Get the free OF REVENUE - 2022 W-4MNP, Minnesota Withholding ...

Show details

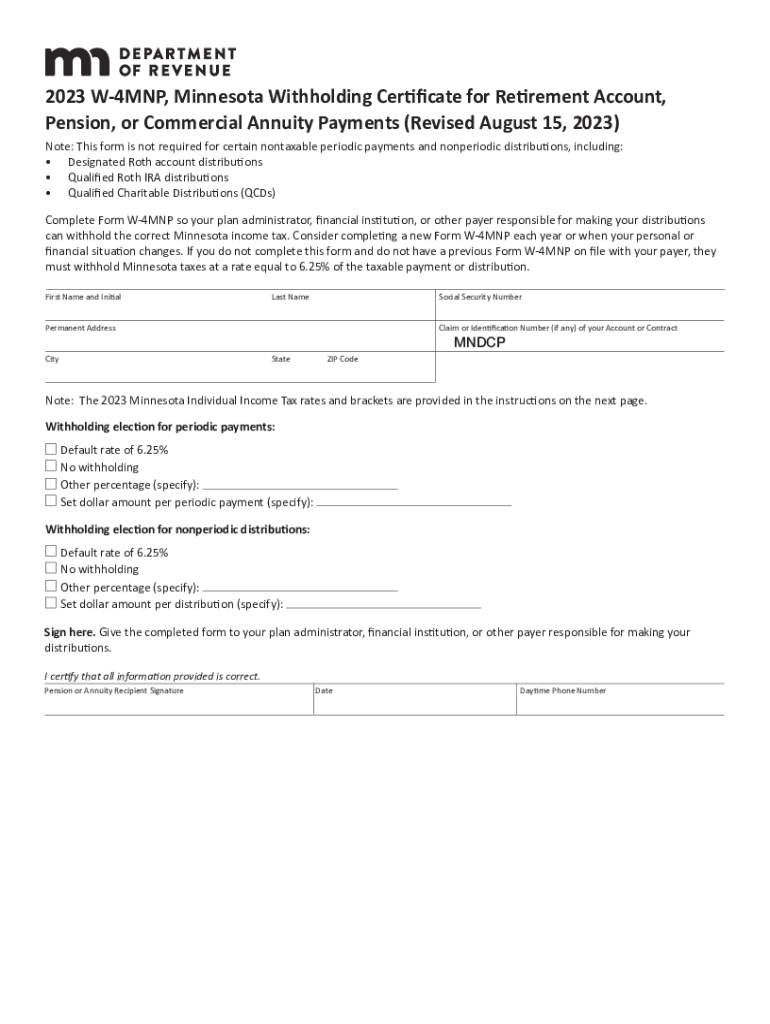

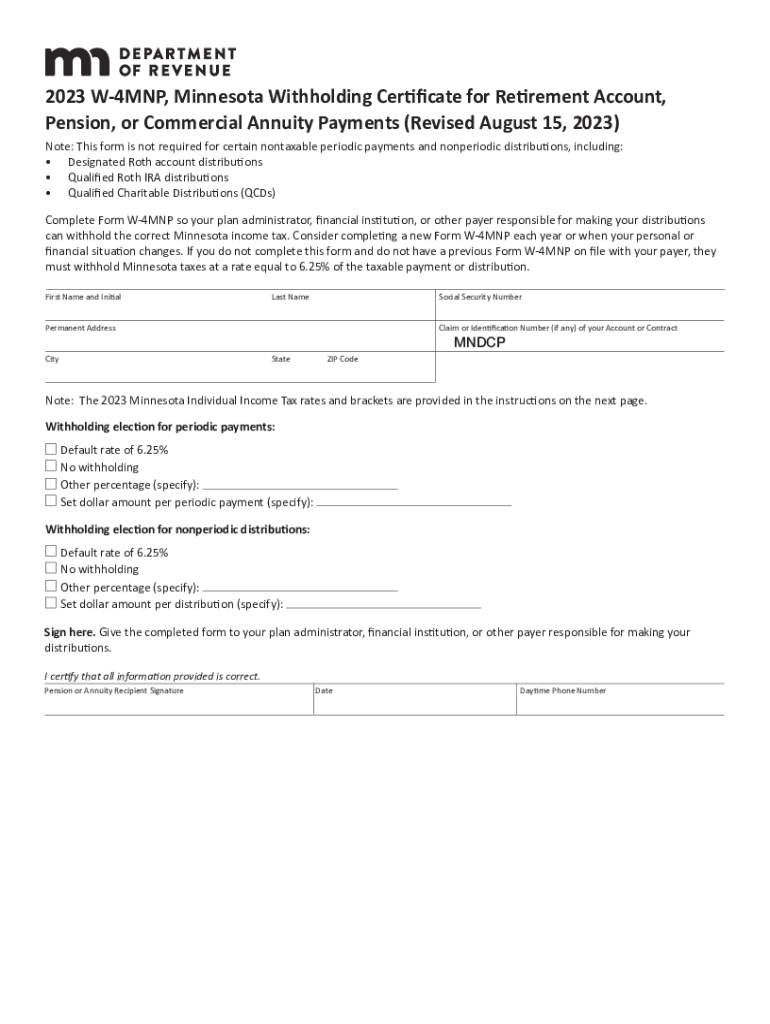

2023 W4MNP, Minnesota Withholding Certificate for Retirement Account, Pension, or Commercial Annuity Payments (Revised August 15, 2023) Note: This form is not required for certain nontaxable periodic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign of revenue - 2022

Edit your of revenue - 2022 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your of revenue - 2022 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing of revenue - 2022 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit of revenue - 2022. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out of revenue - 2022

How to fill out of revenue - 2022

01

Begin by gathering all the necessary financial documents for the year 2022, including income statements, balance sheets, and cash flow statements.

02

Review the previous year's revenue figures to understand the trends and factors that influenced the results.

03

Identify and categorize different sources of revenue, such as sales, services, investments, or other income streams.

04

Create a revenue spreadsheet or use accounting software to input the revenue data. Make sure to include columns for date, source, description, and amount.

05

Fill out the revenue spreadsheet by entering the specific details for each source of revenue. Be as accurate and detailed as possible.

06

Regularly reconcile the revenue figures with other financial statements to ensure consistency and accuracy.

07

Consider consulting with a financial professional or accountant to review and validate the completed revenue report.

08

Once the revenue report is finalized, store it securely for future reference and analysis.

Who needs of revenue - 2022?

01

Various entities and individuals may require the revenue report for different purposes:

02

- Business owners and management need it to assess financial performance, track growth, and make informed decisions.

03

- Investors and shareholders need it to evaluate the company's profitability and potential returns.

04

- Lenders and creditors may require it to assess the company's creditworthiness and repayment capabilities.

