Get the free Provident Trust Strategy FundProvident Trust

Show details

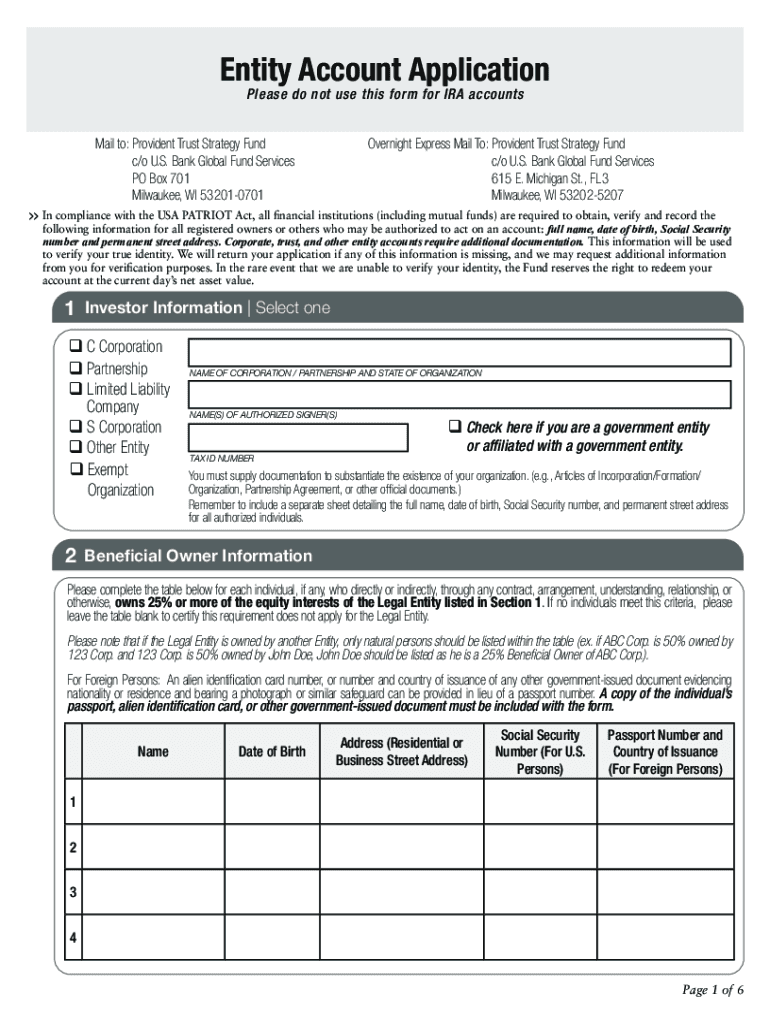

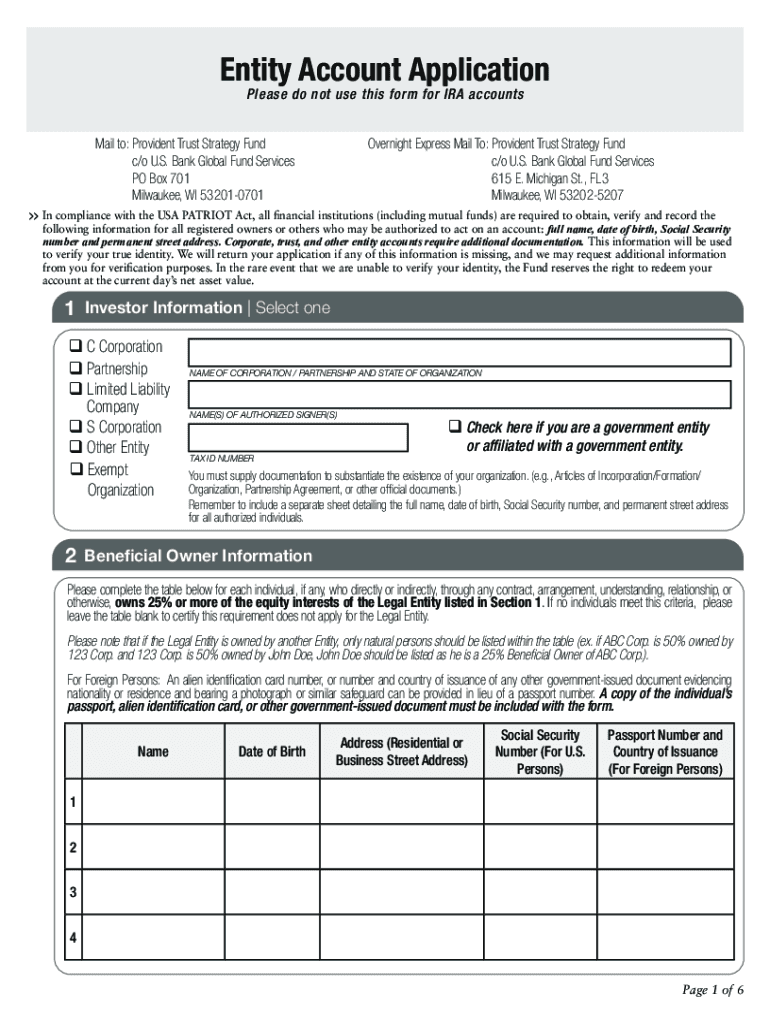

Entity Account Application

Please do not use this form for IRA accountsMail to: Provident Trust Strategy Funds/o U.S. Bank Global Fund Services PO Box 701Milwaukee, WI 532010701Overnight Express Mail

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign provident trust strategy fundprovident

Edit your provident trust strategy fundprovident form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your provident trust strategy fundprovident form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit provident trust strategy fundprovident online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit provident trust strategy fundprovident. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out provident trust strategy fundprovident

How to fill out provident trust strategy fundprovident

01

To fill out provident trust strategy fundprovident, follow these steps:

02

Obtain the provident trust strategy fundprovident application form from the respective provider or website.

03

Read through the instructions and terms carefully to understand the fund's objectives and policies.

04

Provide your personal information, including full name, contact details, and identification proof.

05

Determine the investment amount you want to contribute to the fund.

06

Specify the mode of investment, such as lump sum or periodic contributions.

07

Choose the appropriate investment strategy or portfolio option based on your risk tolerance and investment goals.

08

Review and complete the declaration, ensuring the accuracy of the provided information.

09

Attach any required documents, such as proof of identity and address.

10

Sign and date the application form.

11

Submit the filled-out application form along with any necessary documents to the provided address or online portal.

12

Keep a copy of the filled-out form and documents for your reference.

13

Wait for confirmation from the fund provider regarding the acceptance of your application.

14

Once your application is accepted, you may need to make the initial investment payment as per the fund's requirements.

15

Monitor the performance of the provident trust strategy fundprovident periodically and consider consulting with financial advisors if needed.

Who needs provident trust strategy fundprovident?

01

Provident trust strategy fundprovident can be beneficial for individuals or entities who:

