MA DoR M-4868 2023 free printable template

Show details

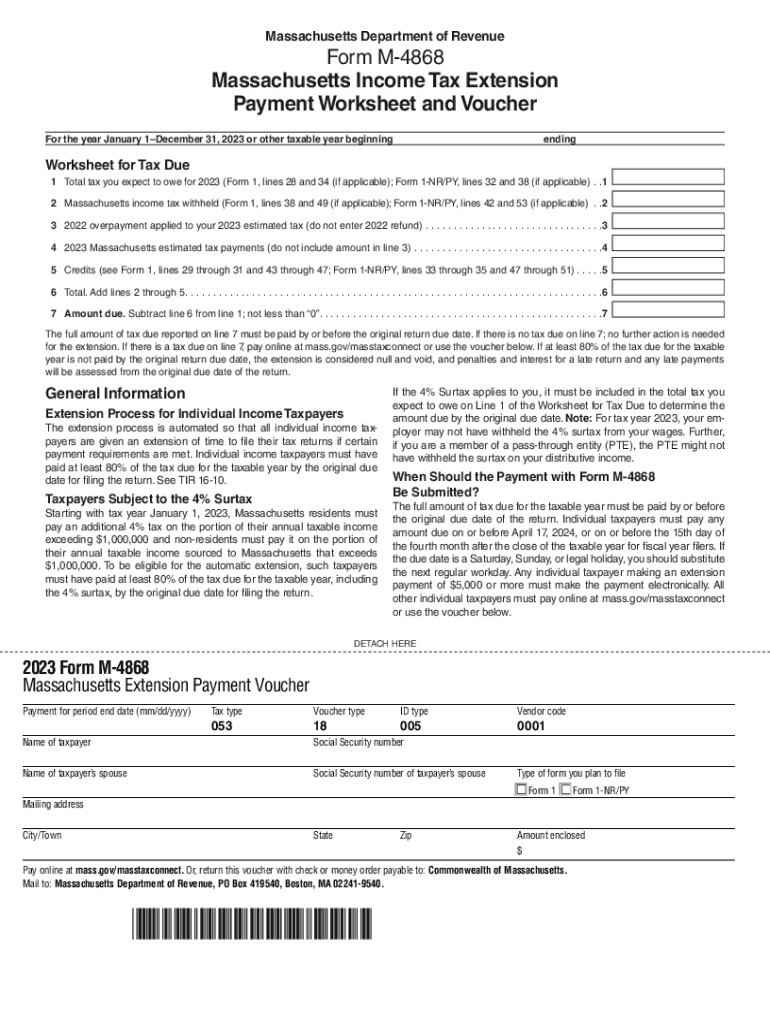

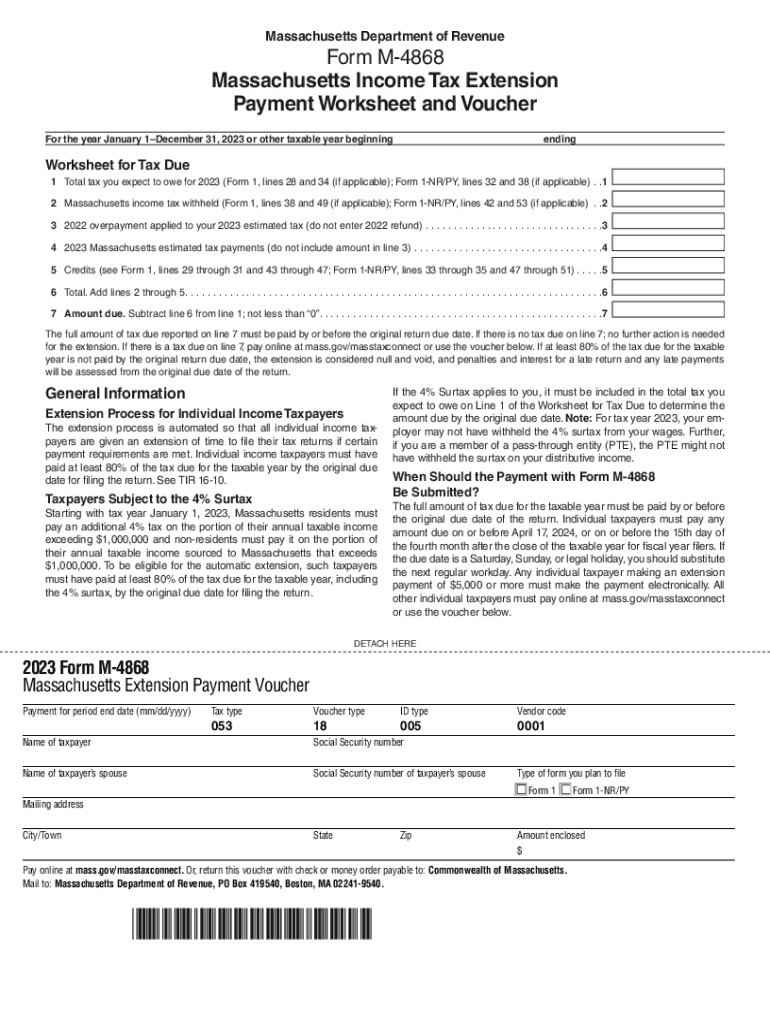

Massachusetts Department of RevenueForm M4868

Massachusetts Income Tax Extension

Payment Worksheet and Voucher

For the year January 1December 31, 2023 or other taxable year beginningendingWorksheet

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ma m payment form printable

Edit your massachusetts m 4868 voucher form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your m 4868 2023 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing m 4868 2023 form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit m 4868 2023 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR M-4868 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out m 4868 2023 form

How to fill out MA DoR M-4868

01

Begin by downloading the MA DoR M-4868 form from the official Massachusetts Department of Revenue website.

