Get the free Fiscal Rule database - European Commission

Show details

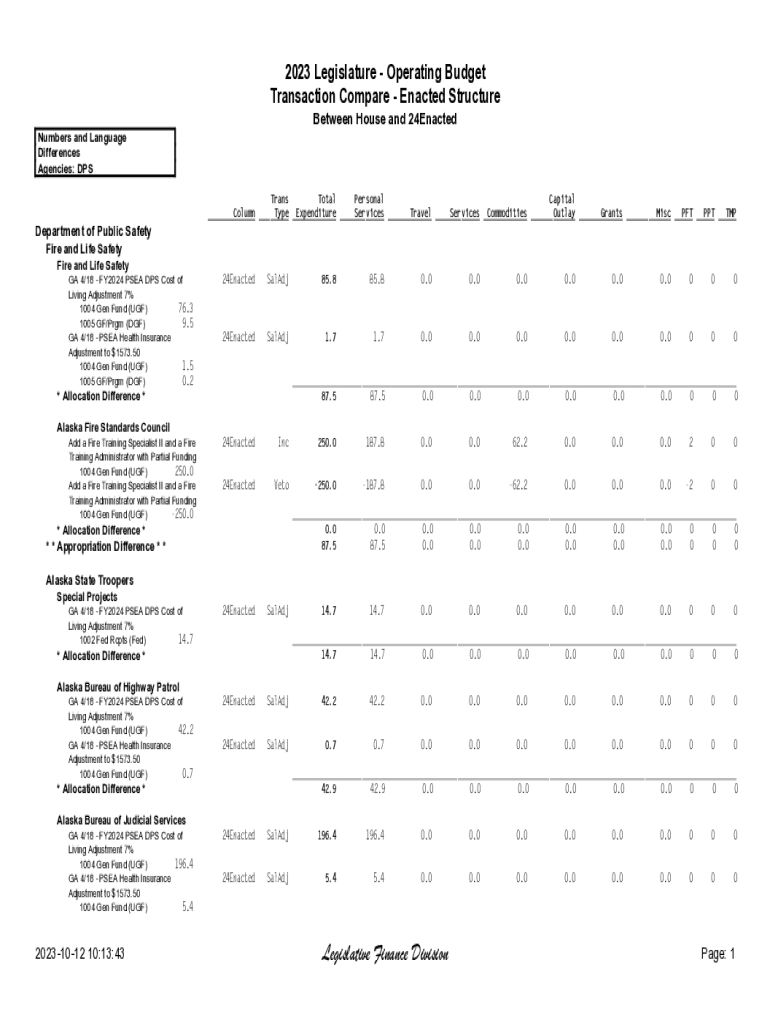

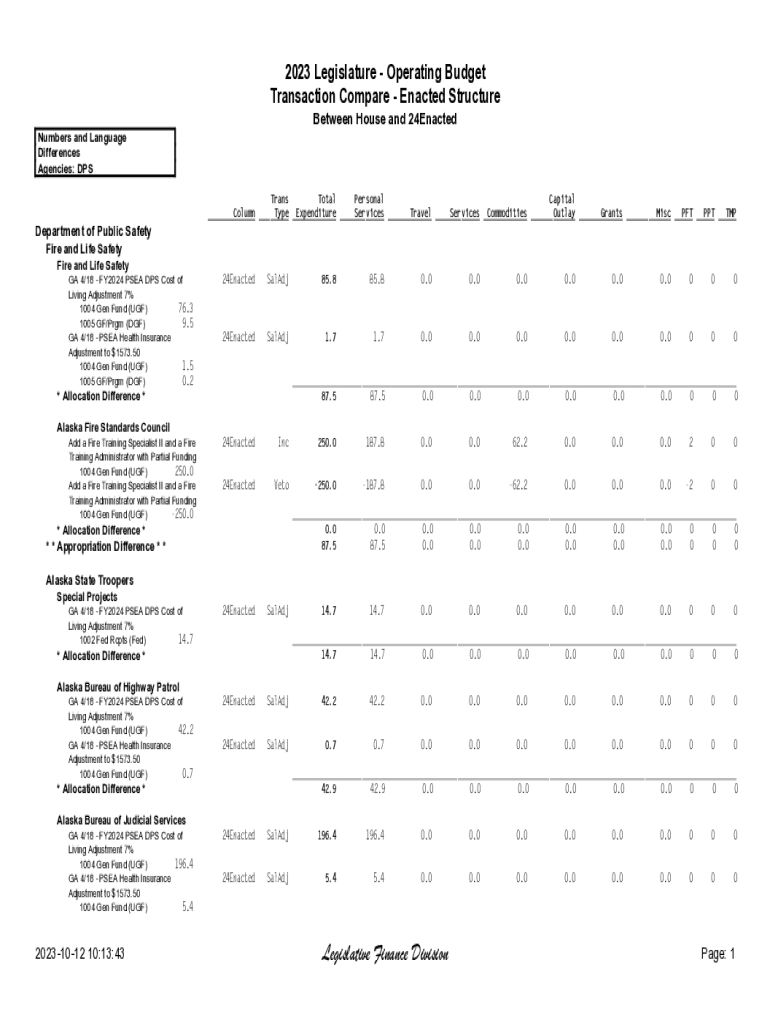

2023 Legislature Operating Budget

Transaction Compare Enacted Structure

Between House and 24Enacted

Numbers and Language

Differences

Agencies: DPS

Trans

Total

Personal

Capital

Column ___

Type ___

Expenditure

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal rule database

Edit your fiscal rule database form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal rule database form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fiscal rule database online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fiscal rule database. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal rule database

How to fill out fiscal rule database

01

Start by gathering all relevant fiscal data, including information on government revenues, expenditures, and debt.

02

Determine the specific rules and requirements that need to be followed for filling out the database.

03

Organize the fiscal data into appropriate categories, such as revenue sources, expenditure types, and debt categories.

04

Enter the fiscal data into the database system, ensuring accuracy and consistency in input.

05

Update the database regularly to reflect any changes in fiscal data.

06

Perform quality checks and validations to ensure the integrity of the data entered.

07

Analyze the data within the database to generate reports and insights on fiscal trends and performance.

08

Use the information from the fiscal rule database for decision-making and policy formulation related to fiscal matters.

Who needs fiscal rule database?

01

Government agencies and ministries responsible for fiscal planning and budgeting.

02

Economists and researchers studying fiscal policies and their impact.

03

Financial institutions and credit rating agencies assessing a country's fiscal health.

04

International organizations monitoring and providing guidance on fiscal sustainability.

05

Policymakers and politicians evaluating the effectiveness of existing fiscal rules and proposing reforms.

06

Citizens and civil society organizations interested in understanding and advocating for sound fiscal policies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fiscal rule database directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign fiscal rule database and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send fiscal rule database to be eSigned by others?

Once your fiscal rule database is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I fill out fiscal rule database on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your fiscal rule database. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is fiscal rule database?

The fiscal rule database is a centralized repository that collects and stores information regarding the fiscal rules established by various governmental entities. It serves as a tool for monitoring compliance with these rules.

Who is required to file fiscal rule database?

Typically, government agencies, departments, and entities subject to fiscal regulations are required to file the fiscal rule database.

How to fill out fiscal rule database?

To fill out the fiscal rule database, entities must provide required financial data, compliance information, and any relevant documentation that adheres to the guidelines set forth by the regulatory body.

What is the purpose of fiscal rule database?

The purpose of the fiscal rule database is to enhance transparency, ensure compliance with fiscal regulations, and enable effective monitoring of fiscal policies on a national or regional level.

What information must be reported on fiscal rule database?

Entities must report financial statements, budgetary outcomes, compliance status with fiscal rules, and any relevant fiscal policy changes or updates.

Fill out your fiscal rule database online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Rule Database is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.