Get the free Potential gains in lifetime net merit from genomic testing of ...

Show details

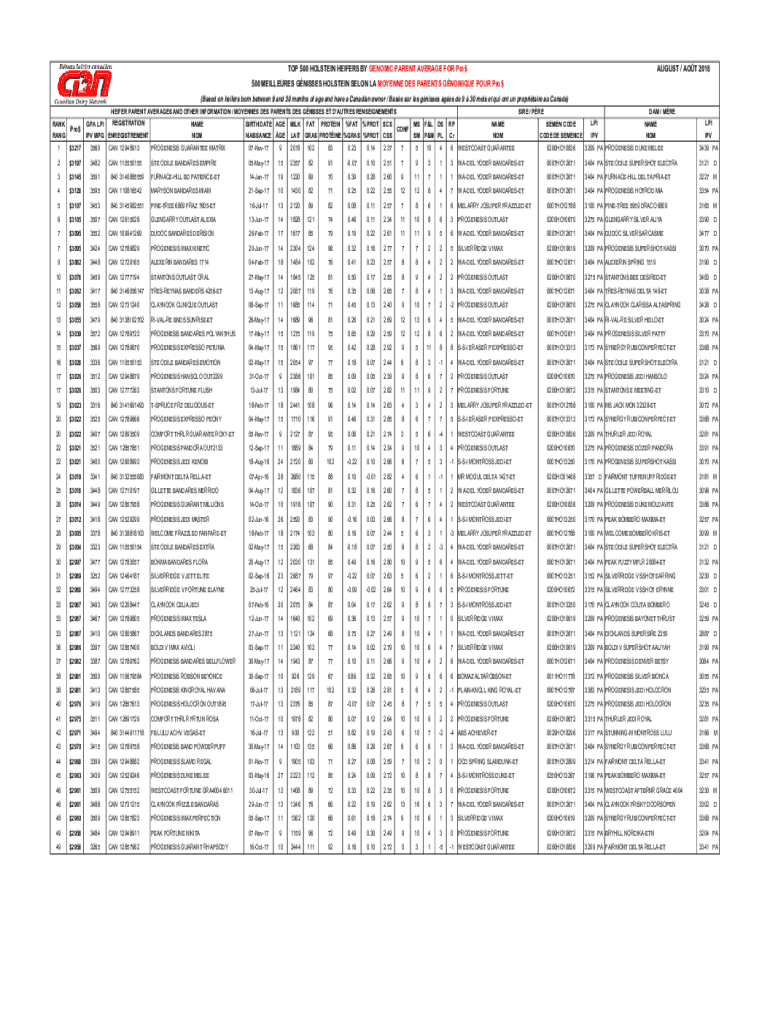

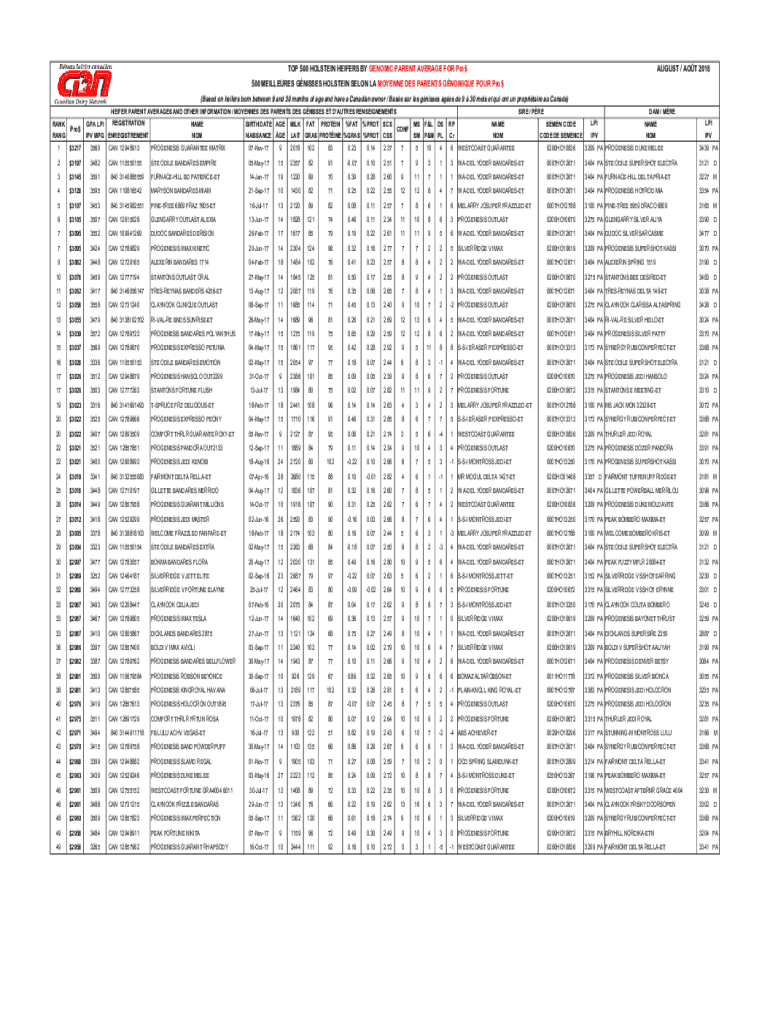

TOP 500 HOLSTEIN HEIFERS BY GENOMIC PARENT AVERAGE FOR Pro$AUGUST / AOT 2018500 MILLERS GLASSES HOLSTEIN SALON LA DOYENNE DES PARENTS UNIQUE POUR Pro

(Based on heifers born between 9 and 30 months

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign potential gains in lifetime

Edit your potential gains in lifetime form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your potential gains in lifetime form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing potential gains in lifetime online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit potential gains in lifetime. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out potential gains in lifetime

How to fill out potential gains in lifetime

01

To fill out potential gains in lifetime, follow these steps:

02

Start by identifying your long-term goals and aspirations.

03

Determine the skills, knowledge, or resources that are required to achieve those goals.

04

Assess your current strengths and weaknesses in relation to those requirements.

05

Create a plan for acquiring the necessary skills or resources, such as enrolling in courses, attending workshops, or seeking mentorship.

06

Take consistent action towards your goals, staying focused and persistent despite challenges or setbacks.

07

Regularly review your progress and make adjustments to your plan as needed.

08

Seek opportunities for personal and professional growth, such as networking events or conferences.

09

Stay motivated and maintain a positive mindset, believing in your ability to achieve your potential gains.

10

Surround yourself with supportive and like-minded individuals who can encourage and inspire you.

11

Celebrate milestones and achievements along the way, acknowledging the progress you have made.

Who needs potential gains in lifetime?

01

Potential gains in lifetime can be beneficial for anyone who wants to maximize their personal and professional growth.

02

Specifically, those who are ambitious, driven, and goal-oriented can greatly benefit from focusing on potential gains.

03

Individuals who have a clear vision of their future and who want to continuously improve themselves are also prime candidates.

