Get the free Tax 8WLOLW Installment Payment Plan

Show details

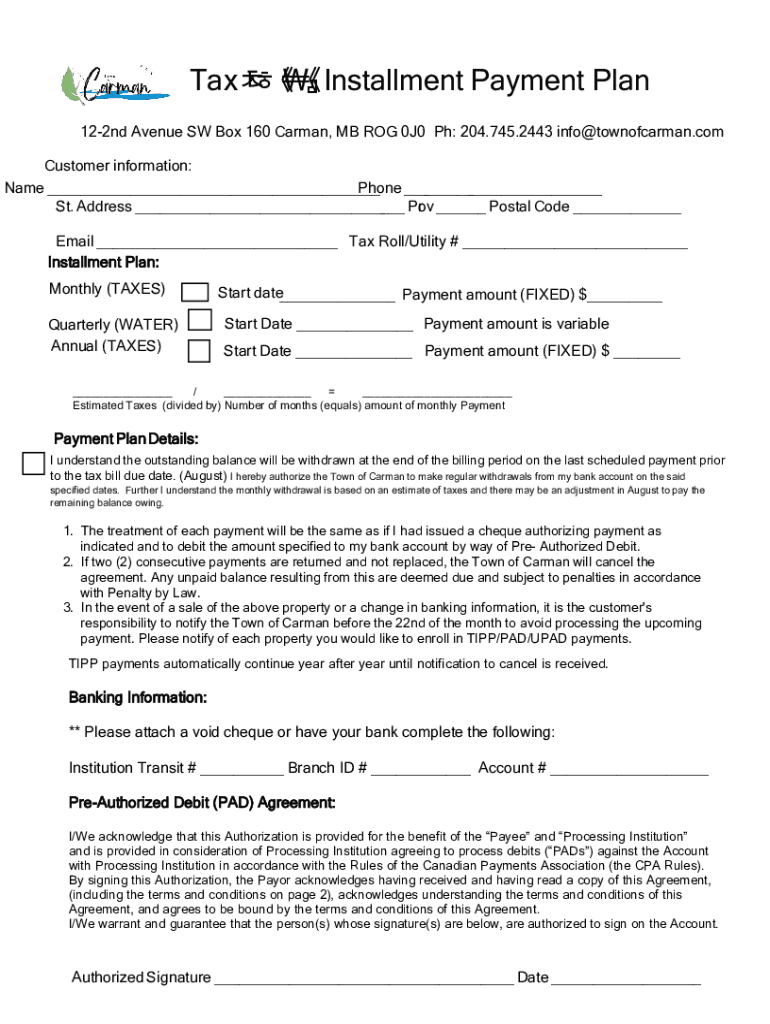

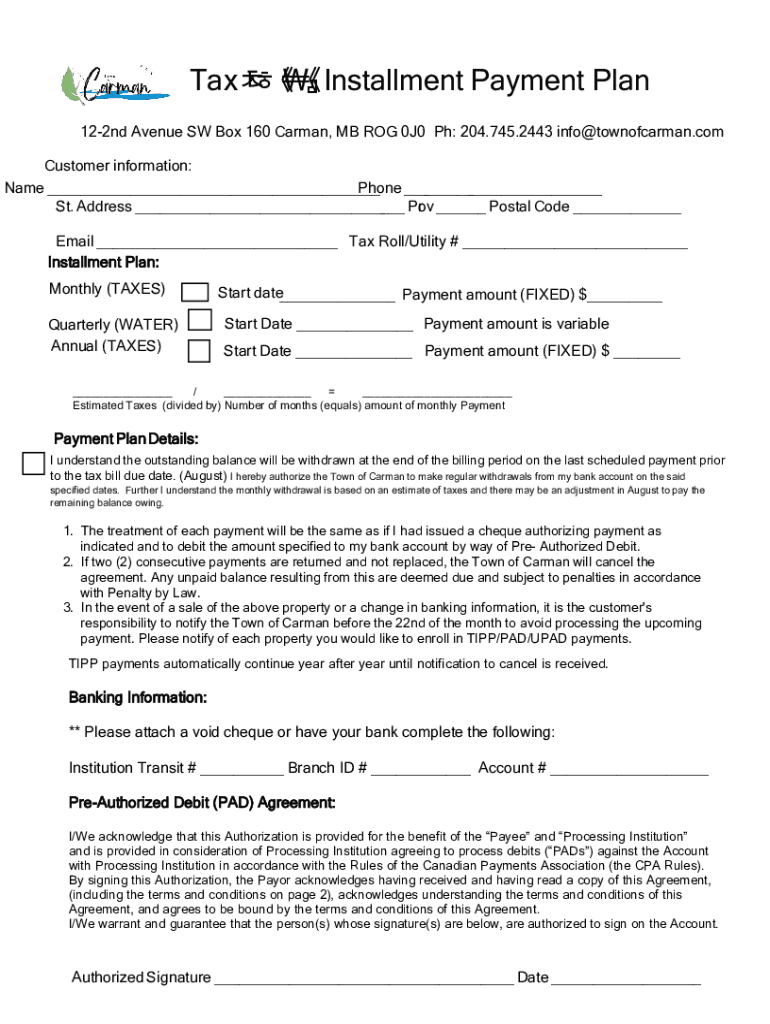

Tax8WLOLW Installment Payment Plan

122nd Avenue SW Box 160 Carmen, MB DOG 0J0 pH: 204.745.2443 info@townofcarman.com

Customer information:

Name ___

Phone ___

St. Address ___ Prov ___ Postal Code ___

Email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax 8wlolw installment payment

Edit your tax 8wlolw installment payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax 8wlolw installment payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax 8wlolw installment payment online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax 8wlolw installment payment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax 8wlolw installment payment

How to fill out tax 8wlolw installment payment

01

To fill out the tax 8wlolw installment payment form, follow these steps:

02

Gather all the necessary documents, such as your income statements, receipts, and other relevant tax documents.

03

Start by entering your personal information, including your name, address, and social security number.

04

Fill in the details of your income and deductions. This may include your salary, investments, business income, and any eligible tax credits or deductions.

05

Calculate the total tax liability for the year and determine the amount you need to pay in installments.

06

Provide your bank account details or choose an alternative payment method for the installment payments.

07

Review all the information entered and make sure it is accurate.

08

Sign and date the form.

09

Submit the form to the appropriate tax authority along with any required attachments or supporting documents.

10

Keep a copy of the filled out form and supporting documents for your records.

11

Follow up with the tax authority to ensure your installment payment plan is accepted and set up properly.

Who needs tax 8wlolw installment payment?

01

Tax 8wlolw installment payment is needed by individuals or businesses who are unable to pay their full tax liabilities in one lump sum.

02

It provides a way to pay the tax debt in installments over a specific period of time, which eases the financial burden for those who cannot afford to pay the full amount at once.

03

