Get the free Australia - Individual - Tax administration

Show details

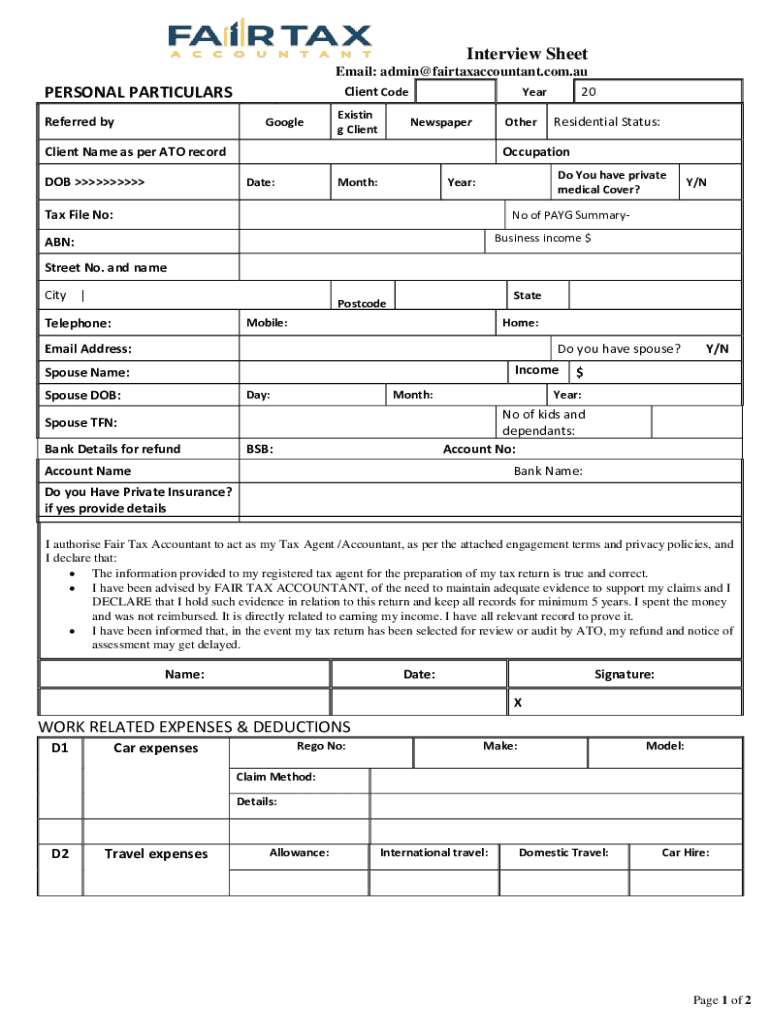

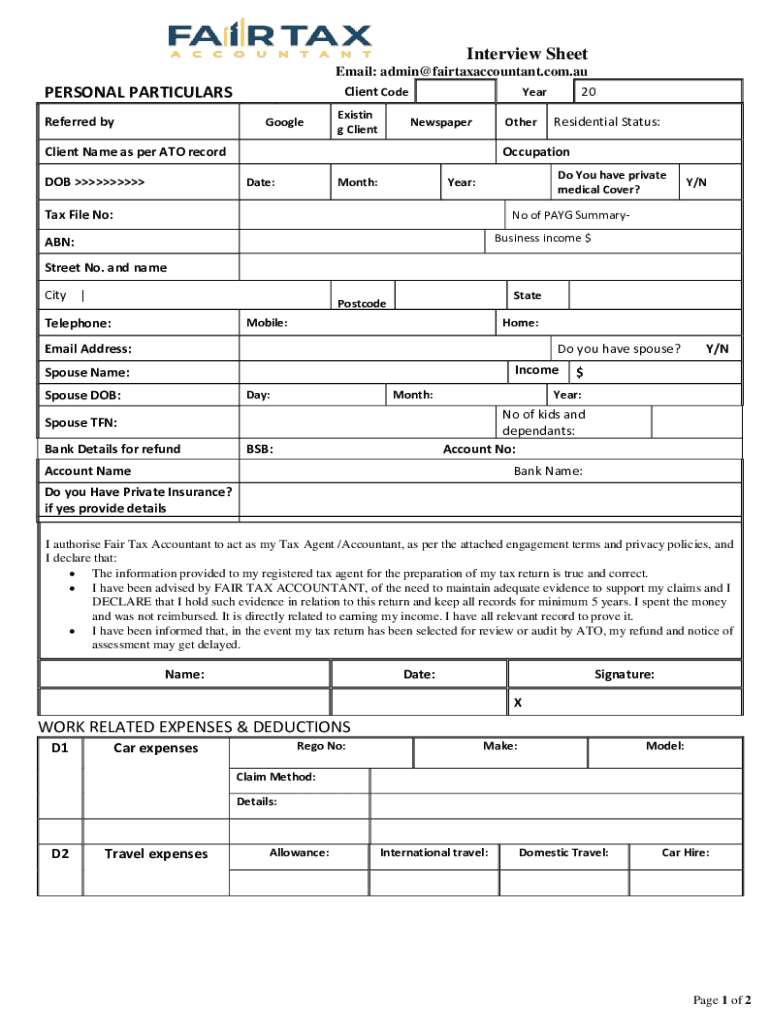

Interview Sheet

Email: admin@fairtaxaccountant.com.auPERSONAL PARTICULARS

Referred client Code

GoogleExistin

g ClientNewspaperOtherClient Name as per ATO record

DOB 201YearResidential Status:Occupation

Date:Month:Do

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign australia - individual

Edit your australia - individual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your australia - individual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit australia - individual online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit australia - individual. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out australia - individual

How to fill out australia - individual

01

To fill out Australia - Individual application form, follow these steps:

02

Start by downloading the form from the official website of the Australian Department of Home Affairs.

03

Read the instructions carefully to understand the requirements and eligibility criteria for an Australia - Individual visa.

04

Gather all the necessary documents, such as a valid passport, proof of funds, medical certificates, and character references.

05

Complete the personal information section of the application form, including your full name, date of birth, and contact details.

06

Provide details about your residential address, employment history, and educational qualifications.

07

Answer all the questions regarding your health, character, and previous travel history truthfully.

08

If applicable, include details about your family members who will be accompanying you to Australia.

09

Pay the required visa fee using the specified payment methods.

10

Double-check all the information provided and ensure that the form is signed and dated.

11

Submit the application form along with the supporting documents to the designated Australian visa processing center.

12

Track the progress of your application through the online portal or contact the appropriate authorities for updates.

13

If approved, you will receive your Australia - Individual visa, allowing you to travel and stay in Australia for the specified period.

Who needs australia - individual?

01

