tax-exempt bond financing. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out multifamily tax-exempt bond financing

How to fill out multifamily tax-exempt bond financing

01

Determine eligibility: Before filling out the application for multifamily tax-exempt bond financing, determine if your project meets the eligibility criteria set by the appropriate government agency.

02

Gather necessary documents: Collect all the necessary financial statements, project plans, legal documents, and other relevant information required for the application process.

03

Complete the application: Fill out the application form accurately and comprehensively, providing all the requested information about your project, organization, and financing needs.

04

Provide supporting documents: Attach all the required supporting documents to the application, such as proof of income, project feasibility study, environmental impact assessment, and any additional documentation specific to your project.

05

Submit the application: Submit your completed application along with the supporting documents to the relevant government agency or financial institution responsible for processing multifamily tax-exempt bond financing applications.

06

Follow up: After submitting the application, follow up with the agency or institution to ensure that all necessary information has been received and to inquire about the status of your application.

07

Meet the requirements: If your application is approved, make sure to meet all the requirements and obligations associated with multifamily tax-exempt bond financing, such as timely reporting, compliance with regulatory guidelines, and appropriate use of funds.

08

Develop a repayment plan: Work with the financing institution to develop a repayment plan that aligns with your project's financial capacity and timeline.

09

Track and report: Keep track of all financial activities related to the bond financing and regularly report to the financing institution as required.

10

Seek professional advice: Consider consulting with qualified professionals, such as accountants, lawyers, and financial advisors, to ensure compliance with tax laws, regulations, and best practices throughout the process.

Who needs multifamily tax-exempt bond financing?

01

Multifamily tax-exempt bond financing is typically needed by organizations or developers involved in the construction, rehabilitation, or preservation of affordable housing projects. This can include non-profit organizations, housing authorities, private developers, and government agencies focused on addressing the housing needs of low-income individuals and families. The financing option is particularly attractive for those aiming to provide affordable rental housing units as it offers low-interest rates and tax advantages, making the projects more financially feasible and sustainable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit multifamily tax-exempt bond financing from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your multifamily tax-exempt bond financing into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit multifamily tax-exempt bond financing online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your multifamily tax-exempt bond financing to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit multifamily tax-exempt bond financing straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing multifamily tax-exempt bond financing right away.

What is multifamily tax-exempt bond financing?

Multifamily tax-exempt bond financing refers to the issuance of bonds that are exempt from federal income tax and are used to finance the construction or rehabilitation of multifamily housing developments.

Who is required to file multifamily tax-exempt bond financing?

Entities that issue or manage multifamily tax-exempt bonds are required to file necessary documentation, typically including state or local housing agencies and developers involved in the financing.

How to fill out multifamily tax-exempt bond financing?

To fill out multifamily tax-exempt bond financing forms, applicants must provide detailed information about the project, including project costs, financing structure, and compliance with federal regulations.

What is the purpose of multifamily tax-exempt bond financing?

The purpose of multifamily tax-exempt bond financing is to lower borrowing costs for developers and promote the construction and rehabilitation of affordable rental housing.

What information must be reported on multifamily tax-exempt bond financing?

Information required includes details about the bond issuance, use of proceeds, compliance with tax-exempt regulations, and information about the financed housing project.

Fill out your multifamily tax-exempt bond financing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Multifamily Tax-Exempt Bond Financing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.