Get the free Revenue Estimate Recommendations - co newton ga

Show details

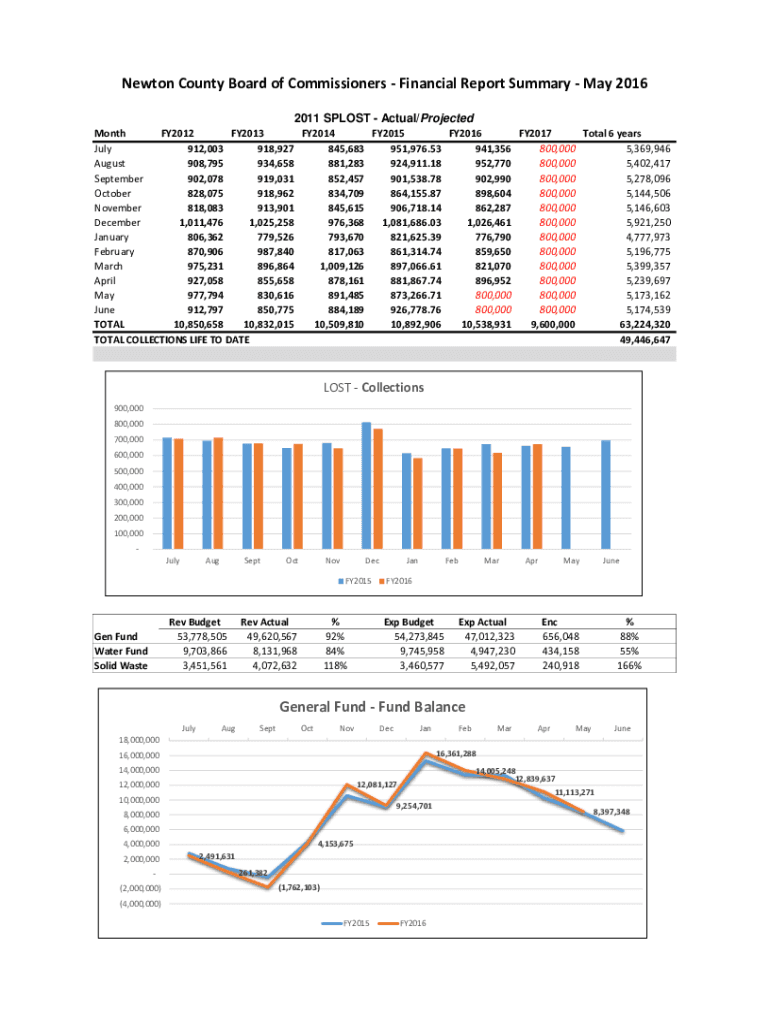

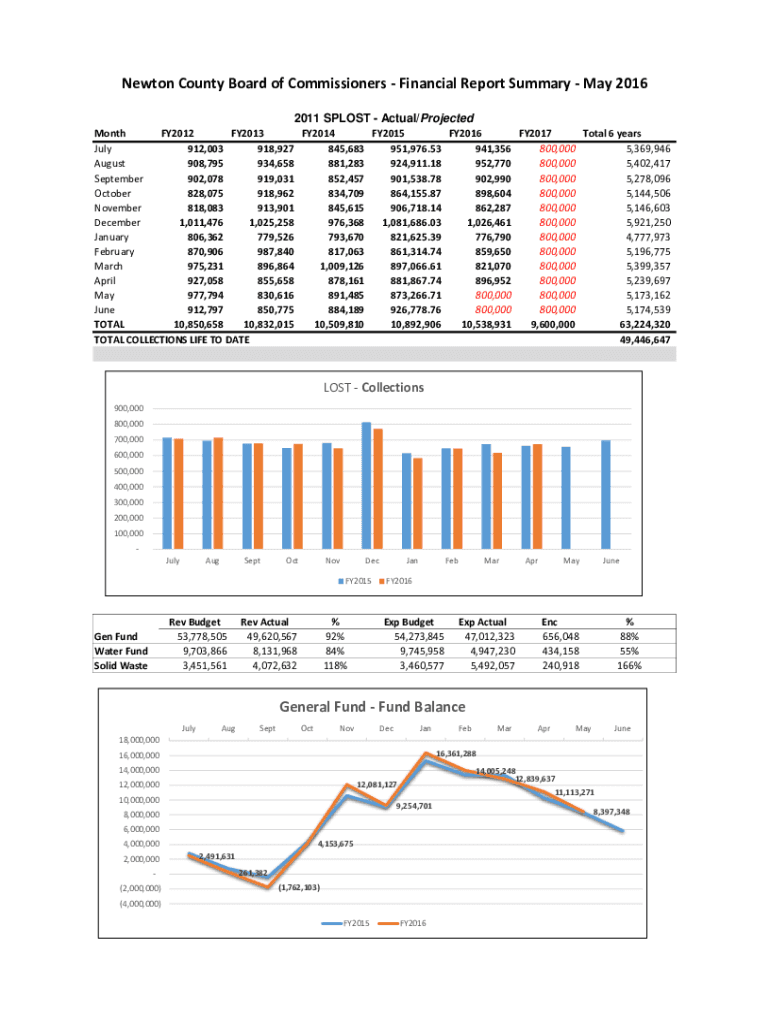

Newton County Board of Commissioners Financial Report Summary May 2016

2011 SPLOSH Actual/Projected

Month

FY2012

FY2013

FY2014

FY2015

FY2016

FY2017

Total 6 years

July

912,003

918,927

845,683

951,976.53

941,356

800,000

5,369,946

952,770

800,000

5,402,417

924,911.18

881,283

August

908,795

934,658

September

902,078

919,031

852,457

901,538.78

902,990

800,000

5,278,096

864,155.87

898,604

800,000

5,144,506

834,709

October

828,075

918,962

November

818,083

913,901

845,615

906,718.14

862,287

800,000...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue estimate recommendations

Edit your revenue estimate recommendations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue estimate recommendations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenue estimate recommendations online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit revenue estimate recommendations. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue estimate recommendations

How to fill out revenue estimate recommendations

01

To fill out revenue estimate recommendations, follow these steps:

02

Start by gathering all relevant financial information, such as sales data, expense records, and previous revenue reports.

03

Analyze the historical revenue trends and identify any patterns or seasonality in the data.

04

Consider external factors that might impact revenue, such as market conditions, industry trends, or changes in customer behavior.

05

Use this information to make educated predictions about future revenue potential.

06

Break down the revenue estimate by different product lines, services, or customer segments if necessary.

07

Validate your estimates by consulting with sales managers, finance team, or industry experts.

08

Document your revenue estimate recommendations in a clear and concise manner, providing supporting rationale for each prediction.

09

Regularly review and update the revenue estimate as new information becomes available, and consider adjusting the recommendations accordingly.

Who needs revenue estimate recommendations?

01

Revenue estimate recommendations are needed by various stakeholders, including:

02