04

Potential gains in lifetime can help students, professionals, entrepreneurs, and anyone who wants to unlock their full potential.

05

Ultimately, it is up to each individual to determine if they are ready and willing to pursue potential gains in their lifetime.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my potential gains in lifetime directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your potential gains in lifetime and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in potential gains in lifetime?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your potential gains in lifetime to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the potential gains in lifetime in Gmail?

Create your eSignature using pdfFiller and then eSign your potential gains in lifetime immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is potential gains in lifetime?

Potential gains in lifetime refer to the estimated financial benefits or profits that an individual can accumulate over their entire life through investments, real estate, or other financial assets.

Who is required to file potential gains in lifetime?

Individuals who have realized capital gains or significant income from investments, as well as businesses that may report earnings from assets, are typically required to file potential gains in lifetime.

How to fill out potential gains in lifetime?

To fill out potential gains in lifetime, individuals must provide detailed information about their income sources, investments, and any relevant deductions, following the guidelines set out by the tax authorities.

What is the purpose of potential gains in lifetime?

The purpose of potential gains in lifetime is to assess an individual's overall financial growth and tax liability, allowing for proper taxation on capital gains and informing future investment decisions.

What information must be reported on potential gains in lifetime?

Information that must be reported includes the type and amount of gains realized, the source of those gains, any losses incurred, and relevant deductions that may affect taxable income.

Fill out your potential gains in lifetime online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Potential Gains In Lifetime is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.