Get the free Anti-Money Laundering / Anti-Terrorist Financing ...

Show details

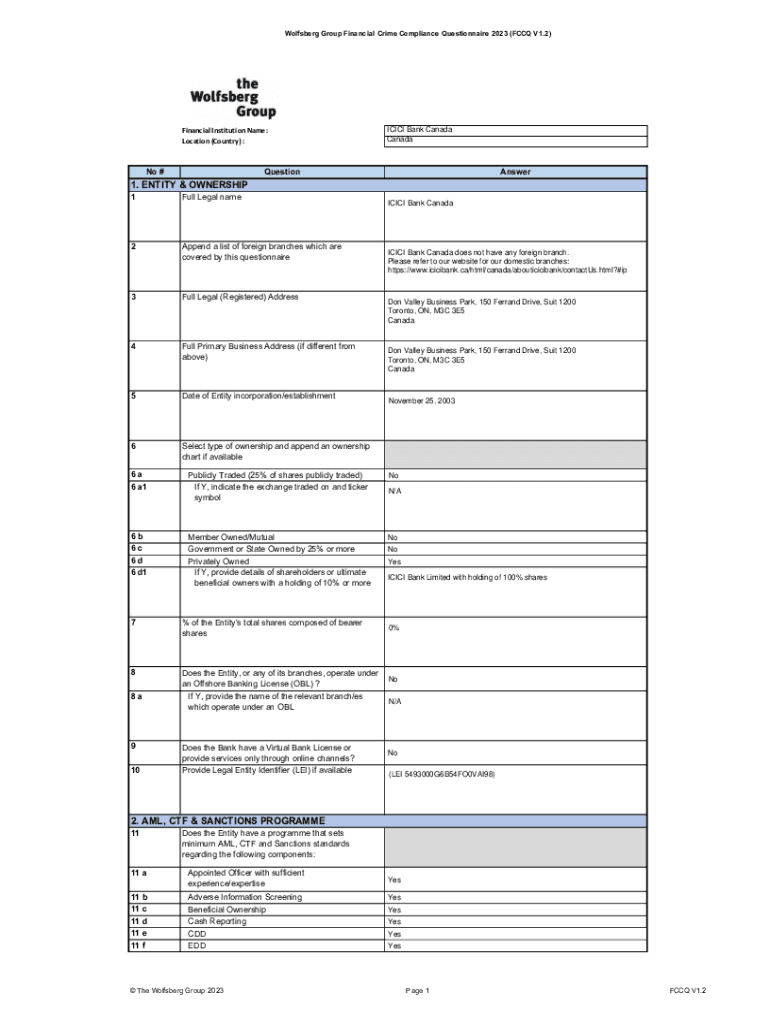

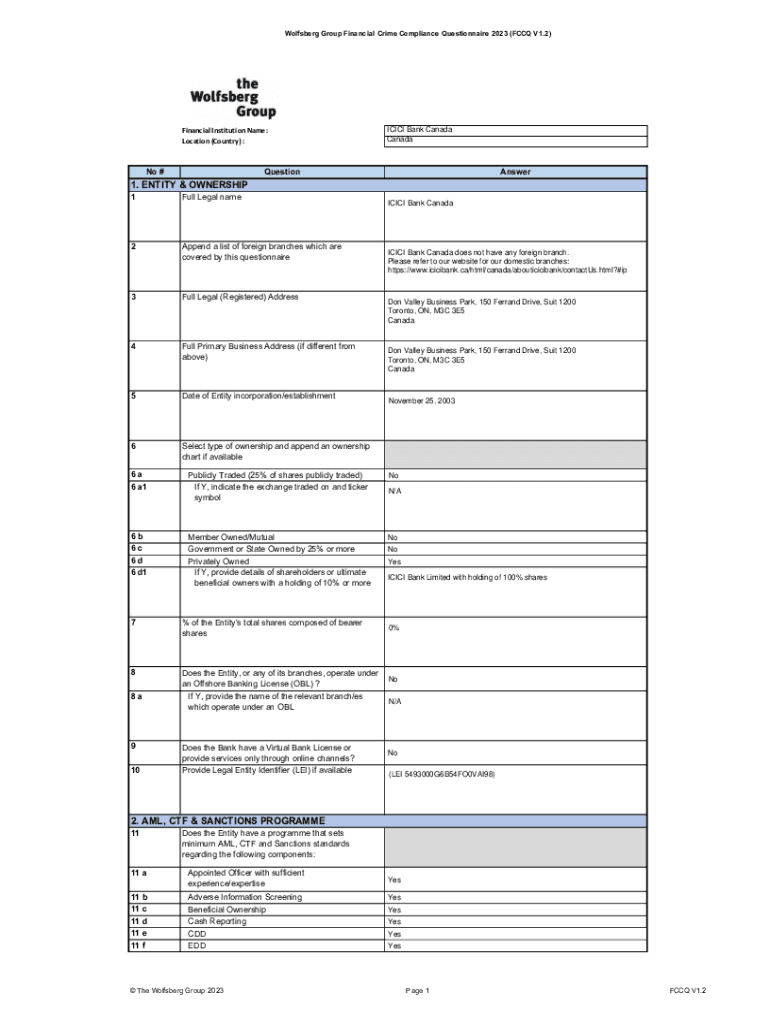

Wolfsberg Group Financial Crime Compliance Questionnaire 2023 (FCCQ V1.2)Financial Institution Name: Location (Country) :No #ICICI Bank Canada CanadaQuestionAnswer1. ENTITY & OWNERSHIP 1Full Legal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti-money laundering anti-terrorist financing

Edit your anti-money laundering anti-terrorist financing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti-money laundering anti-terrorist financing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit anti-money laundering anti-terrorist financing online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit anti-money laundering anti-terrorist financing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti-money laundering anti-terrorist financing

How to fill out anti-money laundering anti-terrorist financing

01

Step 1: Obtain and familiarize yourself with the relevant anti-money laundering (AML) and anti-terrorist financing (ATF) guidelines and regulations.

02

Step 2: Identify and verify your customers' identities, including performing Know Your Customer (KYC) procedures.

03

Step 3: Conduct ongoing monitoring and risk assessments of your customers' transactions and activities.

04

Step 4: Implement internal controls and procedures to detect and report suspicious activities.

05

Step 5: Train your employees regularly on AML and ATF compliance.

06

Step 6: Keep accurate records and ensure proper record keeping for a specified period of time.

07

Step 7: Report any suspicious transactions or activities to your local authorities or designated reporting agencies.

08

Step 8: Cooperate with law enforcement agencies during investigations.

09

Step 9: Regularly review and update your AML and ATF policies and procedures to comply with changing regulations and requirements.

Who needs anti-money laundering anti-terrorist financing?

01

Banks and financial institutions

02

Money service businesses

03

Securities dealers and brokers

04

Real estate professionals

05

Casinos and gambling establishments

06

Lawyers, accountants, and other professionals providing financial services

07

High-value dealers and jewelers

