Get the free self managed superannuation fund audit checklist

Show details

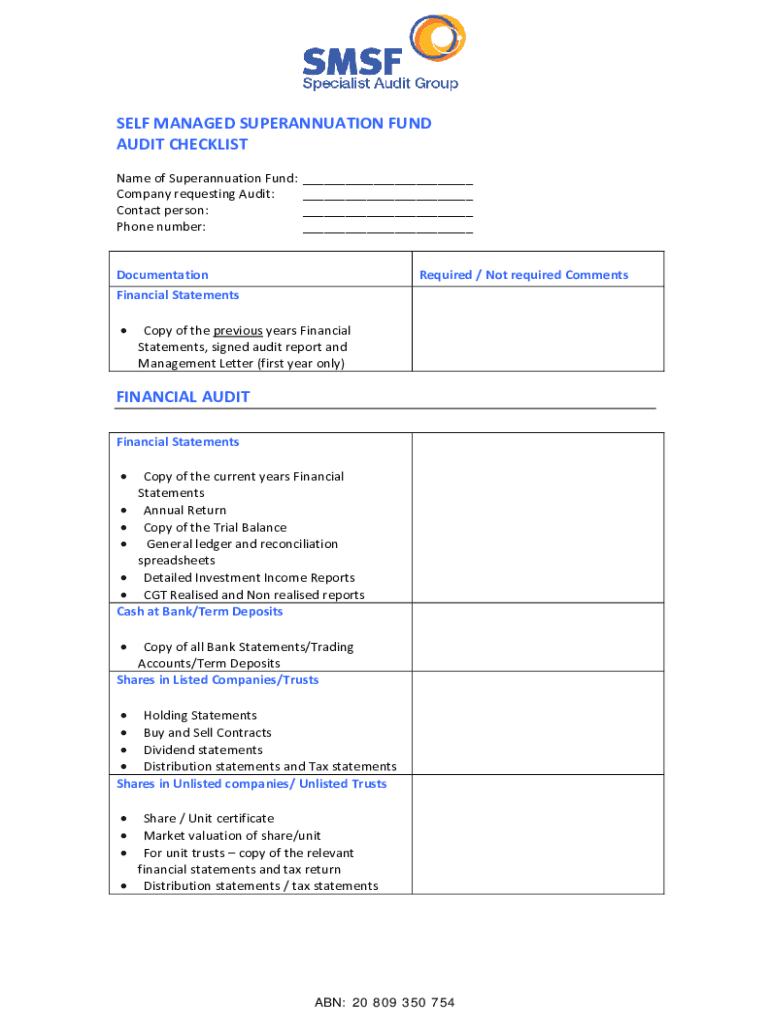

SELF MANAGED SUPERANNUATION FUND

AUDIT CHECKLIST

Name of Superannuation Fund:

Company requesting Audit:

Contact person:

Phone number:___

___

___

___DocumentationRequired / Not required CommentsFinancial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self managed superannuation fund

Edit your self managed superannuation fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self managed superannuation fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self managed superannuation fund online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit self managed superannuation fund. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self managed superannuation fund

How to fill out self managed superannuation fund

01

Step 1: Gather all necessary information about your self managed superannuation fund (SMSF), including your fund's unique identification number and contact details.

02

Step 2: Complete the required application forms provided by the Australian Taxation Office (ATO) or your chosen SMSF provider.

03

Step 3: Provide accurate and up-to-date information about the trustees of the SMSF, including their names, addresses, and tax file numbers.

04

Step 4: Specify the investment strategy for the SMSF, including the types of assets it can invest in and the risk profile of the fund.

05

Step 5: Establish a bank account for the SMSF and ensure that all contributions and payments are made through this account.

06

Step 6: Keep thorough records of all SMSF transactions, including investments, contributions, and expenses.

07

Step 7: Lodge an annual return for the SMSF with the ATO, including financial statements, member information, and tax calculations.

08

Step 8: Stay updated with the latest laws and regulations governing SMSFs and seek professional advice if needed for compliance purposes.

Who needs self managed superannuation fund?

01

Individuals who want more control over their retirement savings and investment decisions.

02

Experienced investors who are knowledgeable about managing their own superannuation funds.

03

People who have a significant amount of superannuation and want to take advantage of potential tax savings and investment opportunities.

04

Those who desire flexibility and diverse investment options beyond what is offered by traditional superannuation funds.

05

Business owners and self-employed individuals who want to use their superannuation to invest in their own business.

06

Individuals with complex estate planning needs who require greater control over the distribution of their superannuation benefits.

07

Families or groups of individuals who wish to pool their superannuation together and make collective investment decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send self managed superannuation fund to be eSigned by others?

When your self managed superannuation fund is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute self managed superannuation fund online?

pdfFiller has made it easy to fill out and sign self managed superannuation fund. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit self managed superannuation fund on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign self managed superannuation fund. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is self managed superannuation fund?

A self managed superannuation fund (SMSF) is a type of superannuation fund that individuals manage themselves rather than relying on a professional fund manager. It allows members to have greater control over their investment choices and retirement savings.

Who is required to file self managed superannuation fund?

All self managed superannuation funds with members are required to file annual returns with the Australian Taxation Office (ATO) to report their financial status and compliance with regulations.

How to fill out self managed superannuation fund?

To fill out an SMSF, individuals must complete a series of financial statements and tax returns, including income statements, expense reports, and member contributions, as required by the ATO's guidelines.

What is the purpose of self managed superannuation fund?

The purpose of an SMSF is to provide a tax-effective way for individuals to save for their retirement. It offers flexibility in investment choices and the ability to tailor the fund to meet personal needs.

What information must be reported on self managed superannuation fund?

SMSFs must report information including fund income, expenses, member contributions, benefits paid, and the fund's financial position, including assets and liabilities.

Fill out your self managed superannuation fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Managed Superannuation Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.