Get the free Interval and Tender Offer Closed-End Funds

Show details

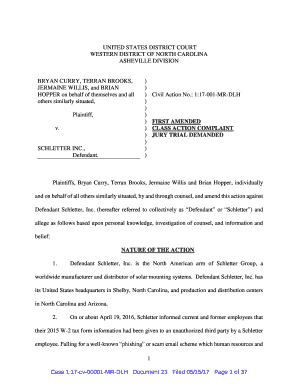

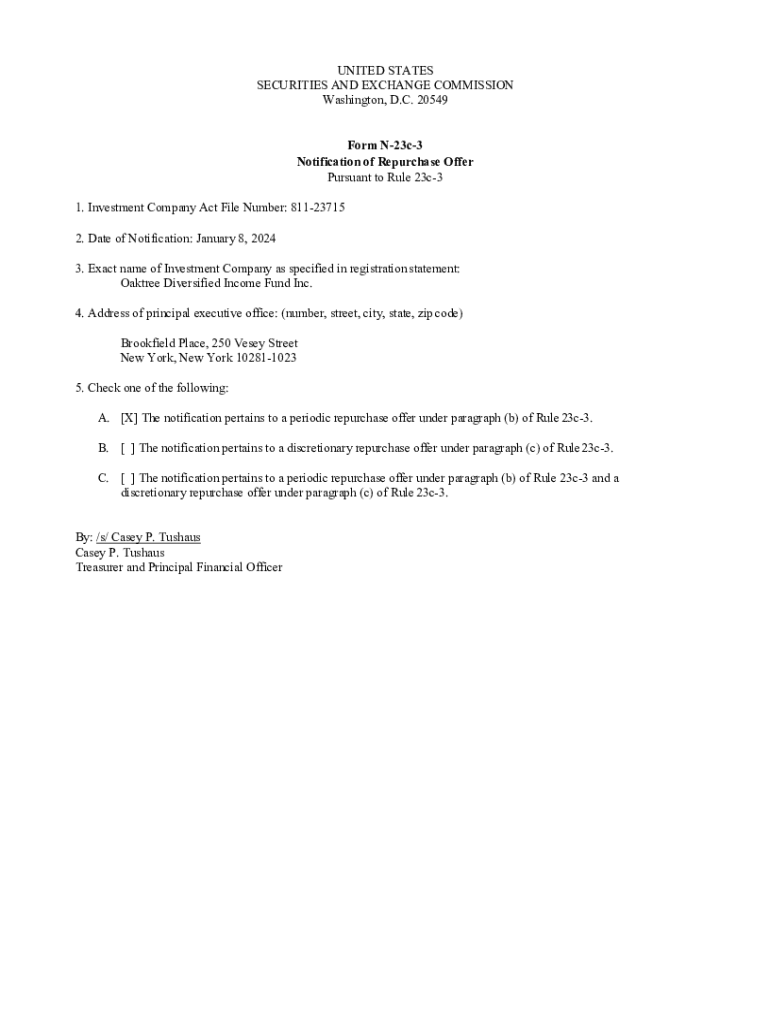

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form N23c3 Notification of Repurchase Offer Pursuant to Rule 23c3 1. Investment Company Act File Number: 81123715 2. Date of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign interval and tender offer

Edit your interval and tender offer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interval and tender offer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit interval and tender offer online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit interval and tender offer. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out interval and tender offer

How to fill out interval and tender offer

01

To fill out an interval and tender offer, follow these steps:

02

Start by reading and understanding the terms and conditions of the interval and tender offer.

03

Gather all the necessary information and documents required for the offer, such as the number of shares you wish to tender or intervals you want to participate in.

04

Contact the company or entity administering the interval and tender offer to request the necessary forms or access to an online portal.

05

Fill out the forms accurately and completely, providing all the required information, such as your name, contact details, the number of shares or intervals you wish to tender, and any other relevant information.

06

Review the filled-out forms thoroughly to ensure all the information is correct and there are no errors or omissions.

07

Submit the completed forms according to the instructions provided by the company or entity administering the offer. This may involve mailing the physical forms or submitting them electronically through the online portal.

08

Keep copies of all the filled-out forms and any supporting documentation for your records.

09

Wait for confirmation from the company or entity administering the offer regarding the acceptance or rejection of your tendered shares or participation in the intervals. Follow any further instructions provided, if applicable.

Who needs interval and tender offer?

01

Interval and tender offers are primarily needed by shareholders or investors who want to sell their shares or participate in specific intervals offered by a company.

02

Individuals who believe the company's share price may decline or want to take advantage of specific benefits offered through the intervals may also need interval and tender offers.

03

Additionally, institutional investors, such as mutual funds or pension funds, may need interval and tender offers to manage their investment portfolios effectively.

04

It is recommended to consult with a financial advisor or the company administering the offer to determine if an interval and tender offer is suitable for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the interval and tender offer electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your interval and tender offer in seconds.

How do I fill out the interval and tender offer form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign interval and tender offer. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit interval and tender offer on an Android device?

With the pdfFiller Android app, you can edit, sign, and share interval and tender offer on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is interval and tender offer?

An interval offer is a type of mutual fund transaction where shares are bought or sold at specific intervals, while a tender offer is a proposal to purchase some or all of shareholders' shares at a specified price.

Who is required to file interval and tender offer?

Companies that plan to initiate an interval or tender offer must file the appropriate documentation with the regulatory authorities, such as the SEC in the United States.

How to fill out interval and tender offer?

To fill out an interval or tender offer, the company must complete the required forms detailing the terms of the offer, including the offer price, the number of shares sought, and the duration of the offer.

What is the purpose of interval and tender offer?

The purpose of an interval offer is to provide liquidity to investors at set intervals, while a tender offer aims to acquire shares from investors typically to consolidate ownership or delist a company.

What information must be reported on interval and tender offer?

The information reported must include the offer's terms, the number of shares required, the pricing mechanism, how to respond to the offer, and any potential risks involved.

Fill out your interval and tender offer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Interval And Tender Offer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.