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in anti-money laundering anti-terrorist financing?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your anti-money laundering anti-terrorist financing to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in anti-money laundering anti-terrorist financing without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing anti-money laundering anti-terrorist financing and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete anti-money laundering anti-terrorist financing on an Android device?

On Android, use the pdfFiller mobile app to finish your anti-money laundering anti-terrorist financing. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is anti-money laundering anti-terrorist financing?

Anti-money laundering (AML) and anti-terrorist financing (ATF) refer to regulations and processes aimed at preventing and minimizing the risks of money laundering and financing of terrorism. These measures are designed to detect and report suspicious activities that could signify illegal financial activities.

Who is required to file anti-money laundering anti-terrorist financing?

Entities such as banks, financial institutions, insurance companies, casinos, and other businesses engaged in financial transactions are required to file reports related to anti-money laundering and anti-terrorist financing as part of their compliance obligations.

How to fill out anti-money laundering anti-terrorist financing?

To fill out anti-money laundering and anti-terrorist financing reports, designated compliance officers should gather required information about transactions, customer identification details, and any suspicious activities. They must follow the specific format and guidelines provided by regulatory authorities and file the forms electronically or via mail.

What is the purpose of anti-money laundering anti-terrorist financing?

The purpose of anti-money laundering and anti-terrorist financing regulations is to protect the financial system from being exploited for illegal activities, to detect suspicious transactions, and to support law enforcement efforts against money laundering and terrorism financing.

What information must be reported on anti-money laundering anti-terrorist financing?

Information that must be reported includes details of the transaction, customer identification data, the nature of the suspicious activity, the amount involved, and any other relevant information that may help authorities assess the transaction's legitimacy.

Fill out your anti-money laundering anti-terrorist financing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti-Money Laundering Anti-Terrorist Financing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.