02

Fill in your personal information, including your name, address, and Social Security Number.

03

Indicate the tax year for which you are requesting an extension.

04

Calculate your total tax liability using your most recent tax information.

05

If you owe taxes, provide an estimate of that amount and include payment if necessary.

06

Check the box indicating whether you are requesting an automatic 6-month extension.

07

Sign and date the form to certify that the information provided is accurate to the best of your knowledge.

08

Submit the completed form to the appropriate address provided on the form.

Who needs MA DoR M-4868?

01

Any individual or business in Massachusetts who needs additional time to file their state income tax return for the tax year.

02

Taxpayers who anticipate being unable to file their tax return by the original deadline and wish to avoid penalties for late filing.

Fill

form

: Try Risk Free

People Also Ask about

Can Form 4868 be mailed?

Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order. See Pay by Check or Money Order, later. Complete Form 4868 to use as a worksheet.

Where do I file my 4868 extension?

You can file an extension for your taxes by submitting Form 4868 with the IRS online or by mail. This must be done before the last day for filing taxes. Filing an extension for your taxes gives you additional months to prepare your return no matter the reason you need the extra time.

What is Massachusetts form M 4868?

Form M-4868 is used as a payment voucher if additional tax payments are required to reach the 80% mark and payment made by or on behalf of a taxpayer filing Forms 1 or 1-NR/PY must be made using electronic means if a payment of $5,000 or more accompanies the extension voucher, or if Form M-4868 is filed electronically

How do I file an extension on my taxes in Massachusetts?

Requests for an extension of time to file or to pay must be made prior to the due date of the return on Form M-4768, Massachusetts Estate Tax Extension Application.

What is the extended tax deadline for 2022?

October 16, 2023 - Deadline to file your extended 2022 tax return. If you chose to file an extension request on your tax return, this is the due date for filing your tax return.

Does Ma require a tax extension?

If you owe MA income taxes, you will either have to submit a MA tax return or extension by the April 18, 2023 tax deadline in order to avoid late filing penalties. The extension will only avoid late filing penalties until Oct. 16, 2023. Note: Unless you pay all your Taxes or eFile your tax return by Oct.

What is form M 4868?

About Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return | Internal Revenue Service.

Do you need to file a Massachusetts extension?

Generally, you automatically get a 6-month extension to file your Massachusetts income tax return as long as you've paid at least 80% of the total amount of tax due on or before the due date, and you're filing: Form 1. Form 1-NR/PY. Form 2.

How much does it cost to file for an extension for your taxes?

Filing a tax extension is free, easy and automatic: Just submit Form 4868 electronically or on paper by the filing deadline.

How do I file an extension for taxes in MA?

Requests for an extension of time to file or to pay must be made prior to the due date of the return on Form M-4768, Massachusetts Estate Tax Extension Application.

How does form 4868 work?

Form 4868 is known as the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. When you complete the form, the IRS will automatically grant you a six-month tax extension (some businesses only get a five-month extension). Anyone can qualify for an automatic federal tax extension.

What does 4868 mean?

About Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return | Internal Revenue Service.

Can I file my own extension for taxes?

You can file an extension for your taxes by submitting Form 4868 with the IRS online or by mail. This must be done before the last day for filing taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send m 4868 2023 form for eSignature?

When you're ready to share your m 4868 2023 form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in m 4868 2023 form?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your m 4868 2023 form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out m 4868 2023 form using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign m 4868 2023 form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is MA DoR M-4868?

MA DoR M-4868 is the Massachusetts Application for Automatic Extension of Time to File Massachusetts Personal Income Tax Return.

Who is required to file MA DoR M-4868?

Any taxpayer who requires additional time to file their Massachusetts personal income tax return can file MA DoR M-4868.

How to fill out MA DoR M-4868?

To fill out MA DoR M-4868, you need to provide your personal information, including your name, Social Security number, and the tax year for which you're requesting the extension, along with an estimated tax payment if applicable.

What is the purpose of MA DoR M-4868?

The purpose of MA DoR M-4868 is to allow taxpayers an automatic extension of time to file their personal income tax return without incurring late-filing penalties.

What information must be reported on MA DoR M-4868?

On MA DoR M-4868, you must report your name, Social Security number, the tax year, any payment being submitted, and your address.

Fill out your m 4868 2023 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

M 4868 2023 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.