Get the free Revenue Estimating Process

Show details

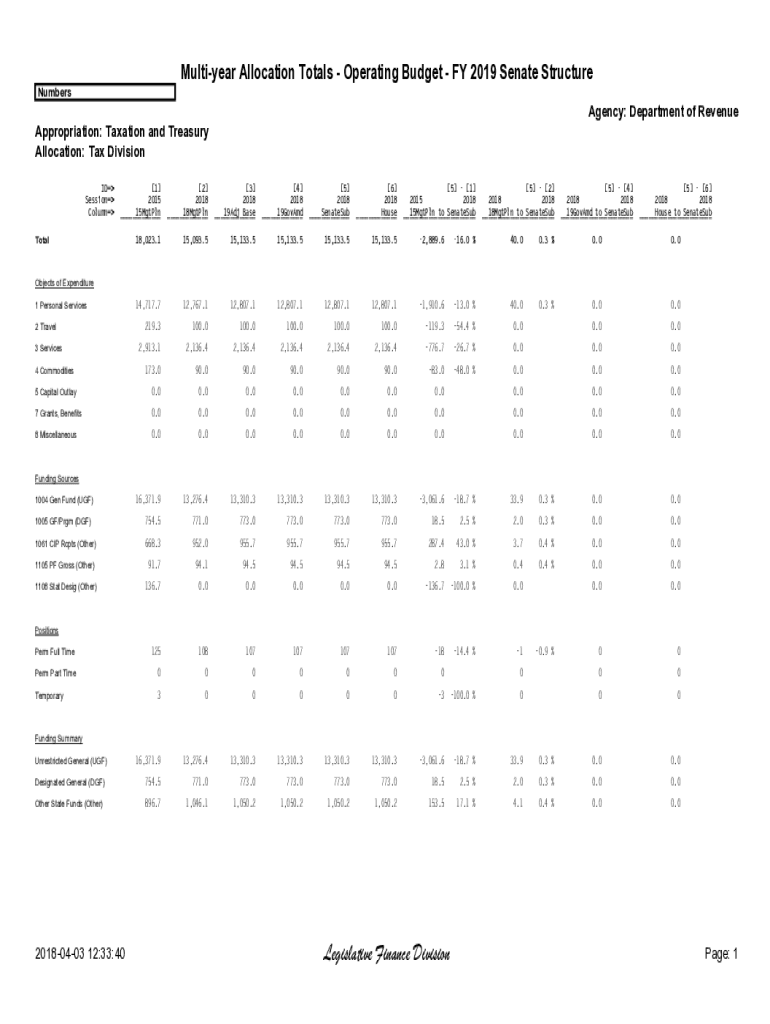

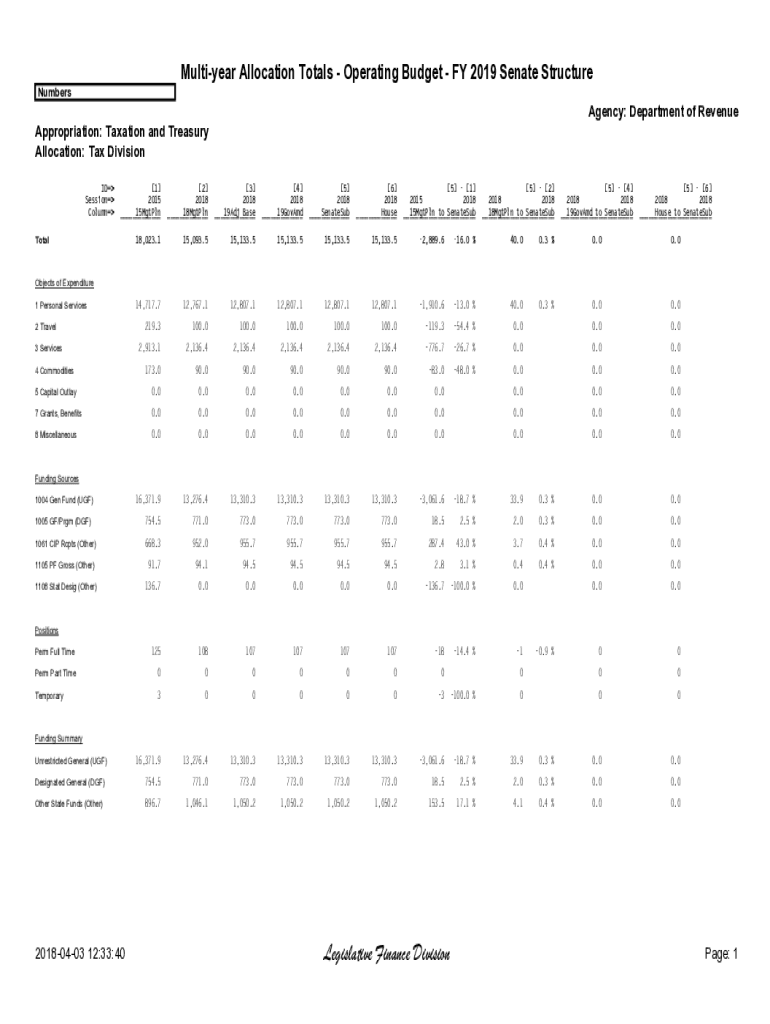

Multiyear Allocation Totals Operating Budget FY 2019 Senate Structure

NumbersAgency: Department of Revenue

Appropriation: Taxation and Treasury

Allocation: Tax Division

ID

Session

Column[1]

2015

15MgtPln

___[2]

2018

18MgtPln

___[3]

2018

19Adj

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue estimating process

Edit your revenue estimating process form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue estimating process form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenue estimating process online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit revenue estimating process. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue estimating process

How to fill out revenue estimating process

01

Gather all relevant data such as historical financial statements, sales data, market research reports, and industry trends.

02

Identify the revenue sources for your business, such as sales of products or services, advertising revenue, licensing fees, or membership fees.

03

Break down the revenue sources into specific categories or product lines.

04

Determine the pricing strategy for each revenue source and estimate the average sale price or revenue per customer.

05

Consider any seasonality or cyclical patterns that may impact your revenue and adjust the estimates accordingly.

06

Take into account any anticipated changes in the market, customer behavior, or competitive landscape that could impact your revenue.

07

Use relevant financial models or forecasting techniques to project future revenue based on the gathered data and analysis.

08

Review and validate the revenue estimates by comparing them against historical data, industry benchmarks, or expert opinions.

09

Document and communicate the revenue estimating process, including the assumptions made and the rationale behind the estimates.

10

Continuously monitor and update the revenue estimates as new information becomes available or as business conditions change.

Who needs revenue estimating process?

01

Businesses of all sizes and industries can benefit from a revenue estimating process.

02

Startups and small businesses can use revenue estimates to determine the financial feasibility of their business idea or plan.

03

