Get the free Tourist Tax information for guests

Show details

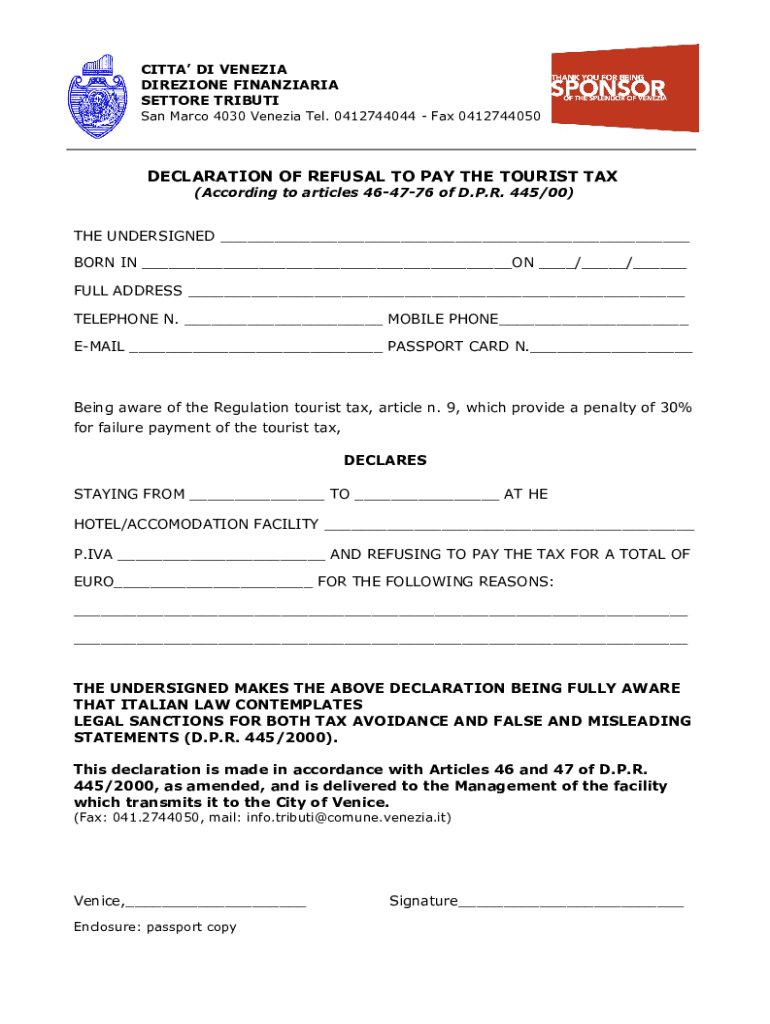

PITTA DI VENETIAN

DIRECTION FINANZIARIA

SECTOR TRIBUTE

San Marco 4030 Venetian Tel. 0412744044 Fax 0412744050DECLARATION OF REFUSAL TO PAY THE TOURIST TAX

(According to articles 464776 of D.P.R. 445/00)THE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tourist tax information for

Edit your tourist tax information for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tourist tax information for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tourist tax information for online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tourist tax information for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tourist tax information for

