Get the free Shared Equity Home Buyer Helper - Revenue NSW

Show details

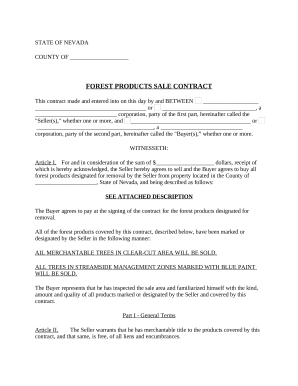

RevenueShared Equity Home Buyer Helper Domestic and family violence declaration Purpose of this declaration This declaration can be completed by a victimsurvivor of a domestic and family violence

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign shared equity home buyer

Edit your shared equity home buyer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your shared equity home buyer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit shared equity home buyer online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit shared equity home buyer. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out shared equity home buyer

How to fill out shared equity home buyer

01

To fill out a shared equity home buyer application, follow these steps:

02

Gather all the necessary documents, such as proof of income, ID, and bank statements.

03

Research and find a shared equity home buyer program in your area.

04

Contact the program administrator or fill out an online application form.

05

Provide accurate and complete information about your financial situation, employment, and any other required details.

06

Submit the application along with all the required documents.

07

Wait for the program administrator to review your application and assess your eligibility.

08

If approved, you may be invited for an interview or further documentation.

09

After all necessary steps are completed, you will receive a decision and guidance on the next steps for purchasing a shared equity home.

Who needs shared equity home buyer?

01

Shared equity home buyers are suitable for individuals or families who are looking to become homeowners but may struggle to afford the full cost of purchasing a property independently.

02

Typically, shared equity home buyers benefit individuals or families with moderate incomes or first-time homebuyers who have limited savings for a down payment.

03

These programs can also be helpful for those who want to live in expensive housing markets where property prices are high.

04

Shared equity home buyer programs provide an opportunity for individuals or families to buy a home with a lower initial investment, as they only need to finance a portion of the property's value, typically with the help of a government or non-profit organization.

05

This concept aims to make homeownership more accessible and affordable, particularly for those who may not qualify for traditional mortgage loans or struggle to save enough for a down payment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my shared equity home buyer in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your shared equity home buyer and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit shared equity home buyer from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your shared equity home buyer into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit shared equity home buyer straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing shared equity home buyer.

What is shared equity home buyer?

A shared equity home buyer is an individual or entity that participates in a housing scheme where they share the ownership costs with a government or private entity, allowing for lower upfront costs and shared investment risks.

Who is required to file shared equity home buyer?

Individuals or entities who have participated in a shared equity scheme and are receiving benefits or incentives from such programs are required to file shared equity home buyer.

How to fill out shared equity home buyer?

