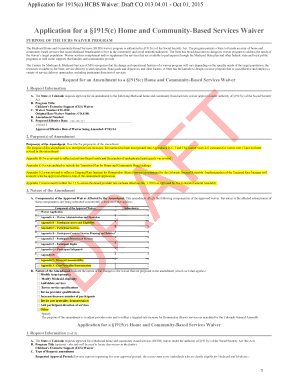

Get the free U.S. and Australian Mortgage InsurersPeer Review ...

Show details

Underwriting

standards and

guidelinesEffective date: 11 December 2023Helia LMA underwriting standards and guidelines Australia 11 December 2023Public1At Helix, we pride ourselves on our commitment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us and australian mortgage

Edit your us and australian mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us and australian mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us and australian mortgage online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit us and australian mortgage. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us and australian mortgage

How to fill out us and australian mortgage

01

To fill out a US mortgage application, follow these steps:

02

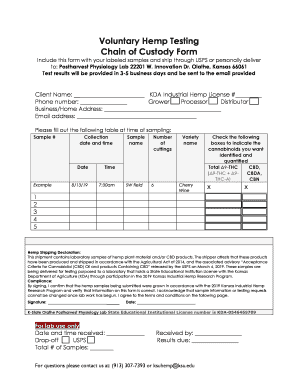

Gather necessary documents such as proof of income, employment history, and credit score.

03

Research and choose a lender or mortgage broker.

04

Complete the loan application form with accurate and detailed information.

05

Provide all required supporting documents.

06

Review and sign all necessary disclosures and agreements.

07

Wait for the lender to process and review your application.

08

Respond promptly to any additional information or documentation requested by the lender.

09

Wait for the lender to make a decision on your application.

10

If approved, review and sign the mortgage loan documents.

11

Arrange for the closing of the loan by coordinating with the lender, real estate agent, and other parties involved.

12

Attend the loan closing, sign the final documents, and make any required payments.

13

To fill out an Australian mortgage application, follow these steps:

14

Gather necessary documentation including proof of identity, income, employment, and financial statements.

15

Research and choose a lender.

16

Meet with the lender or mortgage broker and discuss your borrowing needs and financial situation.

17

Complete the loan application form accurately and thoroughly.

18

Provide all required supporting documents.

19

Wait for the lender to process and assess your application.

20

Respond promptly to any requests for additional information or documents from the lender.

21

Wait for the lender to make a decision on your application.

22

If approved, review and sign the mortgage loan offer and disclosure documents.

23

Arrange for the valuation of the property (if necessary).

24

Ensure all conditions of the loan approval are met.

25

Prepare for the settlement by coordinating with the lender, solicitor, and other parties involved.

26

Attend the settlement, sign the final documents, pay any applicable fees, and complete the mortgage process.

Who needs us and australian mortgage?

01

Both US and Australian mortgages are typically needed by individuals or families who want to purchase a property but do not have the full amount in cash to make the purchase.

02

People who plan to buy a house, apartment, or any real estate property and require financial assistance can benefit from a mortgage.

03

US and Australian mortgages are also commonly used for refinancing existing mortgage loans or accessing equity in properties.

04

Individuals or families who meet the eligibility criteria set by lenders and have the ability to repay the loan are suitable candidates for a US or Australian mortgage.

05

It is important to note that eligibility requirements, loan terms, and conditions may vary between lenders and countries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in us and australian mortgage?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your us and australian mortgage to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in us and australian mortgage without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your us and australian mortgage, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out us and australian mortgage on an Android device?

On Android, use the pdfFiller mobile app to finish your us and australian mortgage. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is us and australian mortgage?

A US mortgage is a loan secured by real estate property in the United States, typically used to purchase a home, while an Australian mortgage refers to a loan secured against real estate in Australia, commonly for home buying or investment purposes.

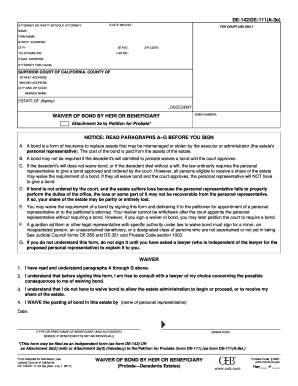

Who is required to file us and australian mortgage?

In the US, borrowers who have a mortgage are required to file relevant mortgage documentation, while in Australia, lenders and borrowers must follow regulations based on their mortgage agreements and laws.

How to fill out us and australian mortgage?

To fill out a US mortgage, one typically needs to provide personal financial information, details about the property, and loan terms. For an Australian mortgage, the process includes providing similar financial details and completing the lender's documentation.

What is the purpose of us and australian mortgage?

The purpose of both US and Australian mortgages is to provide individuals with loans to purchase real estate, allowing them to pay the loan back over time through installment payments.

What information must be reported on us and australian mortgage?

Key information includes the borrower's personal details, property information, loan amount, interest rate, repayment terms, and any disclosures required by state or federal law.

Fill out your us and australian mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us And Australian Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.