IRS 1040-NR 2023 free printable template

Show details

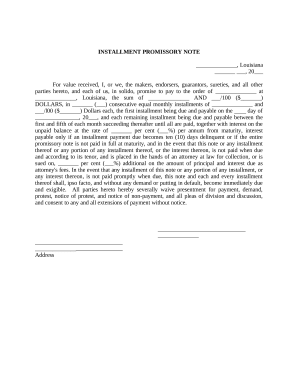

9a. Credit for other dependents Cat. No. 11364D Form 1040NR 2018 Page 2 continued Other Taxes Taxable income. Attach Form 8833 if required. See instructions. a Country b Tax treaty article c Number of months claimed in prior tax years d Amount of exempt income in current tax year e Total. Enter this amount on Form 1040NR line 22. Form 1040NR Go Department of the Treasury Internal Revenue Service beginning U.S. Nonresident Alien Income Tax Return For the year January 1 December 31 2018 or other...tax year 2018 and ending Your first name and initial Identifying number see instructions Check only one box. Also enter this amount on Form 1040NR line 37. Page 4 Schedule NEC Tax on Income Not Effectively Connected With a U.S. Trade or Business see instructions Enter amount of income under the appropriate rate of tax see instructions Nature of income Dividends and dividend equivalents Dividends paid by U.S. corporations Dividend equivalent payments received transactions. Dependents Attach Form...s W-2 1042-S SSA-1042S RRB-1042S and 8288-A here. Also 1099-R if tax was withheld. Adjusted Gross Income Foreign province/state/county Reserved Single nonresident alien Individual Dependents see instructions 1 First name Last name Foreign postal code Married nonresident alien Qualifying widow er see instructions Child s name 4 if qualifies for see instr* relationship to you Child tax credit 8 Wages salaries tips etc* Attach Form s W-2. 9a Taxable interest. b Tax-exempt interest. Do not include...on line 9a. 9b 10a Ordinary dividends. b Qualified dividends see instructions. 10b 11 Taxable refunds credits or offsets of state and local income taxes see instructions. 12 Scholarship and fellowship grants. Attach Form s 1042-S or required statement see instructions 13 Business income or loss. Attach Schedule C or C-EZ Form 1040. 14 Capital gain or loss. Attach Schedule D Form 1040 if required* If not required check here 15 Other gains or losses. Attach Form 4797. 16 Reserved. 17a IRAs...pensions and annuities 17a 17b Taxable amount see instr* 18 Rental real estate royalties partnerships trusts etc* Attach Schedule E Form 1040. 19 Farm income or loss. Attach Schedule F Form 1040. 20 Unemployment compensation. 21 Other income. List type and amount see instructions 22 Total income exempt by a treaty from page 5 Schedule OI Item L 1 e 23 Combine the amounts in the far right column for lines 8 through 21. This is your total effectively connected income. 24 Educator expenses see...instructions. 25 Health savings account deduction* Attach Form 8889. 26 Moving expenses for members of the Armed Forces. Attach Form 3903. 27 Deductible part of self-employment tax. Attach Schedule SE Form 1040. Tax and Credits Check if Estate or Trust If more than four see instructions and check here. Effectively Connected With U*S* Trade/ Business Apt. no. City town or post office state and ZIP code. If you have a foreign address also complete spaces below. See instructions. Foreign country...name Filing Status Present home address number and street or rural route.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040-NR

How to edit IRS 1040-NR

How to fill out IRS 1040-NR

Instructions and Help about IRS 1040-NR

How to edit IRS 1040-NR

You can edit IRS 1040-NR using tools that allow PDF editing. Make sure to keep the format intact when making changes. Ensure that all required information is entered accurately to avoid processing delays.

How to fill out IRS 1040-NR

To fill out IRS 1040-NR, gather the necessary documentation such as your income statements and any other relevant tax information. Follow these steps:

01

Download the IRS 1040-NR form from the IRS website or access it via pdfFiller.

02

Complete your personal information, including your name and address.

03

Report your income and any deductions or credits you may qualify for.

04

Review the completed form for accuracy before submission.

About IRS 1040-NR 2023 previous version

What is IRS 1040-NR?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040-NR 2023 previous version

What is IRS 1040-NR?

IRS 1040-NR is a tax form used by non-resident aliens to report their U.S. income and pay taxes. Non-resident aliens are individuals who are not U.S. citizens and do not meet the substantial presence test for the tax year.

What is the purpose of this form?

The purpose of IRS 1040-NR is to determine your tax liability to the U.S. government. It allows the IRS to track income and tax obligations of individuals who may not live in the U.S. but earn income within its borders.

Who needs the form?

Individuals required to file IRS 1040-NR include non-resident aliens who have U.S. source income, claim a refund of any overpaid tax, or are required to file by other provisions. Common examples include foreign students, scholars, and workers on temporary visas.

When am I exempt from filling out this form?

You may be exempt from filing IRS 1040-NR if your income is below the filing threshold for your residency status or if you meet certain eligibility criteria for exclusions, such as being a foreign student under specific visa classifications. It's essential to check IRS guidelines to confirm your status.

Components of the form

The IRS 1040-NR consists of several sections, including personal information, income details, deductions, tax computation, and signature areas. Each section is designed to capture specific information that contributes to your overall tax profile.

What are the penalties for not issuing the form?

Not filing IRS 1040-NR when required can lead to penalties imposed by the IRS. These may include fines and interest on unpaid taxes. Understanding your filing obligations is crucial to avoid these penalties.

What information do you need when you file the form?

When filing IRS 1040-NR, you will need your Social Security Number or Individual Taxpayer Identification Number, income statements (such as Form 1042-S), details of any deductions you plan to claim, and any other applicable tax documents. Be sure to have this information ready to ensure accurate filing.

Is the form accompanied by other forms?

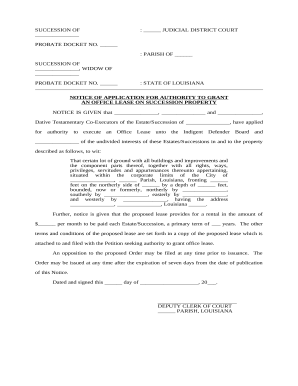

Yes, IRS 1040-NR may need to be submitted alongside supplemental forms, such as Schedule OI, which provides additional information about your income or residency status. Consult the IRS instructions to determine which additional forms are necessary for your situation.

Where do I send the form?

You should send IRS 1040-NR to the address specified in the form's instructions. The mailing address may vary based on whether you are enclosing a payment. Always check the latest IRS guidance to confirm the correct submission address.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

This is a superb tool that's easy to use providing more readable documents than had they been filled out manually with less legible handwriting.

iliant, fast and easy to use. Best pdf signer on the market.

See what our users say