Get the free Beginning Farmer Tax Credit Application Instructions (2020)

Show details

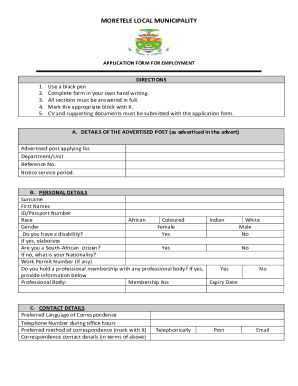

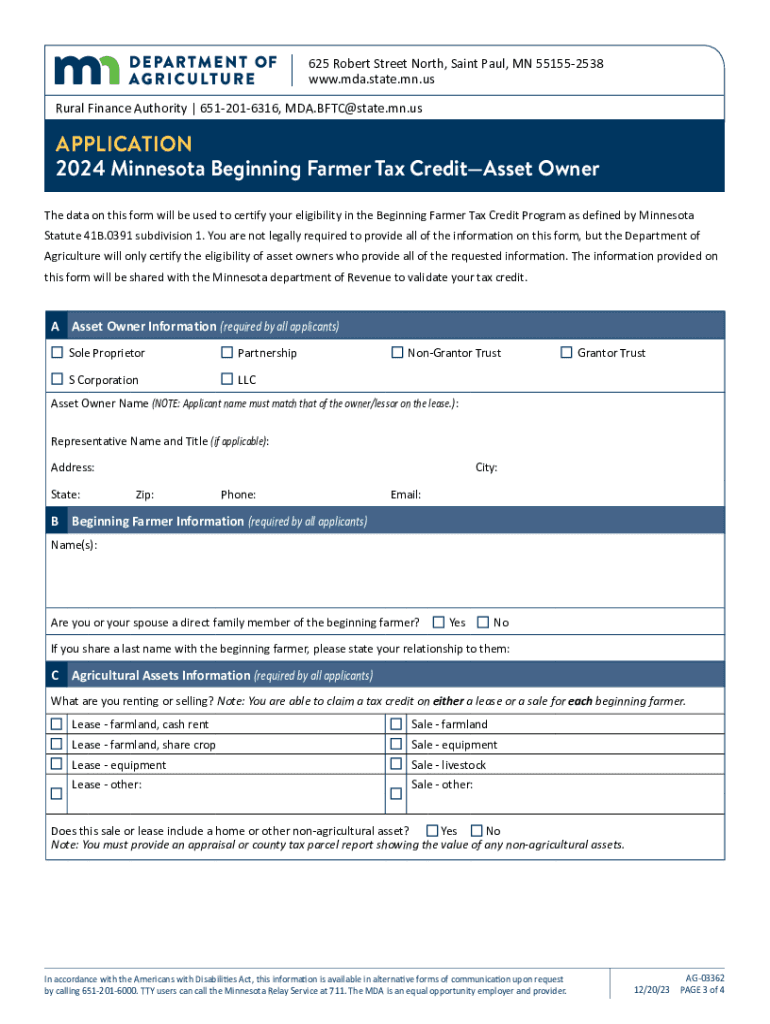

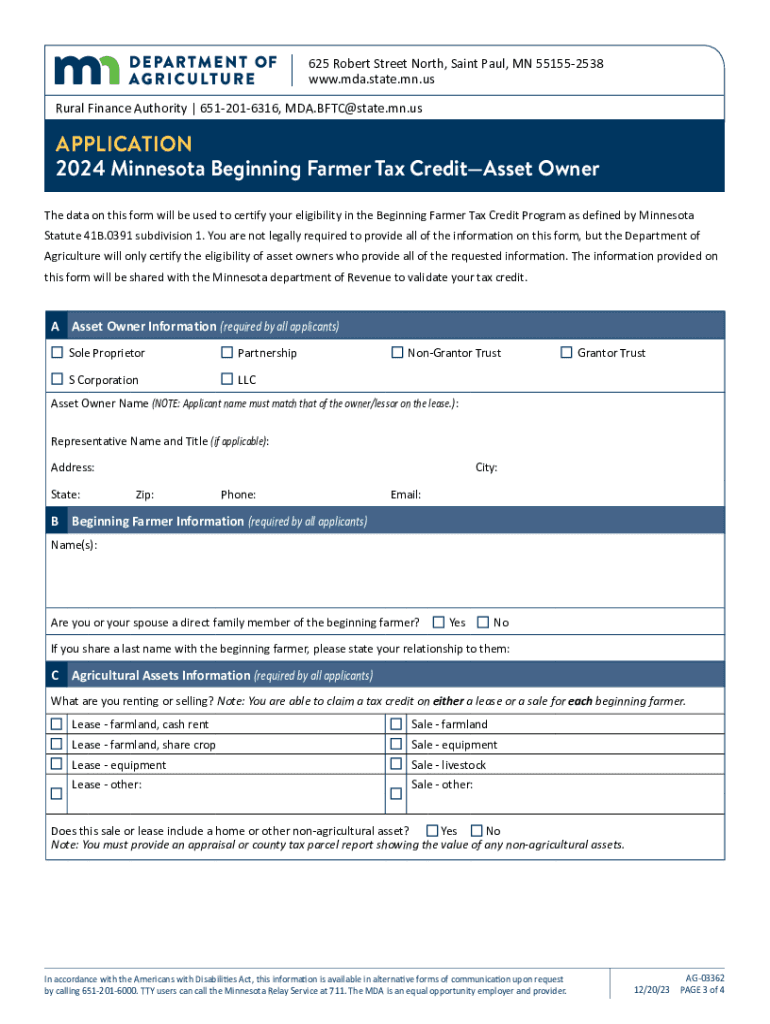

625 Robert Street North, Saint Paul, MN 551552538 www.mda.state.mn.us Rural Finance Authority | 6512016316, MDA.BFTC@state.mn.usAPPLICATION INSTRUCTIONS2024 Minnesota Beginning Farmer Tax CreditAsset

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign beginning farmer tax credit

Edit your beginning farmer tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beginning farmer tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing beginning farmer tax credit online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit beginning farmer tax credit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beginning farmer tax credit

How to fill out beginning farmer tax credit

01

To fill out the beginning farmer tax credit, follow these steps:

02

Determine if you meet the eligibility criteria for the beginning farmer tax credit. These criteria typically include being a new farmer with limited experience, owning or leasing agricultural land, and actively participating in agricultural production.

03

Gather the required documentation, which may include your tax returns, proof of agricultural production, proof of land ownership or lease agreement, and any other supporting documents required by your local tax authority.

04

Fill out the appropriate tax forms for claiming the beginning farmer tax credit. These forms will vary depending on your jurisdiction, so it is important to consult the guidelines provided by your local tax authority.

05

Provide accurate and complete information on the tax forms, ensuring that all fields are correctly filled out. Double-check your entries for any errors or inaccuracies.

06

Submit the completed tax forms and supporting documentation to the relevant tax authority. Follow any additional instructions provided by the authority, such as filing deadlines or submission methods.

07

Keep copies of all submitted documents for your records.

08

Wait for the tax authority to review your application and process the beginning farmer tax credit. This may take some time, so be patient and follow up with the authority if necessary.

09

If approved, the beginning farmer tax credit will be applied to your tax liability or refunded to you, depending on your specific circumstances.

10

It is advised to consult with a tax professional or seek guidance from your local tax authority for specific instructions and requirements related to filling out the beginning farmer tax credit.

Who needs beginning farmer tax credit?

01

