Get the free Application for Mortgage Finance Broker Loan Pack

Show details

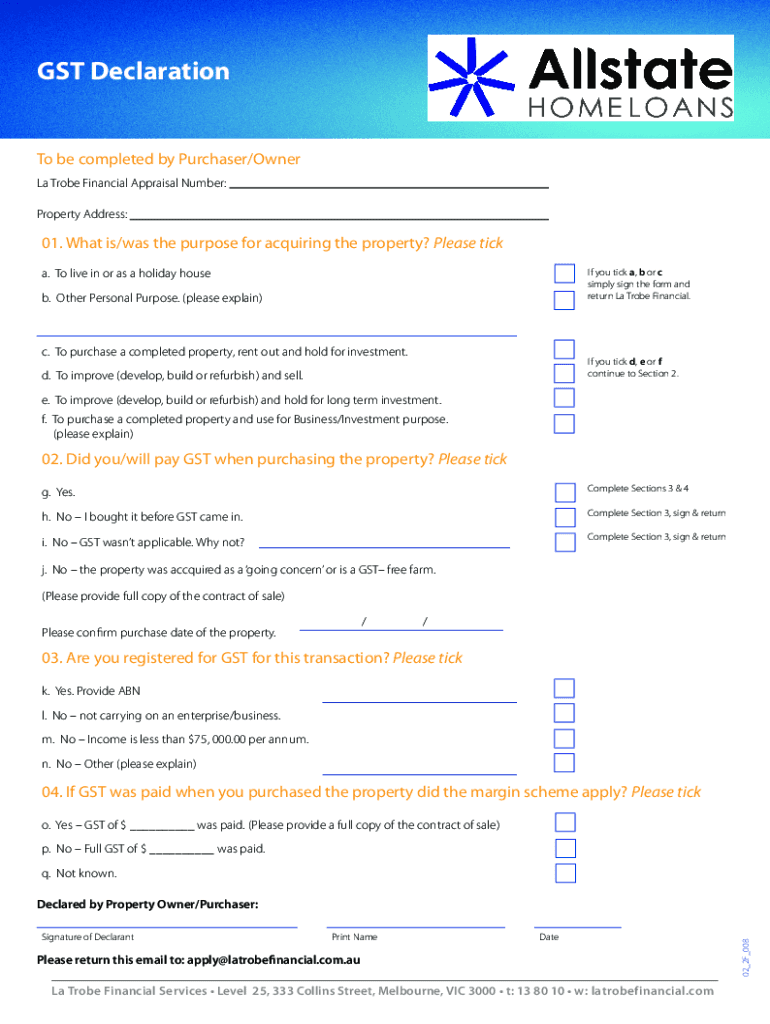

GST Declaration To be completed by Purchaser/Owner La Trobe Financial Appraisal Number: Property Address:01. What is/was the purpose for acquiring the property? Please tick a. To live in or as a holiday

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for mortgage finance

Edit your application for mortgage finance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for mortgage finance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for mortgage finance online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for mortgage finance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for mortgage finance

How to fill out application for mortgage finance

01

To fill out an application for mortgage finance, follow these steps:

02

Gather all necessary documents such as ID proof, employment information, income proof, credit history, and statements of assets and liabilities.

03

Research and compare mortgage lenders and their interest rates to find the best option for your needs.

04

Visit the selected lender's website or physical branch and locate their mortgage finance application form.

05

Fill out the application form accurately and provide all the required information. Make sure to double-check for any errors or missing details.

06

Attach the necessary supporting documents and submit the application either online or in person.

07

Wait for the lender's response. They may contact you for additional information or documents if needed.

08

Once approved, carefully review the terms and conditions of the mortgage finance offer before accepting.

09

If you accept the offer, follow any further instructions provided by the lender to complete the mortgage finance process.

10

Ensure all necessary payments and documentation are submitted on time to secure the mortgage finance successfully.

Who needs application for mortgage finance?

01

Anyone who wishes to purchase a property but requires financial assistance can benefit from applying for mortgage finance.

02

This includes individuals or families planning to buy a home, real estate investors looking to acquire properties, or individuals seeking to refinance their existing mortgage.

03

Applying for mortgage finance allows individuals to fund their property purchases while spreading the payments over an extended period, making homeownership more affordable.

04

However, it is important to note that the eligibility criteria and requirements for mortgage finance may vary among lenders and countries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application for mortgage finance in Gmail?

application for mortgage finance and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify application for mortgage finance without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your application for mortgage finance into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete application for mortgage finance on an Android device?

On an Android device, use the pdfFiller mobile app to finish your application for mortgage finance. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is application for mortgage finance?

An application for mortgage finance is a formal request submitted by an individual or entity to a financial institution to obtain a loan secured by real property, typically for purchasing or refinancing a home.

Who is required to file application for mortgage finance?

Any individual or entity seeking to borrow money through a mortgage loan, including home buyers and homeowners looking to refinance, is required to file an application for mortgage finance.

How to fill out application for mortgage finance?

To fill out an application for mortgage finance, provide accurate personal information, financial details, employment history, and information about the property being financed. It's essential to gather necessary documents such as income verification and credit history to assist in the process.

What is the purpose of application for mortgage finance?

The purpose of an application for mortgage finance is to evaluate the borrower's creditworthiness and financial situation to determine if they qualify for a mortgage loan and the terms of that loan.

What information must be reported on application for mortgage finance?

The application for mortgage finance typically requires reporting personal identification details, income, employment history, debts, assets, the amount of the loan requested, and information about the property being purchased or refinanced.

Fill out your application for mortgage finance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Mortgage Finance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.