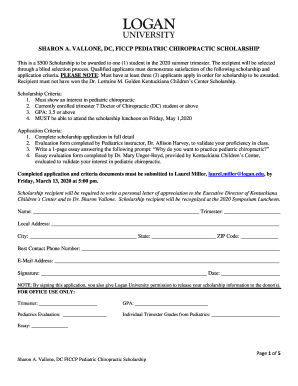

Get the free Real Estate Transactions: Tax Planning - Law Books

Show details

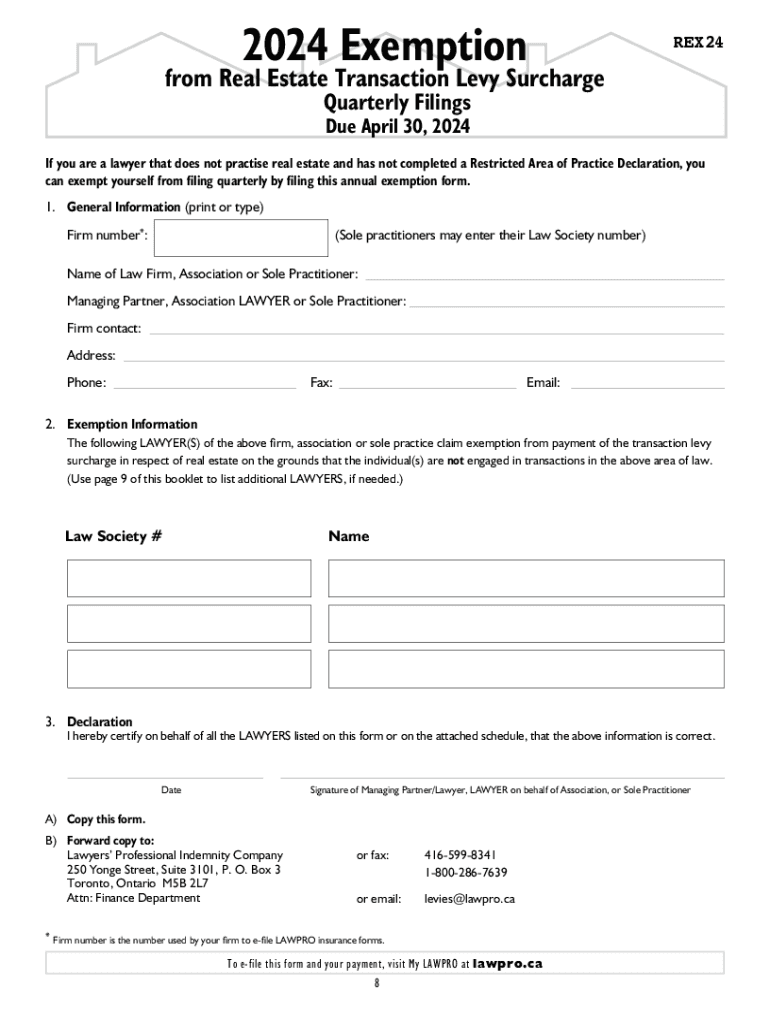

2024 ExemptionREX24from Real Estate Transaction Levy Surcharge

Quarterly Filings

Due April 30, 2024If you are a lawyer that does not practice real estate and has not completed a Restricted Area of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real estate transactions tax

Edit your real estate transactions tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real estate transactions tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing real estate transactions tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit real estate transactions tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real estate transactions tax

How to fill out real estate transactions tax

01

Step 1: Gather all necessary documents and information related to the real estate transaction, including purchase agreements, closing statements, and any relevant financial records.

02

Step 2: Determine the tax rate and regulations applicable to the specific jurisdiction in which the transaction took place. This information can usually be obtained from the local tax authority or department.

03

Step 3: Calculate the taxable amount by subtracting any allowable deductions or exemptions from the total transaction value. This may include things like mortgage balances or certain fees.

04

Step 4: Fill out the appropriate tax forms or documents as required by the local tax authority. These forms will typically require information such as the names and addresses of the buyer and seller, transaction details, and the calculated tax amount.

05

Step 5: Review the completed forms for accuracy and ensure all necessary supporting documentation is attached.

06

Step 6: Submit the filled-out tax forms and any required payments to the appropriate tax authority within the designated deadline.

07

Step 7: Keep copies of all submitted documents and receipts for future reference and potential audits.

Who needs real estate transactions tax?

01

Real estate transactions tax is typically required by individuals or entities involved in buying or selling real estate properties.

02

This may include home buyers, property investors, real estate developers, and businesses engaged in real estate transactions.

03

The specific requirement may vary depending on the jurisdiction and the nature of the transaction, so it is important to consult with the local tax authority or a qualified professional to determine the exact obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send real estate transactions tax to be eSigned by others?

real estate transactions tax is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit real estate transactions tax on an Android device?

With the pdfFiller Android app, you can edit, sign, and share real estate transactions tax on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out real estate transactions tax on an Android device?

Use the pdfFiller mobile app to complete your real estate transactions tax on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is real estate transactions tax?

Real estate transactions tax is a tax imposed on the sale or transfer of real property, typically calculated as a percentage of the sale price.

Who is required to file real estate transactions tax?

Typically, the seller or transferor of the property is required to file the real estate transactions tax, though it may vary by jurisdiction.

How to fill out real estate transactions tax?

To fill out the real estate transactions tax, one should complete the required forms provided by the taxing authority, including details about the property, the sale price, and both parties' information.

What is the purpose of real estate transactions tax?

The purpose of real estate transactions tax is to generate revenue for local or state government, often funding public services such as schools and infrastructure.

What information must be reported on real estate transactions tax?

Information reported should include the names of the buyer and seller, property address, sale price, date of transaction, and any applicable exemptions or deductions.

Fill out your real estate transactions tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Estate Transactions Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.