Get the free Fiduciary (Trust and Estates)

Show details

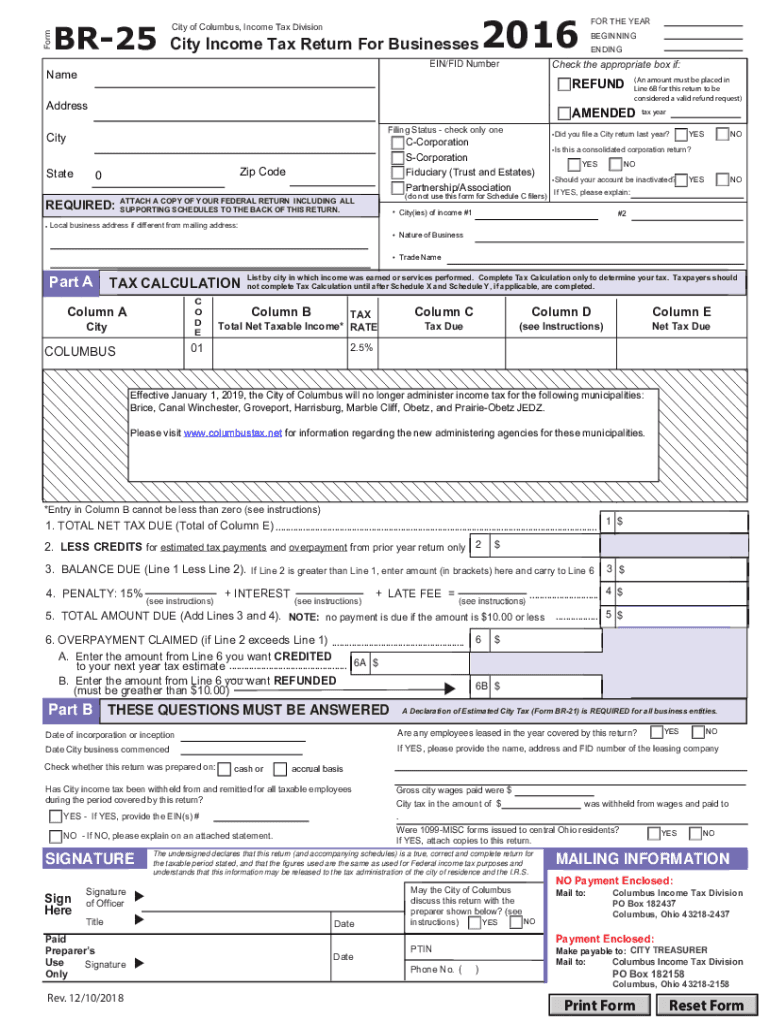

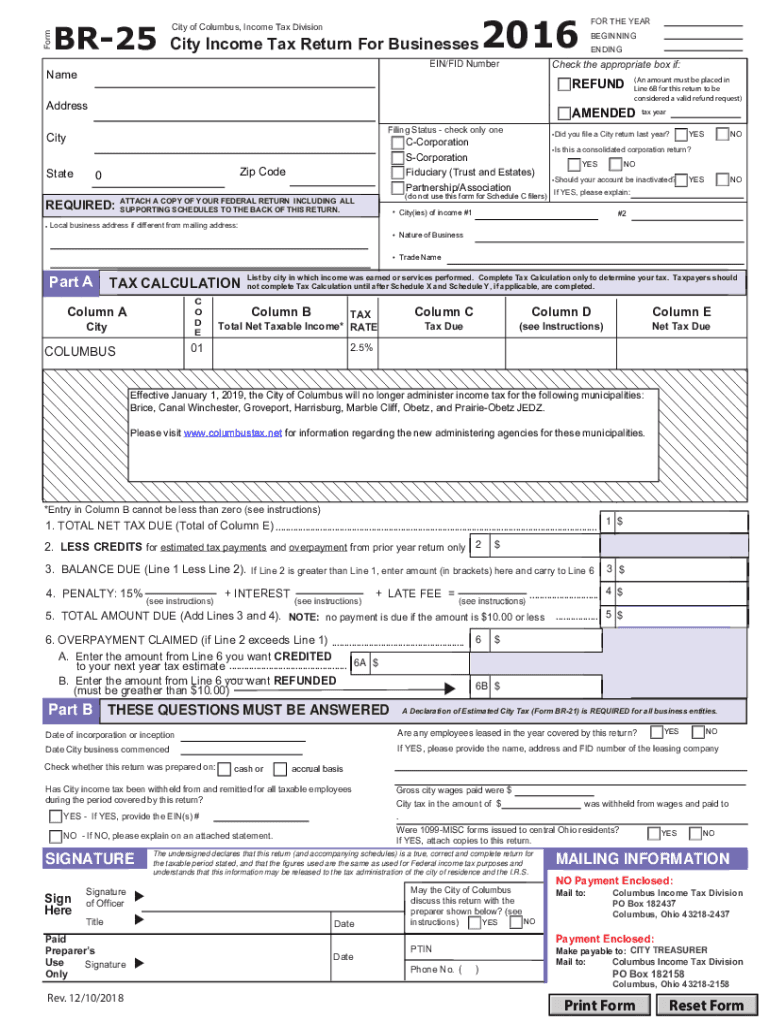

FormBR25City of Columbus, Income Tax Divisibility Income Tax Return For Businesses2016BEGINNING

ENDINGCheck the appropriate box if:EIN/FID NumberNameFOR THE YEARREFUNDAddressAMENDED

Filing Status

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiduciary trust and estates

Edit your fiduciary trust and estates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiduciary trust and estates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiduciary trust and estates online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fiduciary trust and estates. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiduciary trust and estates

How to fill out fiduciary trust and estates

01

To fill out a fiduciary trust and estate, you need to follow these steps:

02

- Gather all necessary documents, including the will, death certificate, and any other relevant legal documents.

03

- Identify all assets owned by the deceased and gather documentation to verify ownership.

04

- Determine any debts or liabilities owed by the estate and gather documentation to support these claims.

05

- Appraise all assets to determine their value at the time of death.

06

- Prepare an inventory or list of all assets, including their estimated value.

07

- Determine the beneficiaries of the estate and their respective entitlements.

08

- Prepare a distribution plan, detailing how the assets will be distributed among the beneficiaries.

09

- Complete all necessary legal forms to initiate the probate process.

10

- Submit the fiduciary trust and estate documents to the appropriate court or governing body.

11

- Attend any required hearings or meetings related to the trust and estate.

12

- Distribute the assets according to the approved distribution plan.

13

- Keep detailed records of all transactions and communications related to the trust and estate.

14

- File any necessary tax returns on behalf of the estate.

15

- Close the fiduciary trust and estate once all assets have been distributed and all obligations have been fulfilled.

Who needs fiduciary trust and estates?

01

Fiduciary trust and estates are typically needed by individuals who want to ensure that their assets are managed and distributed according to their wishes after their death.

02

The following parties may need fiduciary trust and estates:

03

