Get the free Lending Policy - Final Draft 041222 -EO

Show details

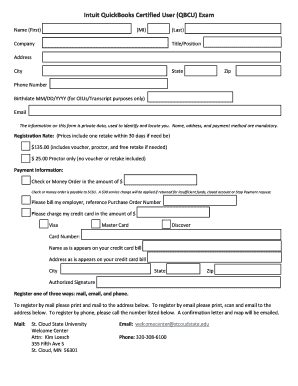

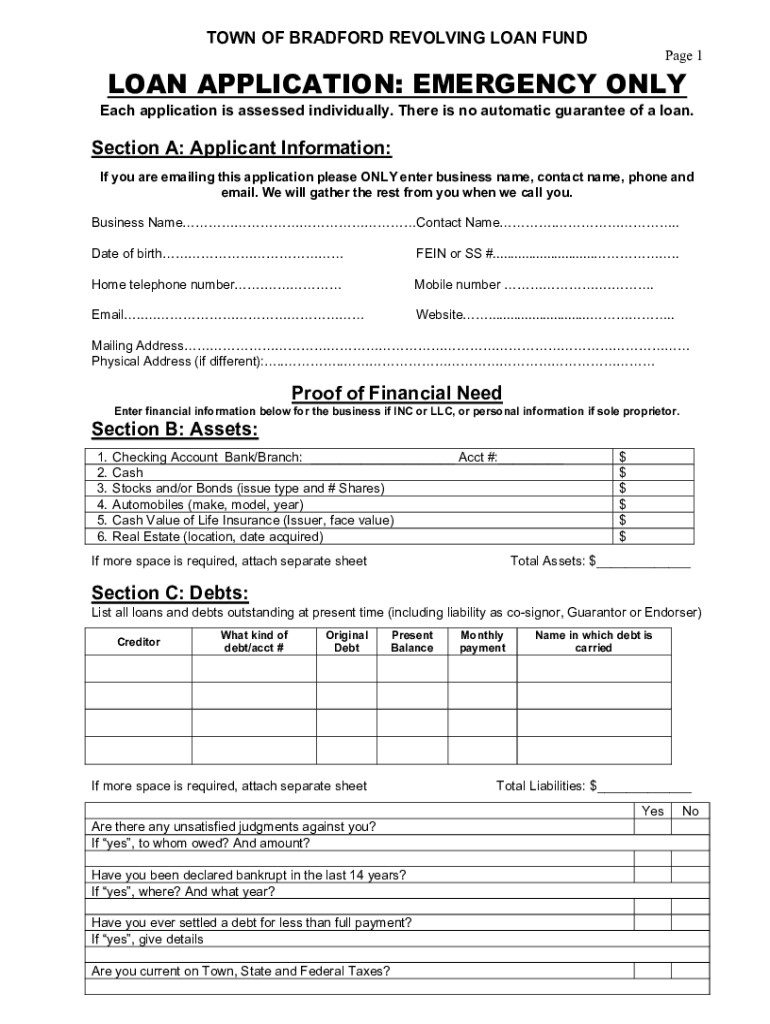

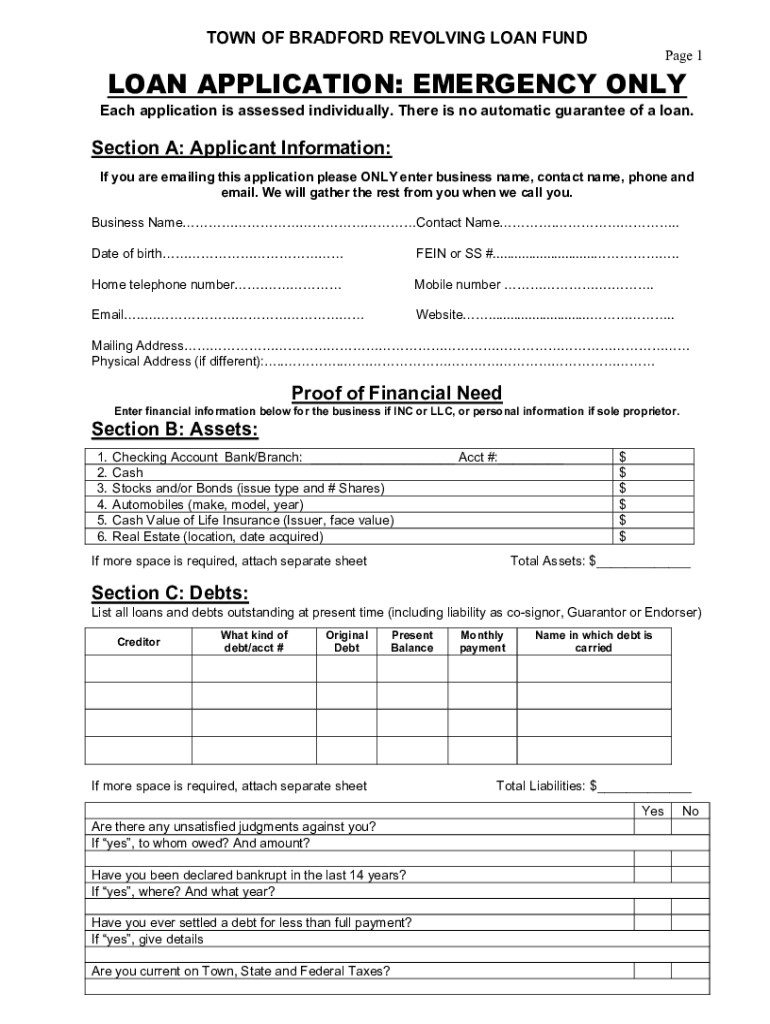

TOWN OF BRADFORD REVOLVING LOAN FUND Page 1LOAN APPLICATION: EMERGENCY ONLY Each application is assessed individually. There is no automatic guarantee of a loan.Section A: Applicant Information: If

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lending policy - final

Edit your lending policy - final form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lending policy - final form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lending policy - final online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lending policy - final. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lending policy - final

How to fill out lending policy - final

01

To fill out the lending policy, follow these steps:

02

Begin by reviewing the current lending policy or template provided by your organization.

03

Understand the purpose of the lending policy and its intended audience.

04

Identify the key areas that need to be covered in the policy, such as eligibility criteria, loan application process, loan approval process, interest rates, repayment terms, and enforcement procedures.

05

Gather relevant information and data that will be included in the lending policy.

06

Organize the information into a clear and logical structure, using headings, subheadings, and bullet points where necessary.

07

Write each section of the lending policy, addressing the key areas identified earlier. Use clear and concise language, avoiding jargon or technical terms that may be difficult for the intended audience to understand.

08

Review and revise the policy to ensure clarity, consistency, and compliance with any legal or regulatory requirements.

09

Seek feedback and input from relevant stakeholders, such as senior management, legal advisors, and lending department staff.

10

Incorporate the feedback and make any necessary revisions.

11

Finalize the lending policy document, ensuring it is properly formatted and includes an introduction, body, and conclusion.

12

Share the final lending policy with all relevant parties, such as employees, customers, and other stakeholders.

13

Regularly review and update the lending policy as needed to reflect changes in business practices, regulations, or market conditions.

Who needs lending policy - final?

01

Various entities and individuals can benefit from having a lending policy in place, including:

02

- Banks and financial institutions: A lending policy helps guide lending activities, manage risk, and ensure compliance with regulatory requirements.