Australia - Individual visa is needed by individuals who:

02

- Intend to visit Australia for tourism, business meetings, or attending conferences.

03

- Plan to study in Australia for a duration exceeding three months.

04

- Wish to work in Australia temporarily under specific employment categories.

05

- Seek to join family members who are already residing in Australia.

06

- Need to receive medical treatments in Australia.

07

- Want to participate in cultural, sports, or religious events in Australia.

08

- Require a transit visa while passing through Australia to reach their final destination.

09

- Have been granted an offshore humanitarian visa and need to travel to Australia.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit australia - individual in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your australia - individual, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for the australia - individual in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out australia - individual using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign australia - individual and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is australia - individual?

Australia - individual refers to the tax return form that individual residents use to report their income and calculate their tax obligations in Australia.

Who is required to file australia - individual?

Individuals who reside in Australia and earn income above a certain threshold are required to file an Australia - individual tax return.

How to fill out australia - individual?

To fill out the Australia - individual tax return, individuals must gather their income information, deductions, and credits, then complete the relevant sections of the tax return form, either online or on paper.

What is the purpose of australia - individual?

The purpose of Australia - individual is to report income earned, claim deductions, and calculate tax liabilities to ensure compliance with Australian tax laws.

What information must be reported on australia - individual?

Individuals must report their total income, deductions, tax offsets, and any other relevant financial information, such as investments and capital gains.

Fill out your australia - individual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Australia - Individual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.