02

- Seek long-term investment opportunities with potential returns

03

- Wish to diversify their investment portfolio

04

- Are comfortable with moderate to high risk investment strategies

05

- Want to invest in a professionally managed fund with a specific investment objective

06

- Have a thorough understanding of the fund's investment policies and potential risks involved

07

- Are willing to monitor and review their investments periodically

08

- Are willing to invest a significant amount of money for a considerable period

09

- May require regular income or capital appreciation in the future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send provident trust strategy fundprovident for eSignature?

Once you are ready to share your provident trust strategy fundprovident, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete provident trust strategy fundprovident online?

pdfFiller makes it easy to finish and sign provident trust strategy fundprovident online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my provident trust strategy fundprovident in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your provident trust strategy fundprovident directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is provident trust strategy fundprovident?

The provident trust strategy fundprovident is a type of investment fund that focuses on long-term growth and capital preservation.

Who is required to file provident trust strategy fundprovident?

Investors and individuals who have invested in the provident trust strategy fundprovident are required to file the necessary paperwork.

How to fill out provident trust strategy fundprovident?

To fill out the provident trust strategy fundprovident, individuals must provide information regarding their investments, income, and any gains or losses incurred.

What is the purpose of provident trust strategy fundprovident?

The purpose of provident trust strategy fundprovident is to help investors achieve long-term financial goals and secure their investments.

What information must be reported on provident trust strategy fundprovident?

Information such as investment amounts, gains or losses, and any distributions received must be reported on the provident trust strategy fundprovident.

Fill out your provident trust strategy fundprovident online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Provident Trust Strategy Fundprovident is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.