Get the free Valuation for Worthless Assets American IRA

Show details

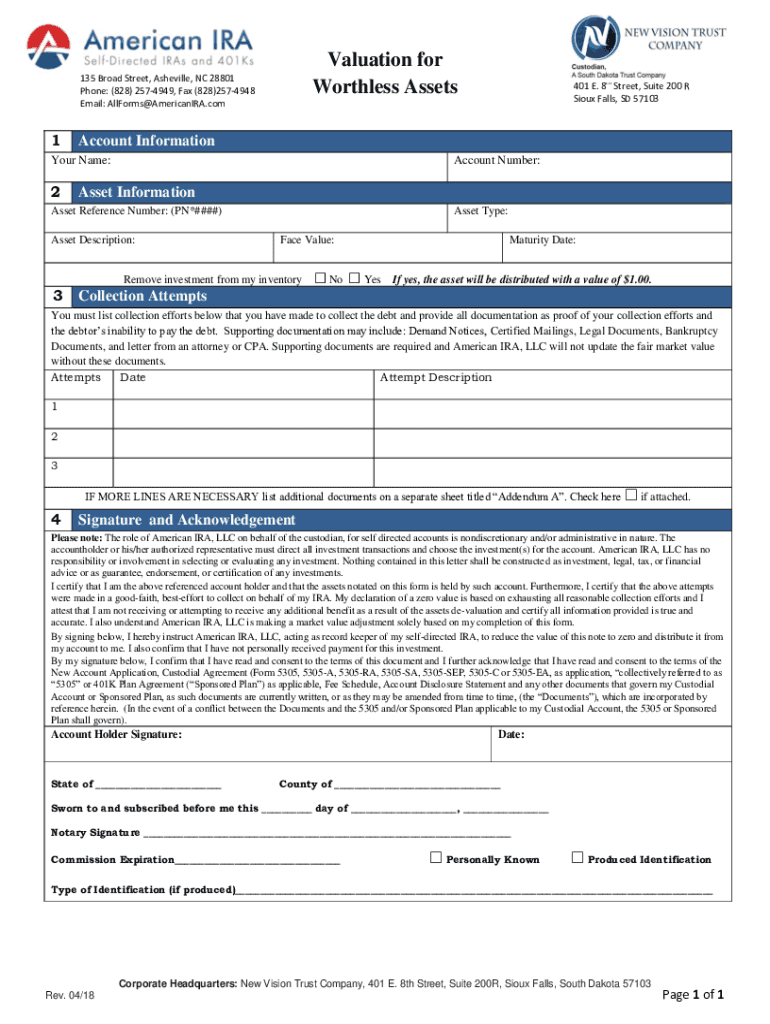

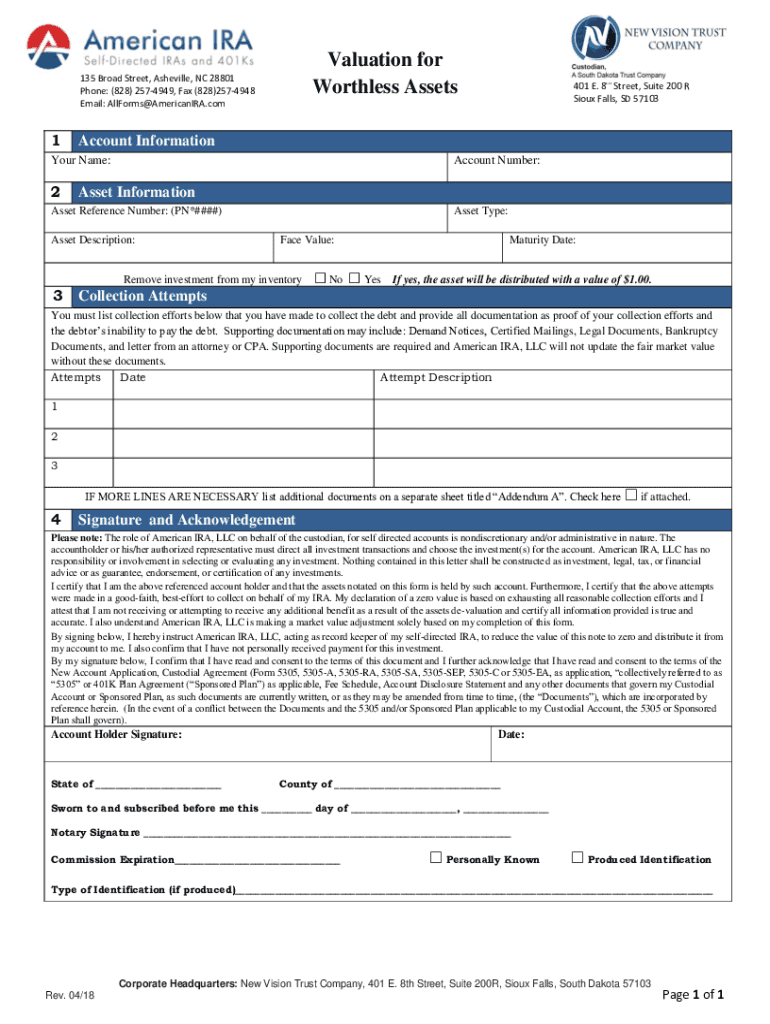

Valuation for

Worthless Assets135 Broad Street, Asheville, NC 28801

Phone: (828) 2574949, Fax (828)2574948

Email: AllForms@AmericanIRA.com1Account InformationYour Name:2Account Number:Asset InformationAsset

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign valuation for worthless assets

Edit your valuation for worthless assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your valuation for worthless assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit valuation for worthless assets online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit valuation for worthless assets. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out valuation for worthless assets

How to fill out valuation for worthless assets

01

To fill out a valuation for worthless assets, follow these steps:

02

Start by identifying the specific assets that are considered worthless. This can include things like machinery, equipment, or even intangible assets like patents or copyrights.

03

Determine the date of valuation. This is usually the date when the assets were deemed worthless.

04

Research and gather any relevant documentation or information that supports the worthlessness of the assets. This may include financial statements, audit reports, or expert opinions.

05

Assess the fair market value of the assets. This involves estimating the amount that could be reasonably obtained for the assets in an open market sale, considering their condition and obsolescence.

06

Take into account any liabilities or encumbrances associated with the worthless assets. These may include outstanding debts or legal claims.

07

Calculate the net realizable value, which is the fair market value minus any liabilities.

08

Include any additional information or disclosures required by applicable accounting standards or regulations.

09

Prepare the valuation report, ensuring it is clear, accurate, and supported by the gathered evidence.

10

Finally, present the valuation report to the relevant stakeholders, such as management, auditors, or regulatory authorities.

Who needs valuation for worthless assets?

01

Valuation for worthless assets is needed by various stakeholders including:

02

- Companies or organizations that need to provide accurate financial statements in compliance with accounting standards.

03

- Auditors who are responsible for assessing the accuracy and reliability of financial statements.

04