Beginning farmer tax credit is typically designed for individuals who meet specific criteria. These criteria may vary depending on the jurisdiction, but generally, individuals who can benefit from the beginning farmer tax credit include:

02

- New farmers with limited experience in agricultural production

03

- Individuals who own or lease agricultural land

04

- Farmers who actively participate in agricultural production

05

It is important to note that eligibility requirements may differ, and it is recommended to consult with your local tax authority or a tax professional to determine if you qualify for the beginning farmer tax credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get beginning farmer tax credit?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the beginning farmer tax credit in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit beginning farmer tax credit online?

With pdfFiller, the editing process is straightforward. Open your beginning farmer tax credit in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out beginning farmer tax credit using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign beginning farmer tax credit and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is beginning farmer tax credit?

The beginning farmer tax credit is a financial incentive offered by certain states in the United States to encourage new farmers to start and sustain their agricultural businesses. It typically provides tax credits for landowners who rent or sell agricultural property to beginning farmers.

Who is required to file beginning farmer tax credit?

Landowners who lease or sell property to beginning farmers may be required to file for the beginning farmer tax credit in order to claim the tax benefits associated with their transactions.

How to fill out beginning farmer tax credit?

To fill out the beginning farmer tax credit, landowners should complete the appropriate state-specific tax credit application form, provide necessary documentation regarding the lease or sale agreement, and submit the form along with their income tax return.

What is the purpose of beginning farmer tax credit?

The purpose of the beginning farmer tax credit is to support the entry of new farmers into the agricultural sector by making it financially easier for them to lease or purchase land, thus promoting agricultural sustainability and rural economic development.

What information must be reported on beginning farmer tax credit?

Information that must be reported includes the specifics of the rental or sale agreement, details about the beginning farmer, the landowner's tax identification, and any other documentation required by the state tax authority.

Fill out your beginning farmer tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beginning Farmer Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.