Get the free Refinancing Fees when converting rental to personal use

Show details

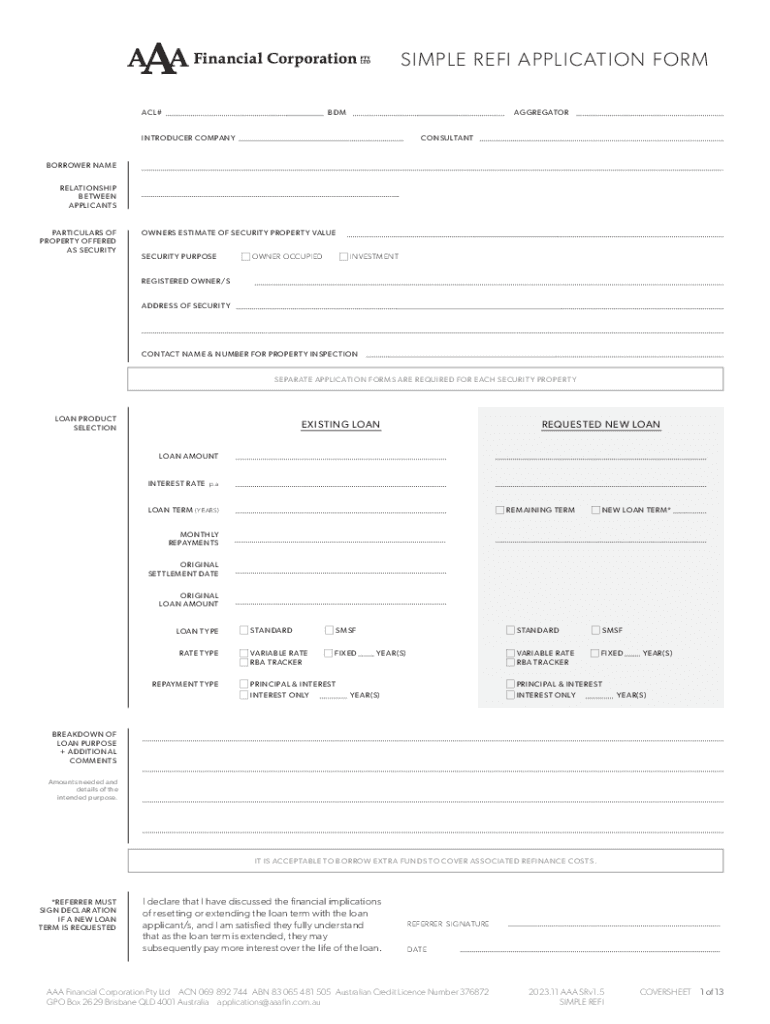

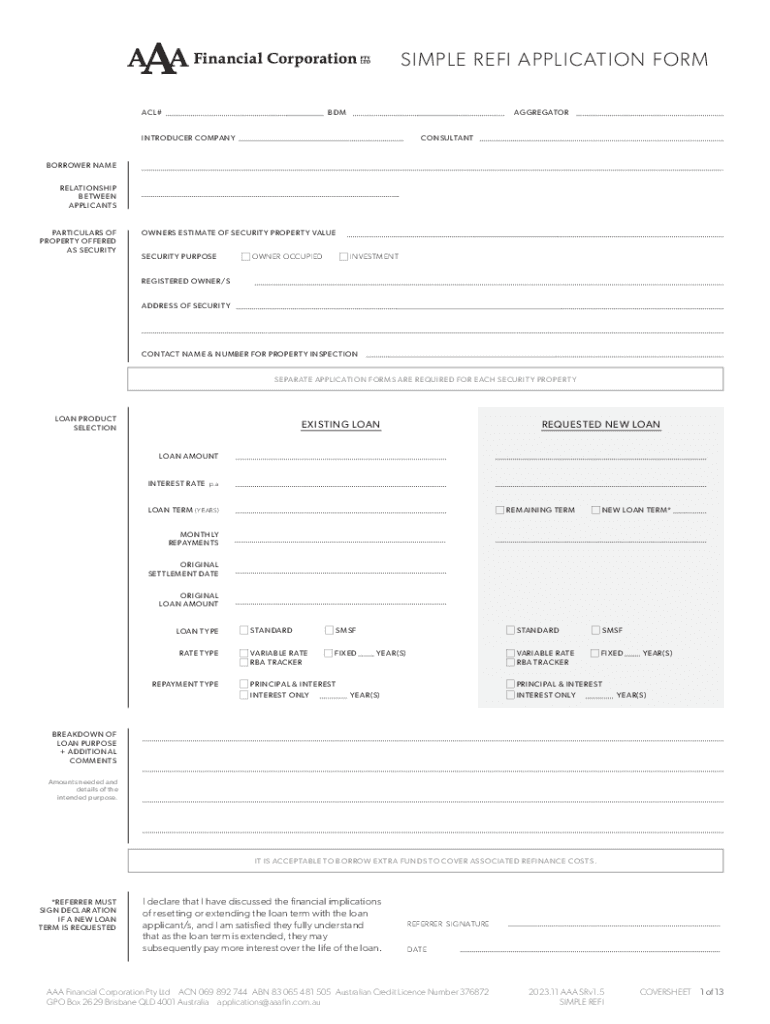

SIMPLE REFI APPLICATION FORM ACL#BDMAGGREGATOR INTRODUCER COMPANYCONSULTANT BORROWER NAME REL ATIONSHIP BET WEEN APPLICANTSPARTICUL ARS OF PROPERT Y OFFERED AS SECURIT YOWNERS ESTIMATE OF SECURIT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign refinancing fees when converting

Edit your refinancing fees when converting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refinancing fees when converting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit refinancing fees when converting online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit refinancing fees when converting. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out refinancing fees when converting

How to fill out refinancing fees when converting

01

Start by gathering all the necessary documents, such as your existing mortgage agreement, income statements, and credit reports.

02

Contact your current lender to inquire about refinancing options and understand the fees involved.

03

Research and compare different refinance lenders to get the best deal.

04

Fill out the refinancing application form with accurate and up-to-date information.

05

Pay attention to the refinancing fees and carefully fill out the relevant sections in the application form.

06

Review the completed application form for any errors or missing information before submitting it.

07

Submit the application and required documents to the chosen refinance lender.

08

Stay in touch with the lender and respond promptly to any requests for additional documentation or information.

09

Wait for the lender's decision on your refinancing request.

10

If approved, carefully review the new mortgage agreement, including the terms and conditions, interest rate, and any associated fees.

11

Sign the new mortgage agreement and fulfill any outstanding requirements or conditions from the lender.

12

Close your existing mortgage account and proceed with the refinancing process as per the lender's instructions.

Who needs refinancing fees when converting?

01

Homeowners who want to save money by securing a lower interest rate on their mortgage.

02

Individuals looking to reduce their monthly mortgage payments by extending the loan term.

03

