Get the free Term Life and AD&D Insurance - Product Overview - Mutual of Omaha

Show details

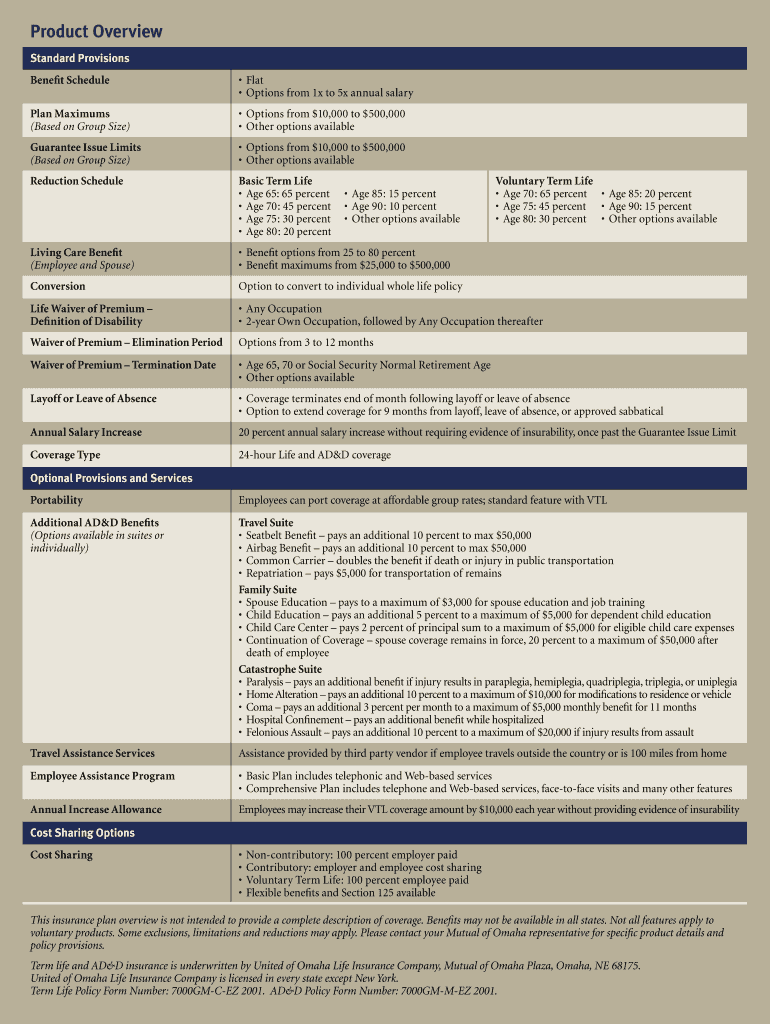

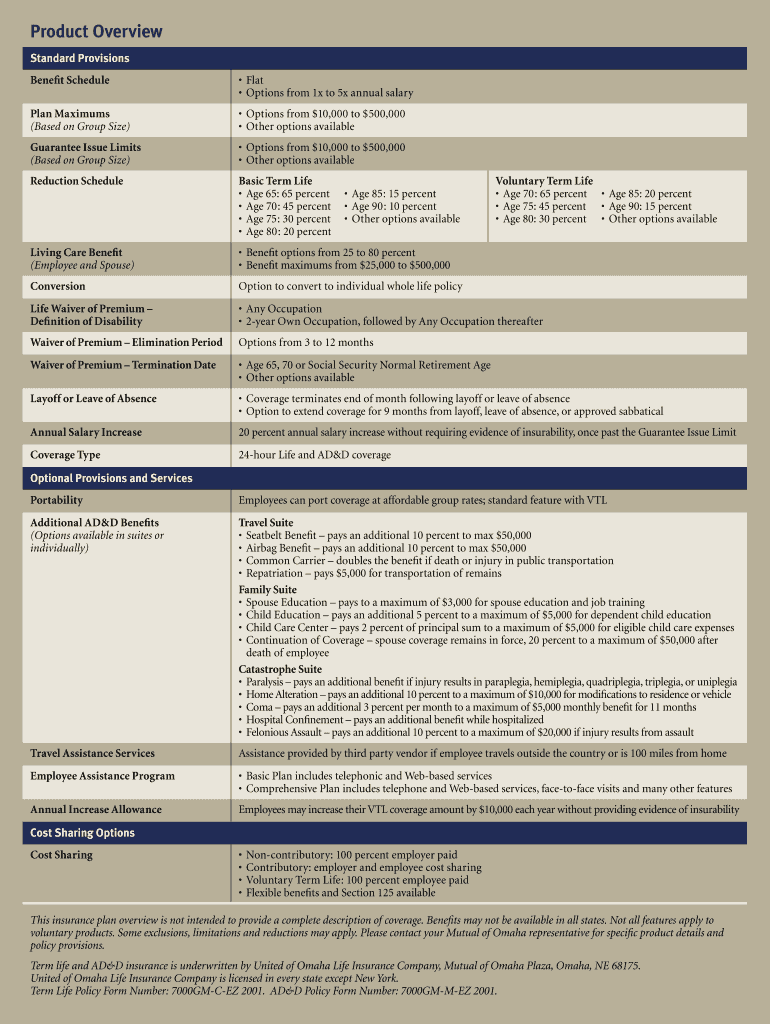

Product Overview Standard Provisions Bene t Schedule Flat Options from 1x to 5x annual salary Plan Maximums Based on Group Size Options from 10 000 to 500 000 Other options available Guarantee Issue Limits Reduction Schedule Basic Term Life Age 65 65 percent Age 70 45 percent Age 80 20 percent Voluntary Term Life Living Care Bene t Employee and Spouse Bene t options from 25 to 80 percent Bene t maximums from 25 000 to 500 000 Conversion Option to convert to individual whole life policy...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign term life and adampd

Edit your term life and adampd form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term life and adampd form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit term life and adampd online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit term life and adampd. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out term life and adampd

How to fill out term life and AD&D:

01

Gather necessary documents: Make sure you have your personal information, beneficiary details, and any additional information required by the insurance company.

02

Determine coverage amount: Decide how much coverage you need based on your financial responsibilities and future plans. Consider factors such as mortgage or rent payments, debt, education expenses, and income replacement.

03

Understand policy options: Familiarize yourself with the different term life and AD&D policies available. Analyze the features, coverage duration, premiums, and any riders or additional benefits offered.

04

Choose a reputable insurance company: Research and compare insurance providers to find one that is financially stable, has good customer reviews, and offers competitive premiums.

05

Fill out the application form: Fill in all the required fields accurately and honestly. Provide details about your health, lifestyle, occupation, and any other information requested.

06

Disclose medical history: Be transparent about your medical history, including any pre-existing conditions, surgeries, or ongoing treatments. Failure to disclose relevant information could lead to policy cancellation or denied claims in the future.

07

Designate beneficiaries: Specify who will receive the benefits in case of your death or accidental dismemberment. Ensure you provide their full names, contact information, and relationship to you.

08

Review the application: Double-check all the information you provided before submitting the application. Correct any errors or inconsistencies to avoid unnecessary delays or complications later.

Who needs term life and AD&D:

01

Individuals with dependents: If you have people who rely on your income, such as a spouse, children, or elderly parents, term life and AD&D insurance can provide financial protection for them if you pass away or experience accidental dismemberment.

02