Established companies can use revenue estimates to make informed decisions about resource allocation, investment opportunities, and growth strategies.

04

Investors and lenders rely on revenue estimates to assess the financial health and potential of a business before making investment or lending decisions.

05

Government agencies may need revenue estimates for tax collection, budget planning, or economic forecasting purposes.

06

Non-profit organizations can use revenue estimates to set fundraising targets and plan their programs and services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify revenue estimating process without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including revenue estimating process, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send revenue estimating process for eSignature?

When your revenue estimating process is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I fill out revenue estimating process on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your revenue estimating process by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is revenue estimating process?

The revenue estimating process is a method used by organizations and governments to predict future revenue based on historical data, economic trends, and other relevant factors.

Who is required to file revenue estimating process?

Typically, government agencies, businesses, and any organization that manages financial resources and budget appropriations are required to file the revenue estimating process.

How to fill out revenue estimating process?

To fill out the revenue estimating process, gather relevant financial data, analyze trends, make projections based on quantitative data, and complete the designated forms as required by the governing body or organization.

What is the purpose of revenue estimating process?

The purpose of the revenue estimating process is to provide an accurate forecast of future revenues to assist in budget planning, resource allocation, and financial decision-making.

What information must be reported on revenue estimating process?

Reported information typically includes past revenue figures, projected income sources, economic indicators, and assumptions used in the estimation process.

Fill out your revenue estimating process online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Estimating Process is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.