- Legal professionals involved in disputes or litigations where the value of worthless assets is relevant.

05

- Regulatory authorities that oversee and regulate financial reporting and disclosure requirements.

06

- Investors or shareholders who need to understand the financial health and value of a company, including the impact of worthless assets.

07

- Tax authorities who use valuation for worthless assets to determine tax deductions or write-offs.

08

- Liquidators or insolvency practitioners who need to assess the value of assets in bankruptcy or insolvency proceedings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit valuation for worthless assets on an iOS device?

You certainly can. You can quickly edit, distribute, and sign valuation for worthless assets on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out valuation for worthless assets on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your valuation for worthless assets from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit valuation for worthless assets on an Android device?

With the pdfFiller Android app, you can edit, sign, and share valuation for worthless assets on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is valuation for worthless assets?

Valuation for worthless assets refers to the process of officially determining the value of assets that have no financial worth, typically for tax or legal purposes.

Who is required to file valuation for worthless assets?

Individuals or entities that hold assets deemed to be worthless and wish to claim losses for tax deduction purposes are required to file valuation for worthless assets.

How to fill out valuation for worthless assets?

To fill out valuation for worthless assets, one typically needs to complete a specific form provided by tax authorities, detailing the assets in question, the basis for their valuation as worthless, and any relevant supporting documentation.

What is the purpose of valuation for worthless assets?

The purpose of valuation for worthless assets is to allow taxpayers to claim a deduction for losses incurred on assets that no longer hold any value, thereby reducing their taxable income.

What information must be reported on valuation for worthless assets?

Information that must be reported includes a description of the asset, the date it became worthless, the method used to determine its worthlessness, and any documentation supporting the claim.

Fill out your valuation for worthless assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Valuation For Worthless Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.