This option is typically available for individuals who owe a significant amount of tax but need more time to pay it off, or for businesses experiencing financial difficulties.

04

It is important to note that eligibility for the tax 8wlolw installment payment program may vary depending on the country or tax jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tax 8wlolw installment payment?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your tax 8wlolw installment payment to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the tax 8wlolw installment payment electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your tax 8wlolw installment payment in seconds.

Can I edit tax 8wlolw installment payment on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share tax 8wlolw installment payment on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is tax 8wlolw installment payment?

Tax 8wlolw installment payment refers to a method of paying taxes in multiple installments rather than a single lump sum. This is typically allowed when taxpayers owe taxes for a given period and choose to spread their payments over several months.

Who is required to file tax 8wlolw installment payment?

Taxpayers who expect to owe $1,000 or more in taxes after subtracting withholding and refundable credits may be required to file tax 8wlolw installment payments. This often includes self-employed individuals and those with significant income not subject to withholding.

How to fill out tax 8wlolw installment payment?

To fill out tax 8wlolw installment payment, you need to complete the appropriate tax form provided by the tax authority, providing details such as your income, tax owed, and how much you are paying in each installment.

What is the purpose of tax 8wlolw installment payment?

The purpose of tax 8wlolw installment payment is to allow taxpayers to manage their tax liability more effectively by breaking it down into smaller, more manageable payments, reducing financial burden.

What information must be reported on tax 8wlolw installment payment?

The information that must be reported includes your total tax liability, the amount paid with each installment, due dates for upcoming payments, and any additional relevant tax information.

Fill out your tax 8wlolw installment payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax 8wlolw Installment Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.