People who wish to change from an adjustable-rate mortgage to a fixed-rate mortgage to have more stability in their payments.

04

Homeowners who want to tap into their home equity for cash or to consolidate debts.

05

Those who want to switch lenders to benefit from better customer service or more favorable terms.

06

Individuals planning to stay in their current home for a longer period and want to improve the overall financial plan.

07

Homeowners facing financial difficulties and seeking to refinance to avoid foreclosure or manage their debts more effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete refinancing fees when converting online?

With pdfFiller, you may easily complete and sign refinancing fees when converting online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the refinancing fees when converting in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your refinancing fees when converting in minutes.

How do I fill out the refinancing fees when converting form on my smartphone?

Use the pdfFiller mobile app to complete and sign refinancing fees when converting on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is refinancing fees when converting?

Refinancing fees when converting are costs incurred when a borrower refinances a loan or mortgage, often involving charges such as application fees, appraisal fees, and closing costs.

Who is required to file refinancing fees when converting?

The borrower who is refinancing the loan or mortgage is required to file the refinancing fees when converting.

How to fill out refinancing fees when converting?

To fill out refinancing fees, borrowers must provide necessary details about the loan, itemize the fees involved, and submit the documentation to the relevant financial institution or authority.

What is the purpose of refinancing fees when converting?

The purpose of refinancing fees is to cover the costs associated with processing a new loan or mortgage, including administrative expenses and services needed for the transaction.

What information must be reported on refinancing fees when converting?

Information that must be reported includes the type of loan, amount financed, itemized fees, the lender's contact information, and terms of the new loan.

Fill out your refinancing fees when converting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refinancing Fees When Converting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.