03

- Credit unions: Lending policies help establish consistent lending practices and protect the interests of members.

04

- Microfinance institutions: Having a lending policy promotes responsible lending and supports financial inclusion efforts.

05

- Small businesses: A lending policy can provide guidelines for accessing loans to support business growth and expansion.

06

- Non-profit organizations: Lending policies can help non-profit organizations manage lending activities and provide loans to support their mission.

07

- Individuals: Understanding lending policies can help individuals make informed decisions when borrowing money and ensure they are treated fairly by lenders.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the lending policy - final in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your lending policy - final in seconds.

How do I fill out the lending policy - final form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign lending policy - final. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit lending policy - final on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign lending policy - final. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is lending policy - final?

The lending policy - final refers to the formal guidelines that institutions must follow regarding the extension of credit and managing loans. It outlines the standards for assessing creditworthiness, terms of lending, and risk management strategies.

Who is required to file lending policy - final?

Typically, financial institutions, including banks, credit unions, and mortgage lenders, are required to file the lending policy - final as part of regulatory compliance with governing bodies.

How to fill out lending policy - final?

To fill out the lending policy - final, institutions should follow the prescribed format provided by the regulatory authority, including specific details about credit risk assessment procedures, approval processes, and documentation requirements.

What is the purpose of lending policy - final?

The purpose of the lending policy - final is to ensure that lending practices are consistent, transparent, and compliant with regulatory standards to mitigate risks and safeguard against potential losses.

What information must be reported on lending policy - final?

The lending policy - final must report information regarding loan approval criteria, risk assessment procedures, borrower eligibility requirements, loan terms and conditions, and compliance with relevant laws.

Fill out your lending policy - final online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lending Policy - Final is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.