How to fill out tourist tax information for

01

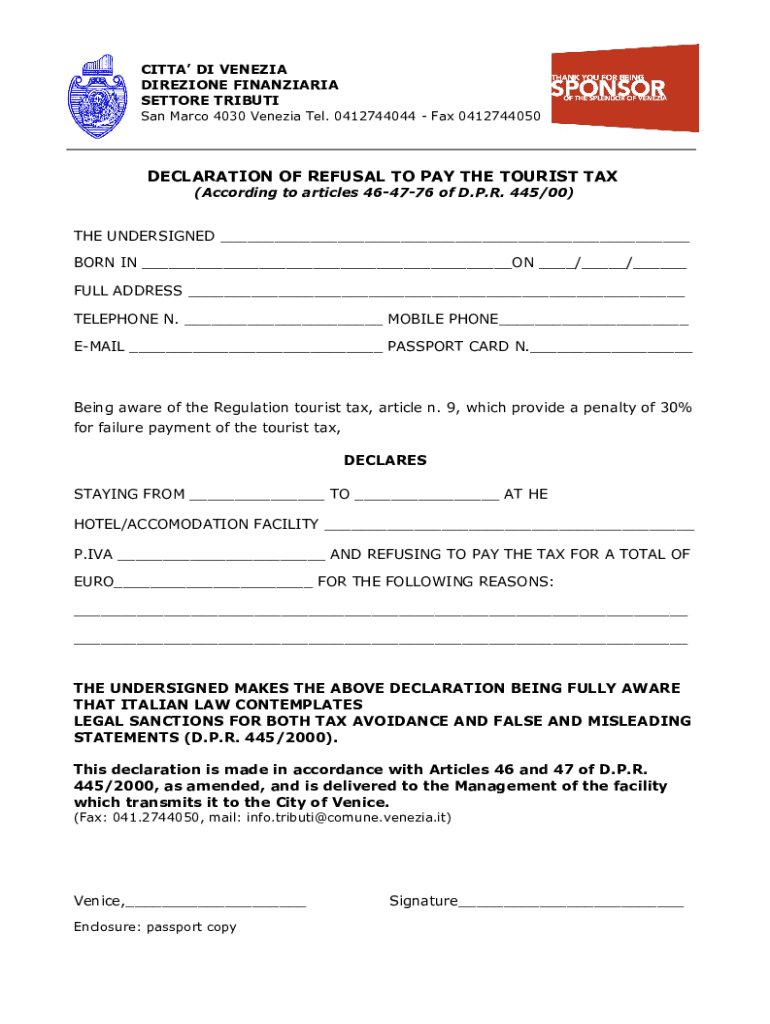

To fill out tourist tax information, follow these steps:

02

Obtain the necessary forms: Typically, you can obtain the tourist tax information forms from the local tourism authority or the accommodation provider.

03

Fill in personal details: Provide your full name, address, contact information, and other required personal details as mentioned in the forms.

04

Trip details: Enter the details of your trip, including the dates of arrival and departure, duration of stay, purpose of visit, and the accommodation details.

05

Payment information: If there is any payment associated with the tourist tax, provide the necessary payment details such as credit card information or preferred payment method.

06

Sign and submit: After completing the form, sign it and submit it according to the instructions provided. This might involve sending the form by mail, online submission, or submitting it in person at the designated office.

Who needs tourist tax information for?

01

Tourist tax information needs to be filled out by individuals who are visiting or staying in a specific location that requires the payment of tourist tax.

02

This can include tourists, travelers, or temporary visitors who are staying at hotels, hostels, vacation rentals, and other similar accommodations.

03

The requirements for filling out tourist tax information may vary depending on the country, region, or city you are visiting, so it is important to check the local regulations or inquire with the accommodation provider or tourism authority for specific details.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tourist tax information for to be eSigned by others?

To distribute your tourist tax information for, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the tourist tax information for in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your tourist tax information for in minutes.

Can I edit tourist tax information for on an iOS device?

Create, edit, and share tourist tax information for from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is tourist tax information for?

Tourist tax information is used to report taxes collected from visitors staying in accommodations, which helps fund local services and infrastructure used by tourists.

Who is required to file tourist tax information for?

Accommodations providers such as hotels, motels, vacation rentals, and other lodging establishments are required to file tourist tax information for the taxes they collect from guests.

How to fill out tourist tax information for?

Tourist tax information can typically be filled out using designated forms provided by local tax authorities, which require details of the collected tax amounts, guest information, and the period of collection.

What is the purpose of tourist tax information for?

The purpose of tourist tax information is to ensure proper collection and remittance of tourist taxes which support local community development, tourism promotion, and related services.

What information must be reported on tourist tax information for?

Information that must be reported includes the total number of guests, number of nights stayed, the amount of tax collected, and identification details of the lodging provider.

Fill out your tourist tax information for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tourist Tax Information For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.