Get the free Low Income Taxpayer Clinic Grant Program; Availability of ...

Show details

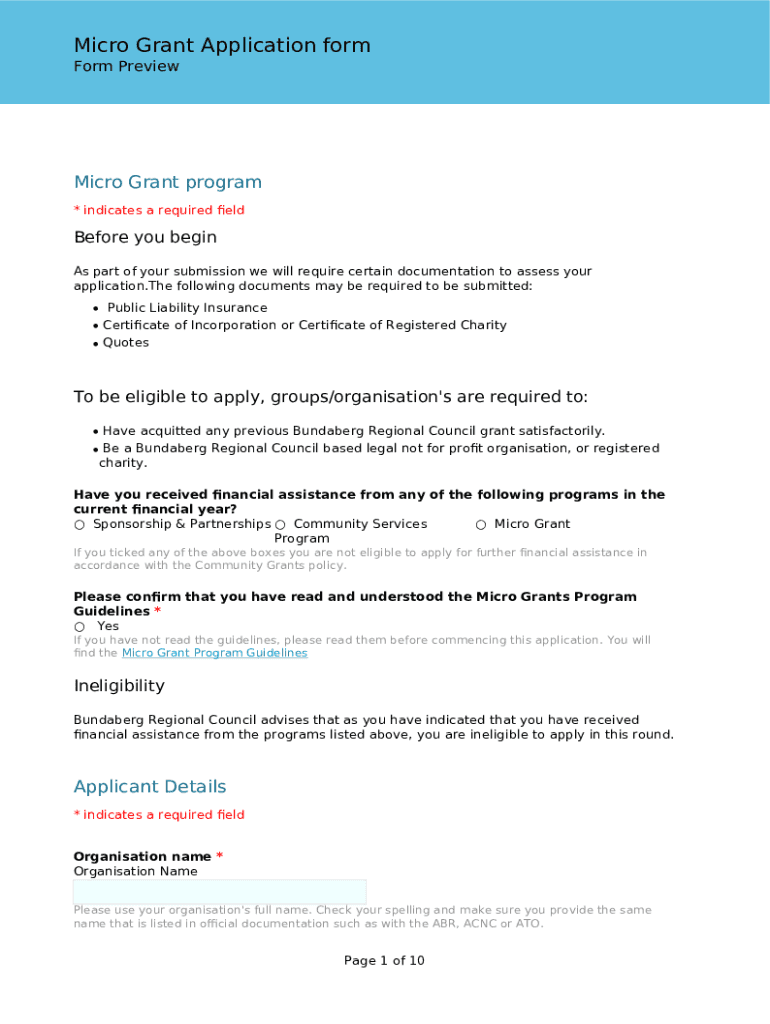

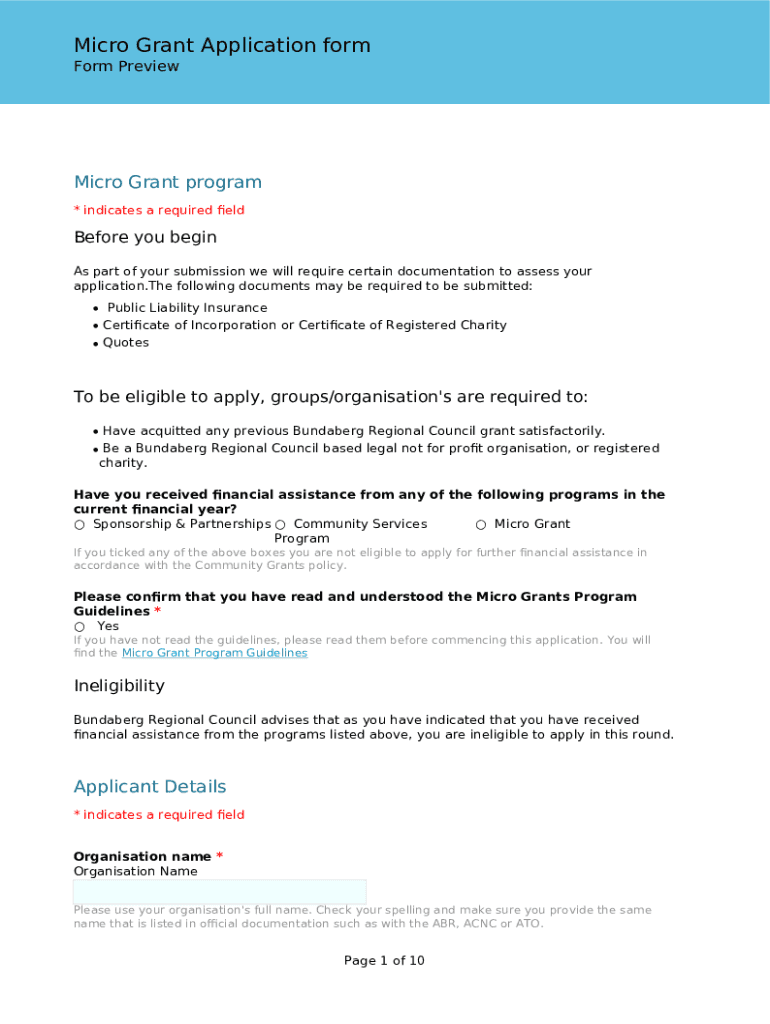

Micro Grant Application form

Form PreviewMicro Grant program

* indicates a required eldBefore you begin

As part of your submission we will require certain documentation to assess your

application.The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign low income taxpayer clinic

Edit your low income taxpayer clinic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your low income taxpayer clinic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing low income taxpayer clinic online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit low income taxpayer clinic. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out low income taxpayer clinic

How to fill out low income taxpayer clinic

01

To fill out a low income taxpayer clinic, follow the steps below:

02

Start by gathering all the necessary documents and information, such as your personal identification, income records, tax returns, and any relevant correspondence with the Internal Revenue Service (IRS).

03

Research and locate a low income taxpayer clinic in your area. You can find this information on the IRS website or by contacting local tax assistance organizations.

04

Contact the low income taxpayer clinic to schedule an appointment. They will provide you with further instructions and let you know what documents to bring with you to the appointment.

05

Attend the scheduled appointment at the low income taxpayer clinic. Make sure to bring all the required documents and information.

06

Meet with a representative or tax professional at the clinic who will assist you in filling out the necessary forms and provide guidance on your tax-related issues.

07

Provide all the requested information and answer any questions honestly and accurately.

08

Review all the completed forms before submitting them to ensure they are correctly filled out.

09

Submit the filled-out forms to the low income taxpayer clinic, and they will handle the further process or contact the relevant authorities on your behalf.

10

Follow up with the low income taxpayer clinic to check the progress of your case and to address any additional questions or concerns that may arise.

11

Keep copies of all the submitted documents and any communication with the clinic or IRS for your records.

12

Remember to seek assistance from qualified professionals if you have any doubts or difficulties at any stage.

Who needs low income taxpayer clinic?

01

Low income taxpayer clinic is primarily designed to assist individuals who meet certain income and financial criteria. The following individuals may benefit from the services of a low income taxpayer clinic:

02

- Individuals with low income who need help with their tax returns or resolving tax-related issues.

03

