Get the free State General Revenue Estimates Increase Again

Show details

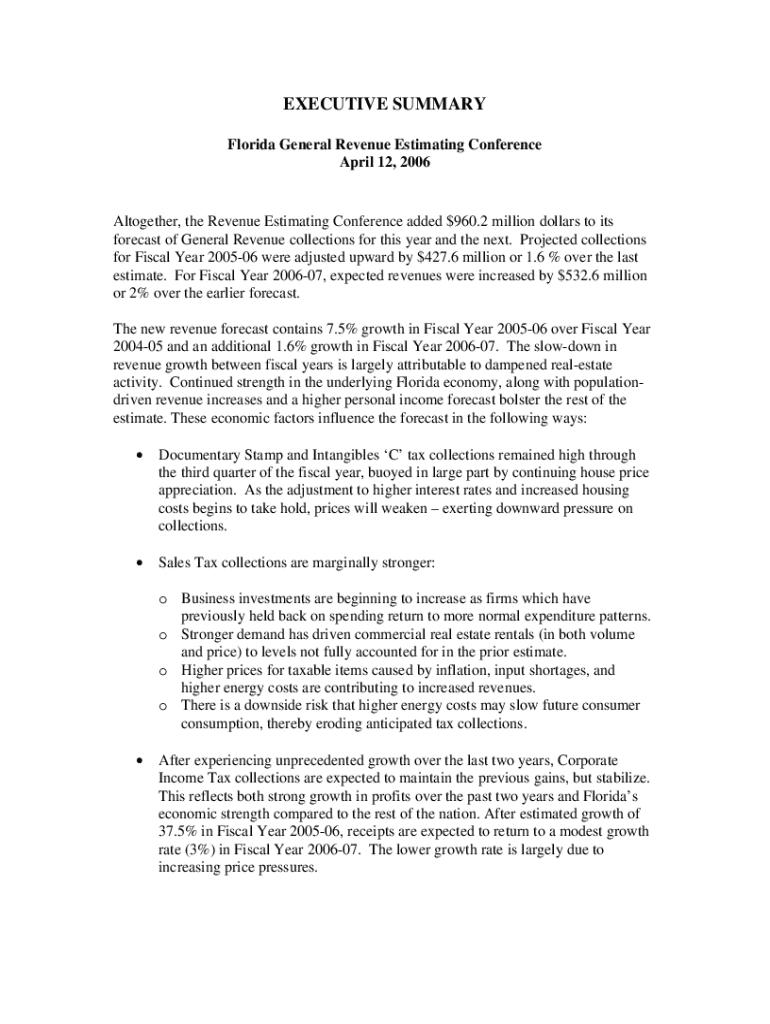

EXECUTIVE SUMMARY

Florida General Revenue Estimating Conference

April 12, 2006Altogether, the Revenue Estimating Conference added $960.2 million dollars to its

forecast of General Revenue collections

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state general revenue estimates

Edit your state general revenue estimates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state general revenue estimates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state general revenue estimates online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit state general revenue estimates. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state general revenue estimates

How to fill out state general revenue estimates

01

To fill out state general revenue estimates, follow these steps:

02

Gather financial data: Collect information about revenue sources, such as taxes, fees, and grants, which contribute to the state's general revenue.

03

Analyze historical data: Review past revenue trends and patterns to understand the factors that affect general revenue.

04

Consider economic factors: Assess the current economic conditions and how they might impact revenue generation.

05

Project revenue growth: Based on the analysis, estimate the expected growth or decline in revenue for the upcoming period.

06

Factor in policy changes: Take into account any policy changes or legislative decisions that could affect revenue.

07

Validate assumptions: Ensure that the estimates are realistic and aligned with economic forecasts and policy changes.

08

Document and communicate: Record all calculations and assumptions made during the estimation process and share the estimates with relevant stakeholders.

Who needs state general revenue estimates?

01

State governments, legislative bodies, and financial departments require state general revenue estimates.

02

Economists, policy analysts, and researchers rely on these estimates to study economic trends and make informed decisions.

03

Budget planning committees utilize revenue estimates to allocate resources and determine spending priorities.

04

Investors and bond rating agencies use revenue estimates to assess the financial health and creditworthiness of a state.

05

Citizens and advocacy groups may also be interested in revenue estimates as they provide transparency about the state's financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit state general revenue estimates in Chrome?

Install the pdfFiller Google Chrome Extension to edit state general revenue estimates and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the state general revenue estimates electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your state general revenue estimates in seconds.

How do I edit state general revenue estimates on an Android device?

You can make any changes to PDF files, like state general revenue estimates, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is state general revenue estimates?

State general revenue estimates are projections of the anticipated revenue that a state expects to collect during a specific fiscal period, typically based on economic forecasts and previous revenue performance.

Who is required to file state general revenue estimates?

Generally, businesses and individuals who anticipate owing income or business taxes to the state are required to file state general revenue estimates, particularly those who expect to make payments exceeding a certain threshold.

How to fill out state general revenue estimates?

To fill out state general revenue estimates, individuals or businesses should provide their anticipated income, apply the appropriate tax rates, and calculate the estimated tax liability for the upcoming period.

What is the purpose of state general revenue estimates?

The purpose of state general revenue estimates is to help state tax authorities plan for future revenue and budget expenditures effectively, enabling them to maintain fiscal stability.

What information must be reported on state general revenue estimates?

Information that must be reported typically includes projected income, the applicable tax rate, any deductions, credits, and the resulting estimated tax liability.

Fill out your state general revenue estimates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State General Revenue Estimates is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.