Get the free FISCAL IMPACT STATEMENT Notice of Motion: MM7.33

Show details

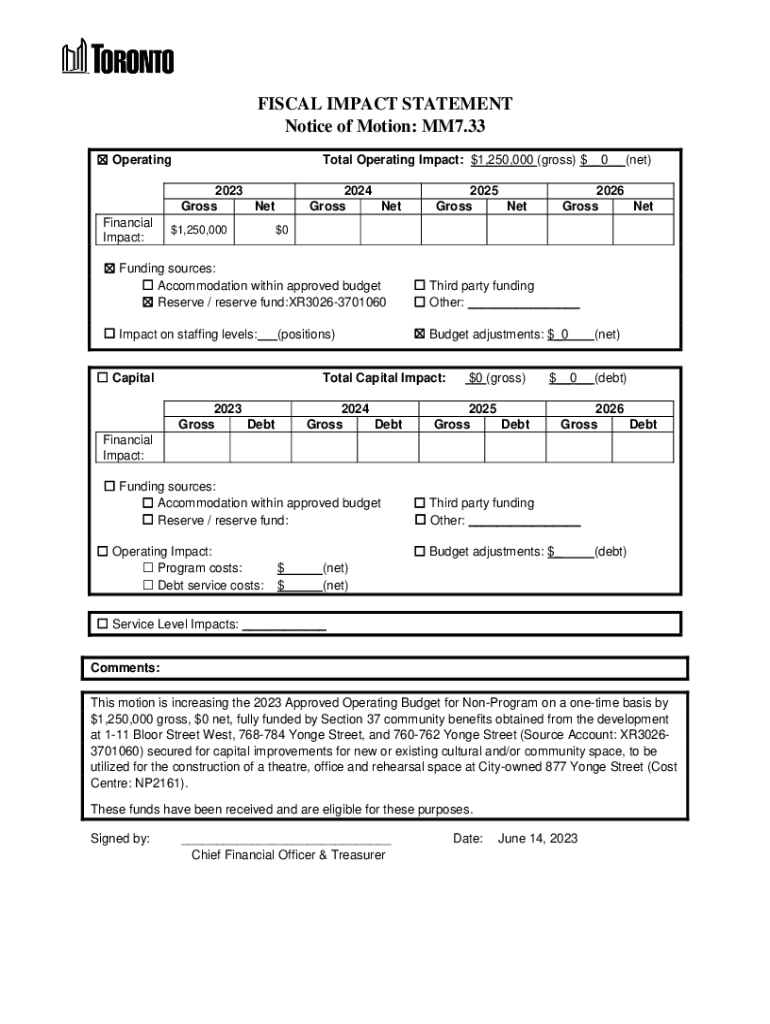

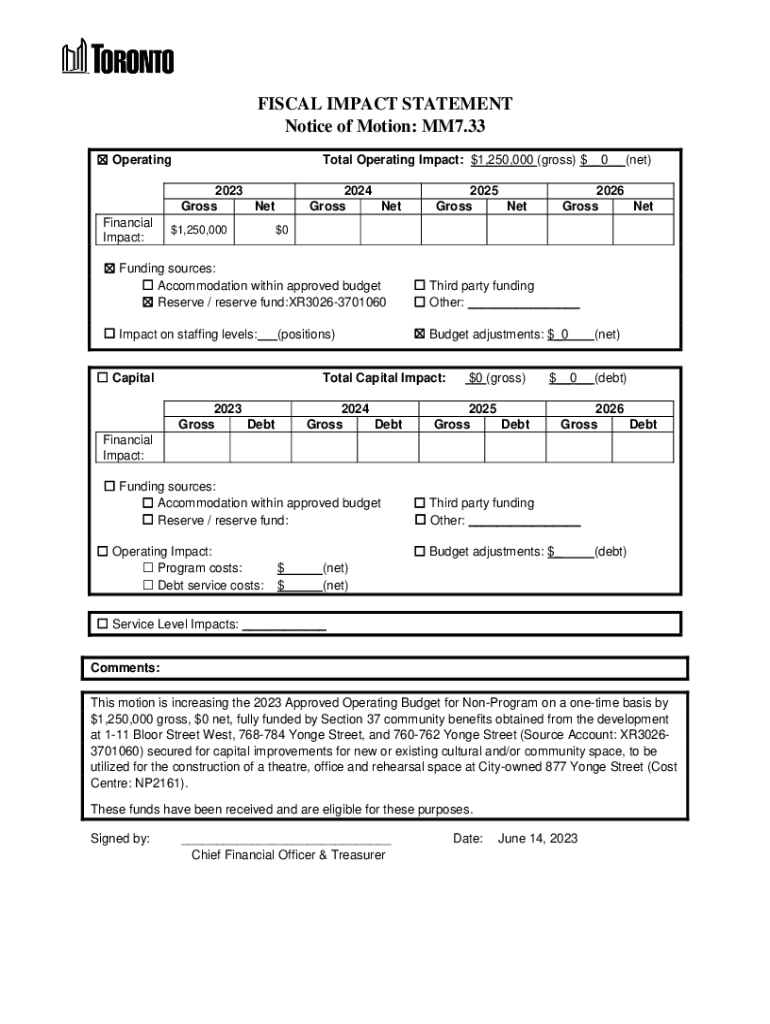

FISCAL IMPACT STATEMENT

Notice of Motion: MM7.33

OperatingTotal Operating Impact: $1,250,000 (gross) $__0__ (net)

2023

Gross

Financial

Impact:$1,250,0002024

Gross

Net2025

Gross

Net2026

Gross

Net$0

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal impact statement notice

Edit your fiscal impact statement notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal impact statement notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fiscal impact statement notice online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fiscal impact statement notice. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal impact statement notice

How to fill out fiscal impact statement notice

01

To fill out a fiscal impact statement notice, follow these steps:

02

Start by gathering all relevant information and data that will be necessary to complete the notice.

03

Begin the notice by clearly stating the purpose and intent of the statement.

04

Provide a detailed description of the proposed action or legislation for which the fiscal impact needs to be assessed.

05

Include a section for estimating the potential costs associated with the proposed action. This may involve analyzing the financial impact on different entities or stakeholders.

06

Next, estimate any potential revenue or savings that may result from the proposed action or legislation.

07

Consider any potential indirect or secondary impacts that may arise from the proposed action and include them in the notice.

08

Provide a clear analysis of the long-term fiscal implications of the proposed action.

09

Finally, summarize the overall fiscal impact and make any recommendations or suggestions for mitigating potential negative impacts.

10

Review and proofread the notice before submission to ensure accuracy and clarity.

11

Submit the completed fiscal impact statement notice to the appropriate department or agency as required.

Who needs fiscal impact statement notice?

01

A fiscal impact statement notice is usually required by government departments, agencies, or legislative bodies that are considering the implementation of new actions or legislation.

02

This includes but is not limited to:

03

