Get the free Application for Debt Review (Debt Wise) Applicant Details: Date ...

Show details

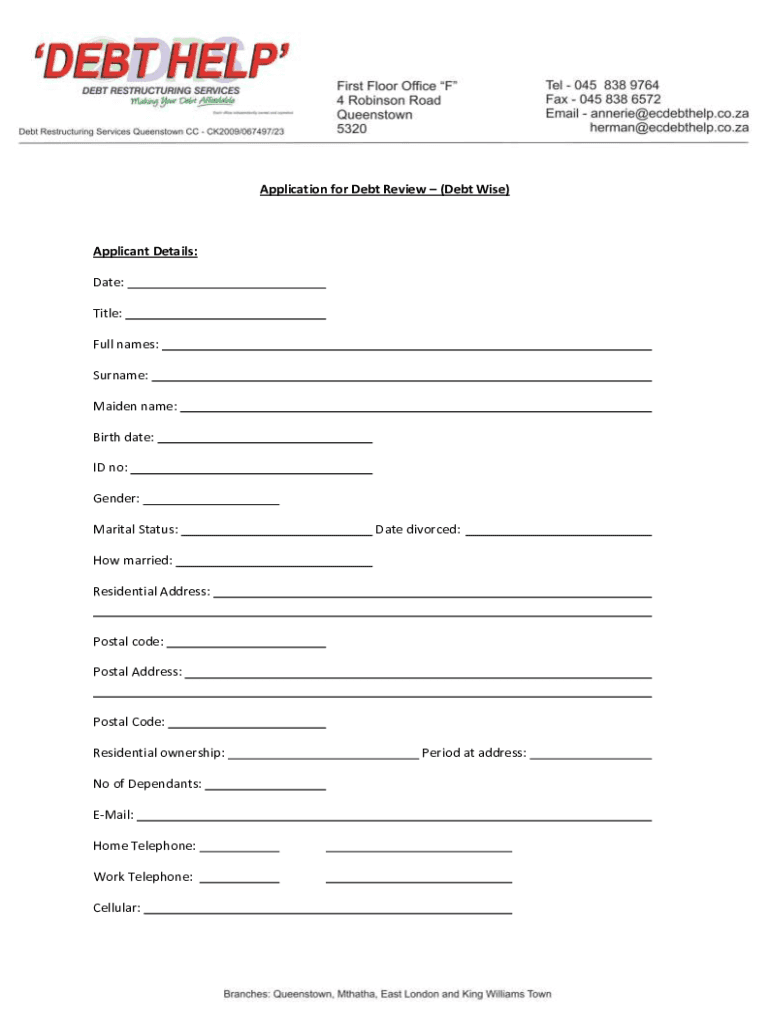

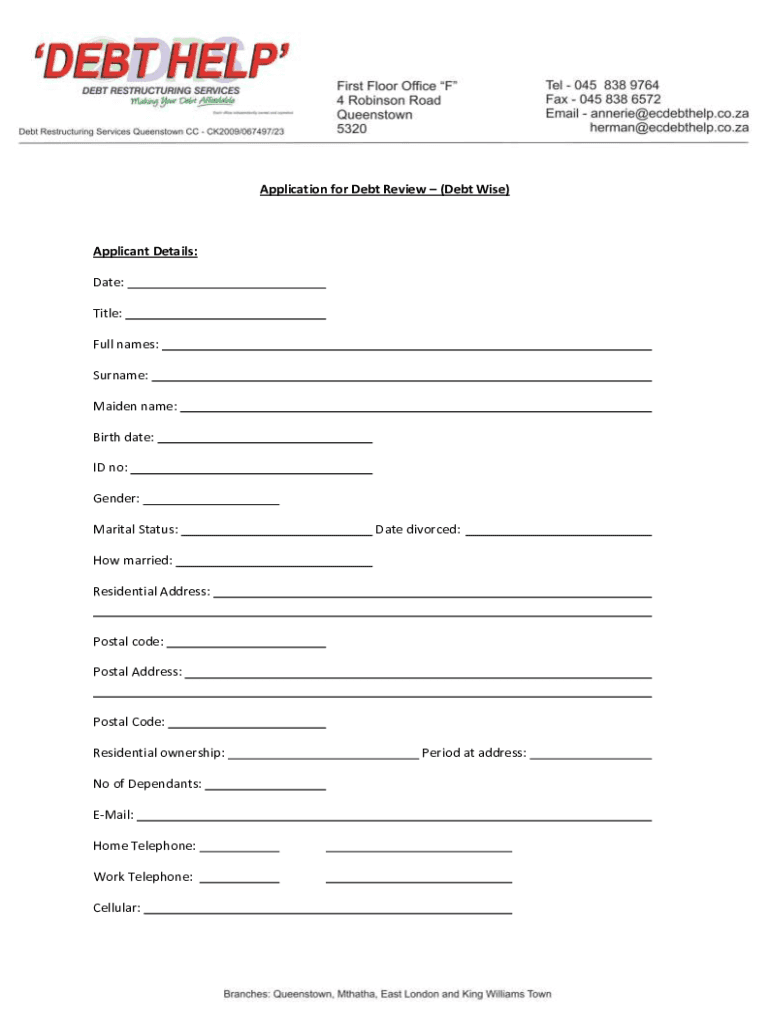

Application for Debt Review (Debt Wise)Applicant Details:

Date:

Title:

Full names:

Surname:

Maiden name:

Birth date:

ID no:

Gender:

Marital Status:Date divorced:How married:

Residential Address:Postal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for debt review

Edit your application for debt review form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for debt review form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for debt review online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for debt review. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for debt review

How to fill out application for debt review

01

To fill out an application for debt review, follow these steps:

02

Gather all necessary information: You will need to provide details about your financial situation, including your income, expenses, and debts. Collect any documentation, such as bank statements and bills, to support this information.

03

Find a reputable debt review agency: Look for a company or organization that specializes in debt review and has a good track record. Research their reputation and read reviews from other customers.

04

Contact the debt review agency: Reach out to the chosen agency and express your interest in applying for debt review. They will provide you with the necessary forms and guidance throughout the process.

05

Complete the application form: Fill out the application form accurately and honestly. Make sure to include all required information and attach supporting documents as requested.

06

Submit the application: Once you have completed the form, submit it to the debt review agency. They will review your application and assess your eligibility for debt review.

07

Cooperate with the agency: Throughout the debt review process, it is important to cooperate fully with the agency. Provide any additional information or documentation they may require, respond promptly to their inquiries, and attend meetings as scheduled.

08

Follow the agency's recommendations: If your application is approved, the agency will develop a debt repayment plan for you. It is crucial to follow this plan and make payments as instructed to gradually clear your debts.

09

Seek financial guidance and support: While under debt review, consider seeking financial advice or counseling to help improve your financial habits and prevent future debt issues.

10

Regularly update the agency: Keep the debt review agency informed about any changes in your financial situation, such as an increase in income or unexpected expenses. This will help them adjust your repayment plan if necessary.

11