05

- Regulatory authorities and tax agencies may request it to ensure compliance with financial regulations and tax obligations.

06

- Researchers and analysts may use it to conduct industry studies, market analysis, or forecasting.

07

- Potential buyers or partners may request it to evaluate the financial health and potential of a business.

08

Ultimately, anyone with an interest in understanding the revenue generated by a particular entity or organization can benefit from the revenue report for the year 2022.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send of revenue - 2022 to be eSigned by others?

When your of revenue - 2022 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the of revenue - 2022 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your of revenue - 2022 in seconds.

How do I fill out of revenue - 2022 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign of revenue - 2022. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is of revenue - w-4mnp?

The W-4MNP is a form used by taxpayers in certain jurisdictions to declare their withholding allowances for personal income tax purposes.

Who is required to file of revenue - w-4mnp?

Individuals who are employees and wish to have their federal income tax withheld based on their specific personal circumstances are required to file the W-4MNP.

How to fill out of revenue - w-4mnp?

To fill out the W-4MNP, taxpayers should provide their personal information including name, address, Social Security number, and the number of allowances they are claiming. The form should be signed and dated before submission to the employer.

What is the purpose of of revenue - w-4mnp?

The purpose of the W-4MNP is to inform the employer of the employee's tax withholding preferences, which helps in determining the amount of federal income tax to withhold from their paycheck.

What information must be reported on of revenue - w-4mnp?

The W-4MNP must report the employee's full name, Social Security number, marital status, the number of allowances being claimed, and any additional amount to be withheld.

Fill out your of revenue - 2022 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Of Revenue - 2022 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.