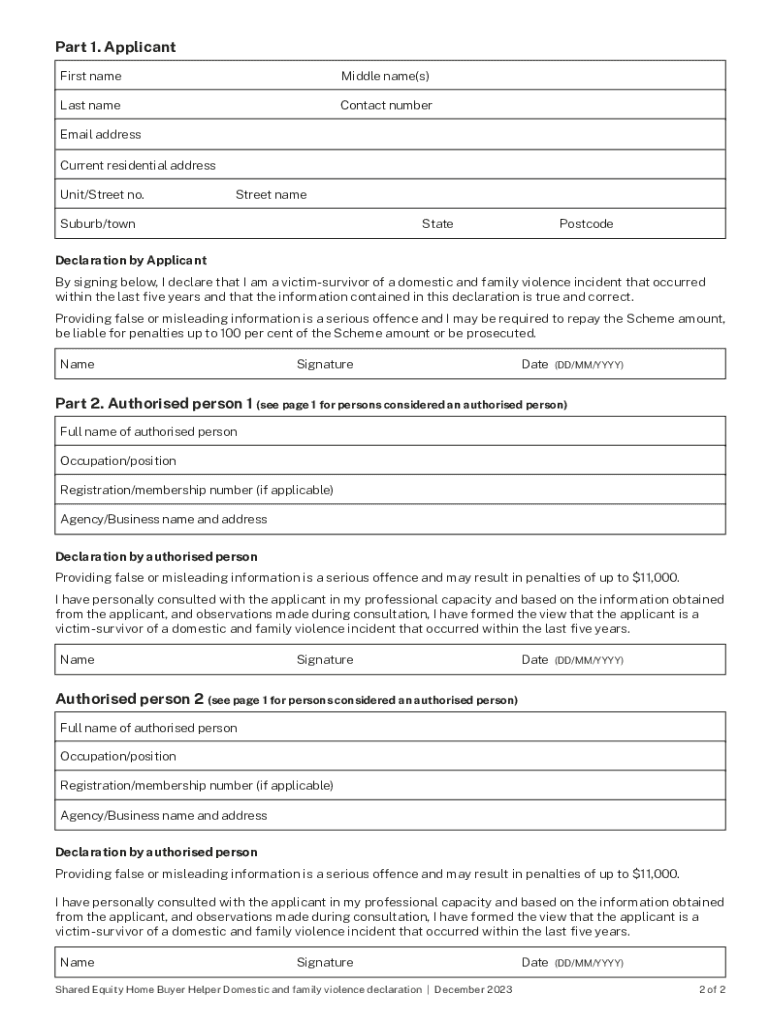

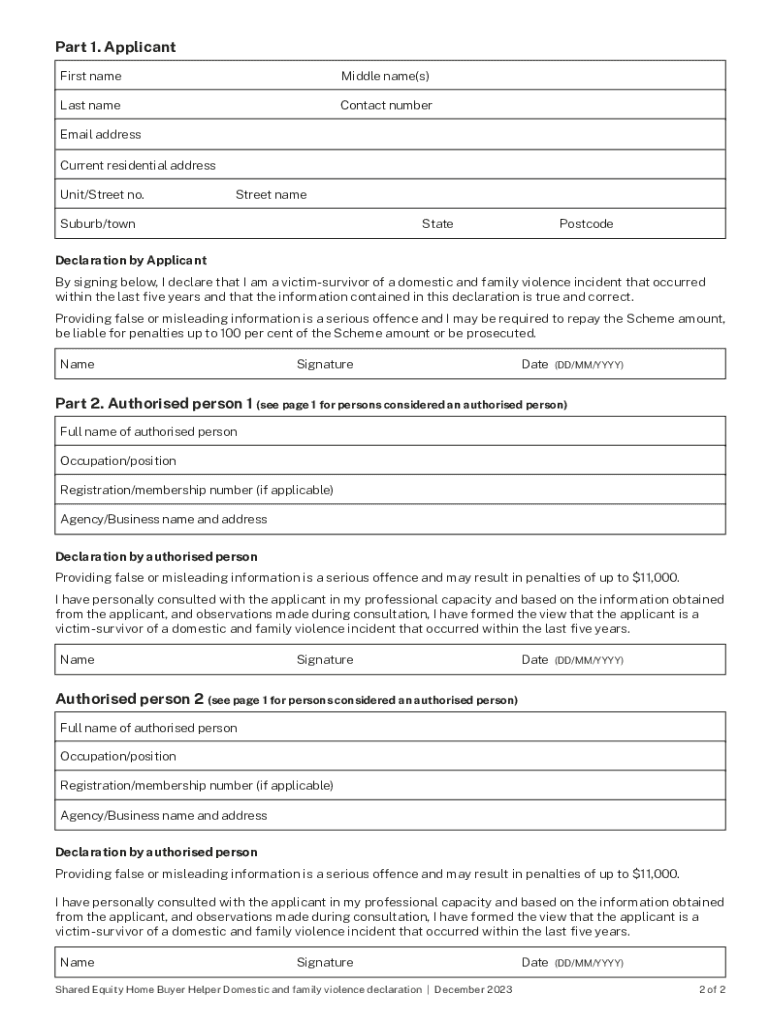

To fill out the shared equity home buyer form, you should provide accurate personal information, details about the property, the shared equity agreement, and any income or financial information required by the program.

What is the purpose of shared equity home buyer?

The purpose of the shared equity home buyer program is to make home ownership more accessible and affordable by allowing buyers to share the financial burden, thus reducing the amount of upfront equity required.

What information must be reported on shared equity home buyer?

The information that must be reported includes the buyer's personal details, property address, income level, share of ownership, and any agreements made with the equity partner.

Fill out your shared equity home buyer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Shared Equity Home Buyer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.