Breadwinners: If you are the primary earner in your family, term life and AD&D insurance can help replace lost income and cover expenses, ensuring your loved ones can maintain their standard of living.

03

Business owners: Entrepreneurs who have debts, loans, or business partners may need term life and AD&D insurance to protect their businesses and ensure their partners or beneficiaries are financially secure if something happens to them.

04

Individuals with financial responsibilities: If you have significant financial obligations, such as a mortgage, car loan, or other debts, term life and AD&D insurance can help cover these expenses if you're no longer able to.

05

Anyone concerned about financial security: Even if you don't have dependents or substantial obligations, term life and AD&D insurance can still be beneficial. It provides peace of mind, knowing that you have financial protection in case of an unforeseen event.

Remember, it is always crucial to consult with a licensed insurance agent or financial advisor to assess your specific needs and find the most suitable insurance coverage for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my term life and adampd directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your term life and adampd as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete term life and adampd online?

Easy online term life and adampd completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an eSignature for the term life and adampd in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your term life and adampd right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is term life and adampd?

Term life insurance provides coverage for a specified period of time, while AD&D insurance offers additional coverage in the event of accidental death or dismemberment.

Who is required to file term life and adampd?

Individuals who have term life and AD&D insurance policies are not required to file any documents. However, beneficiaries may need to file a claim in the event of the policyholder's death or dismemberment.

How to fill out term life and adampd?

There is usually no need to fill out any specific forms for term life and AD&D insurance. Policyholders should review their policies and contact their insurance provider for any necessary information or to file a claim.

What is the purpose of term life and adampd?

The purpose of term life insurance is to provide financial protection to the policyholder's beneficiaries in the event of their death. AD&D insurance provides additional coverage for accidents resulting in death or dismemberment.

What information must be reported on term life and adampd?

There is generally no requirement to report specific information for term life and AD&D insurance. However, beneficiaries may need to provide documentation such as a death certificate or medical records when filing a claim.

Fill out your term life and adampd online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Term Life And Adampd is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.