- Company executives and management teams who make strategic decisions based on revenue projections.

03

- Financial analysts and investors who use revenue estimates to assess a company's financial health and growth potential.

04

- Sales and marketing teams who rely on revenue forecasts to set targets and create effective business strategies.

05

- Consultants or advisors who provide financial guidance to businesses.

06

- Government agencies or regulatory bodies that monitor economic indicators and revenue projections for policy-making purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find revenue estimate recommendations?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the revenue estimate recommendations in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the revenue estimate recommendations electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your revenue estimate recommendations.

How do I fill out revenue estimate recommendations on an Android device?

Use the pdfFiller mobile app to complete your revenue estimate recommendations on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is revenue estimate recommendations?

Revenue estimate recommendations are projections made by taxpayers regarding their expected income for the upcoming tax year, which help tax authorities determine anticipated tax revenues.

Who is required to file revenue estimate recommendations?

Individuals and businesses that expect to owe a certain amount of tax for the upcoming year are typically required to file revenue estimate recommendations.

How to fill out revenue estimate recommendations?

To fill out revenue estimate recommendations, taxpayers need to provide their expected income, deductions, credits, and any previous tax payments to calculate the estimated tax due.

What is the purpose of revenue estimate recommendations?

The purpose of revenue estimate recommendations is to help tax authorities plan for budgetary needs and ensure that taxpayers meet their tax obligations throughout the year.

What information must be reported on revenue estimate recommendations?

Required information typically includes projected income, deductions, credits, total tax liability, and any payments already made.

Fill out your revenue estimate recommendations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Estimate Recommendations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.