- Local and state governments

04

- Lawmakers and policymakers

05

- Planning and zoning commissions

06

- Regulatory agencies

07

- Economic development agencies

08

- Budget committees

09

Any entity or individual involved in the decision-making process regarding new actions or legislation may need a fiscal impact statement notice to better understand the financial implications of their choices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute fiscal impact statement notice online?

pdfFiller has made it simple to fill out and eSign fiscal impact statement notice. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit fiscal impact statement notice online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your fiscal impact statement notice to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out fiscal impact statement notice using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign fiscal impact statement notice and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is fiscal impact statement notice?

A fiscal impact statement notice is a document that analyzes the financial implications of proposed legislation or policy changes, detailing potential costs or savings for government entities.

Who is required to file fiscal impact statement notice?

Typically, governmental agencies or legislators proposing new laws or regulations are required to file a fiscal impact statement notice.

How to fill out fiscal impact statement notice?

To fill out a fiscal impact statement notice, one must provide detailed financial analysis, specify the estimated costs or savings, and include any relevant data supporting the analysis. Proper formatting and adherence to guidelines are also essential.

What is the purpose of fiscal impact statement notice?

The purpose of a fiscal impact statement notice is to inform policymakers and the public about the financial consequences of proposed legislation, helping to ensure informed decision-making.

What information must be reported on fiscal impact statement notice?

Information reported generally includes the projected financial impact, sources of funding, expected revenues or expenditures, and any assumptions made during the analysis.

Fill out your fiscal impact statement notice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Impact Statement Notice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.