- Individuals with significant assets and complex financial holdings.

04

- Families with minor or disabled beneficiaries who require ongoing financial management and protection.

05

- Business owners who want to ensure the continuity of their business operations and distribution of assets.

06

- Individuals who want to minimize estate taxes and ensure efficient administration of their estate.

07

- Anyone who wishes to avoid potential disputes or conflicts among beneficiaries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my fiduciary trust and estates in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your fiduciary trust and estates right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit fiduciary trust and estates on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share fiduciary trust and estates on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete fiduciary trust and estates on an Android device?

Use the pdfFiller Android app to finish your fiduciary trust and estates and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is fiduciary trust and estates?

Fiduciary trust and estates refer to the legal arrangements where a trustee manages assets on behalf of beneficiaries and the legal framework surrounding the administration of estates after someone's death.

Who is required to file fiduciary trust and estates?

Fiduciaries managing estates, such as executors, administrators, or trustees of trusts, are required to file fiduciary trust and estates tax returns.

How to fill out fiduciary trust and estates?

To fill out fiduciary trust and estates forms, you need to gather necessary information about the trust or estate, report income, deductions, and provide details about beneficiaries, then complete the appropriate tax forms, such as Form 1041 in the U.S.

What is the purpose of fiduciary trust and estates?

The purpose of fiduciary trust and estates is to manage and protect assets for the benefit of beneficiaries, ensure proper distribution according to the trust document or will, and comply with tax obligations.

What information must be reported on fiduciary trust and estates?

Information that must be reported includes income earned by the trust or estate, deductions, distributions to beneficiaries, and details about the trustee or fiduciary managing the assets.

Fill out your fiduciary trust and estates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiduciary Trust And Estates is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.