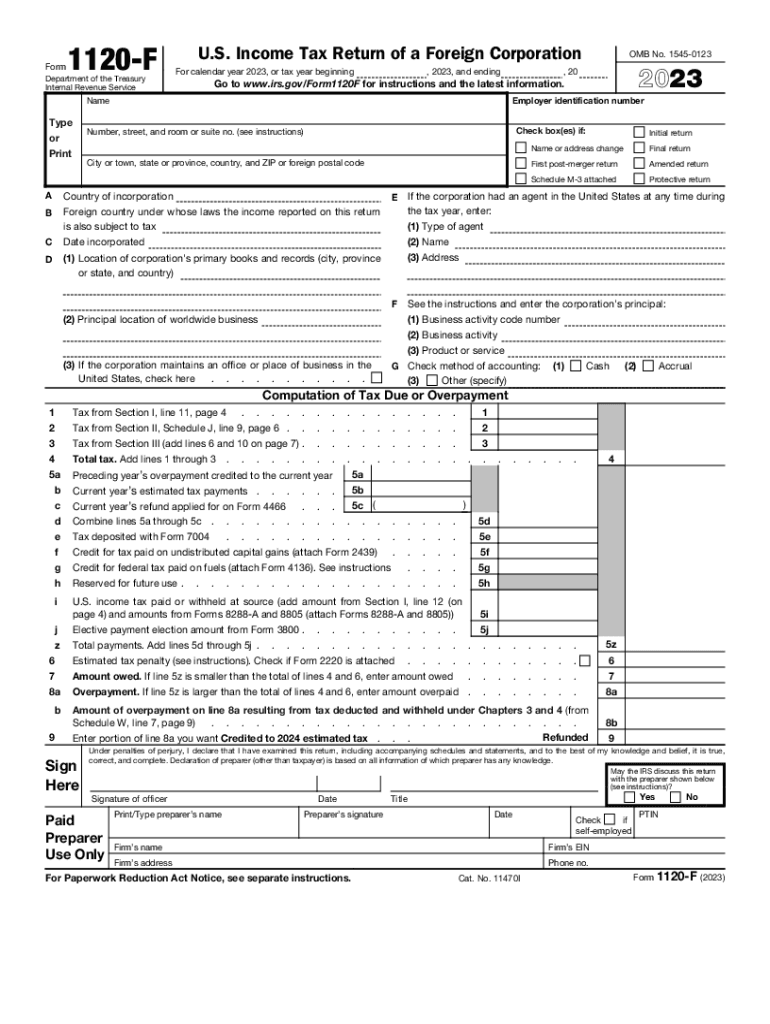

IRS 1120-F 2023 free printable template

Instructions and Help about IRS 1120-F

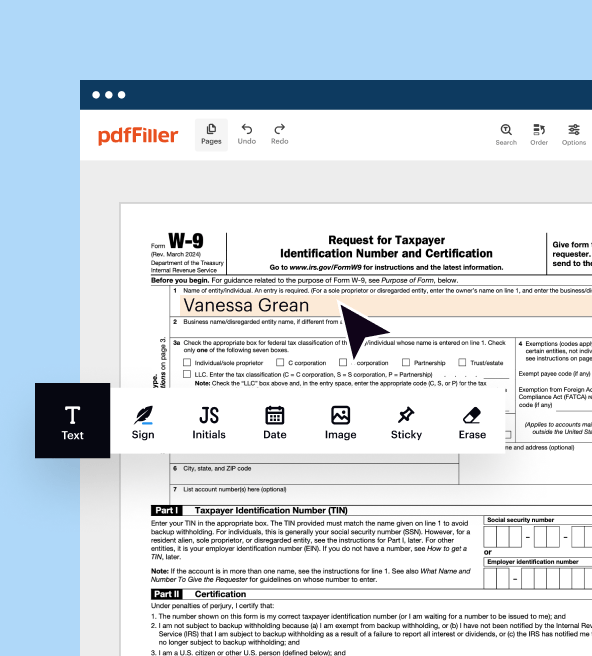

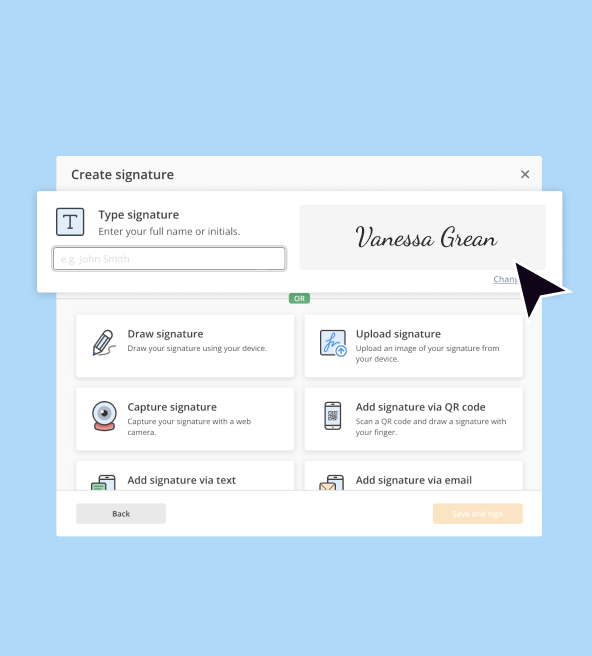

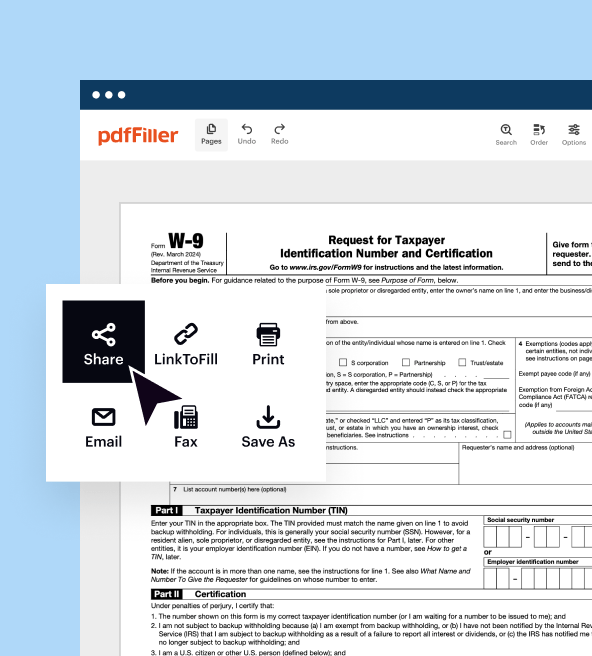

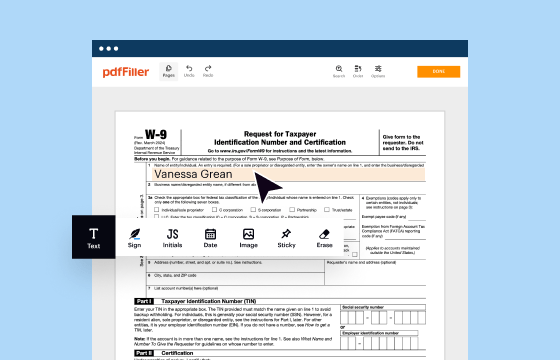

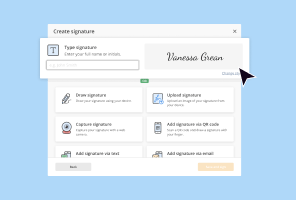

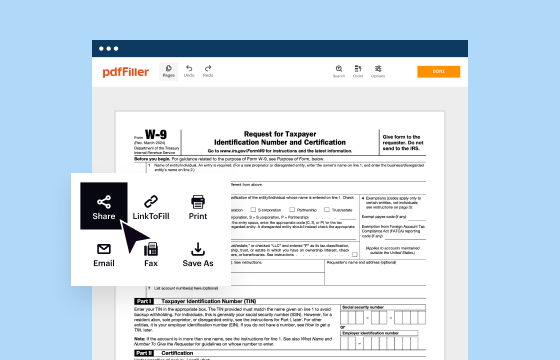

How to edit IRS 1120-F

How to fill out IRS 1120-F

About IRS 1120-F 2023 previous version

What is IRS 1120-F?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120-F

What should I do if I discover an error after filing my IRS 1120-F?

If you realize there’s an error on your IRS 1120-F after submission, you can file an amended return using Form 1120-FX. This form allows for corrections to be made and ensures that the IRS has the correct information. Make sure to provide a detailed explanation of the changes made in your amended submission.

How can I confirm that my IRS 1120-F has been received and is being processed?

To verify the status of your filed IRS 1120-F, you can contact the IRS Business and Specialty Tax Line or check their online tools if you e-filed. Be prepared to provide details such as your Employer Identification Number (EIN) and filing status to assist in the inquiry.

What should nonresidents know when filing IRS 1120-F?

Nonresidents filing IRS 1120-F need to be aware of different tax obligations and possible treaty benefits based on their country of residence. It’s important to accurately report income effectively while utilizing any applicable tax treaties that may exempt certain types of income from U.S. taxation.

What are some common mistakes to avoid when completing IRS 1120-F?

Some common errors include inaccurate calculations, incorrect selection of filing status, and failing to include all required schedules. Thoroughly double-check your figures and ensure all relevant supporting documents are attached to prevent delays in processing your IRS 1120-F.