- Taxpayers who are experiencing financial hardship or struggling to pay their taxes.

04

- Individuals facing audits, examinations, or collections actions by the IRS.

05

- Taxpayers who have limited English proficiency or need assistance understanding their tax rights and responsibilities.

06

- Those who believe they have been subject to unfair or improper treatment by the IRS.

07

- Individuals who qualify for the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), or other refundable tax credits and need guidance in claiming them.

08

It is important to note that specific eligibility requirements may vary depending on the clinic and location, so it is advisable to contact your local low income taxpayer clinic for more information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send low income taxpayer clinic for eSignature?

When you're ready to share your low income taxpayer clinic, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the low income taxpayer clinic electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your low income taxpayer clinic in minutes.

Can I create an eSignature for the low income taxpayer clinic in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your low income taxpayer clinic and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is low income taxpayer clinic?

A Low Income Taxpayer Clinic (LITC) is an organization that provides assistance to low income taxpayers in resolving tax disputes with the Internal Revenue Service (IRS) and offers education regarding their rights and responsibilities under the tax laws.

Who is required to file low income taxpayer clinic?

There is no requirement for taxpayers to file specifically to utilize a Low Income Taxpayer Clinic; instead, these clinics assist eligible low income individuals who need help with their tax issues.

How to fill out low income taxpayer clinic?

To access services from a Low Income Taxpayer Clinic, individuals typically need to contact the clinic directly, provide their tax information, and explain their tax issues. There are no specific forms to fill out just for utilizing the services.

What is the purpose of low income taxpayer clinic?

The purpose of Low Income Taxpayer Clinics is to assist low income individuals in resolving disputes with the IRS, educate them about their tax rights, and provide representation in audits, appeals, and collection matters.

What information must be reported on low income taxpayer clinic?

Clinics must report various information, including the number of clients served, types of cases handled, outcomes achieved, and financial data for funding agencies. However, clients themselves do not need to report specific information related to their personal cases.

Fill out your low income taxpayer clinic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Low Income Taxpayer Clinic is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.