Complete the debt review process: Once you have successfully repaid your debts according to the agency's plan, you will complete the debt review process. Make sure to obtain all necessary documentation and confirm that your financial status has improved.

Who needs application for debt review?

01

Anyone facing overwhelming debt and struggling to manage their financial obligations can benefit from applying for debt review.

02

This may include individuals who:

03

- Have a high amount of outstanding debts

04

- Are receiving multiple debt collection calls or notices

05

- Find it difficult to make minimum payments on their debts

06

- Have experienced a significant decrease in income

07

- Are at risk of legal action due to unpaid debts

08

Debt review can provide an avenue for individuals to restructure their debts, negotiate with creditors, and develop a realistic repayment plan. It aims to alleviate financial stress and help individuals regain control of their financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in application for debt review?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your application for debt review to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my application for debt review in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your application for debt review right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out application for debt review on an Android device?

Complete your application for debt review and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is application for debt review?

An application for debt review is a formal request submitted by an individual or a consumer to a debt review company in order to seek assistance with managing and restructuring their debts.

Who is required to file application for debt review?

Any individual or consumer who is struggling to manage their debts and seeking professional help to restructure their debts is required to file an application for debt review.

How to fill out application for debt review?

To fill out an application for debt review, one must provide personal information, details of their debts, income, and expenses, as well as any additional documentation requested by the debt review company.

What is the purpose of application for debt review?

The purpose of an application for debt review is to help individuals or consumers who are struggling with debts to create a structured repayment plan that is manageable and affordable.

What information must be reported on application for debt review?

Information such as personal details, details of debts, income, expenses, assets, and liabilities must be reported on an application for debt review.

Fill out your application for debt review online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Debt Review is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.