Get the free Tax Management System RFP - Sauk County

Show details

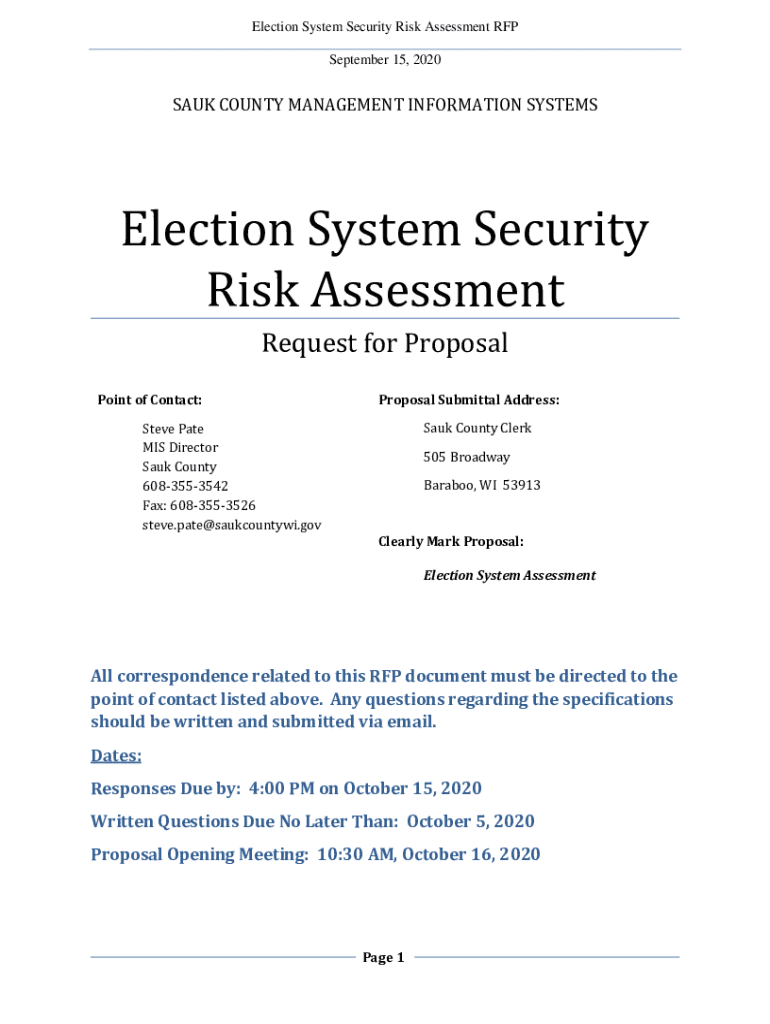

Election System Security Risk Assessment RFP

September 15, 2020SAUK COUNTY MANAGEMENT INFORMATION SYSTEMSElection System Security

Risk Assessment

Request for Proposal

Point of Contact:Proposal Submittal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax management system rfp

Edit your tax management system rfp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax management system rfp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax management system rfp online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax management system rfp. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax management system rfp

How to fill out tax management system rfp

01

To fill out a tax management system RFP, follow these steps:

02

Begin by reviewing the requirements and objectives of your organization for the tax management system. Determine what specific features and functionalities you require.

03

Research and identify potential vendors or providers that offer tax management systems that align with your organization's needs.

04

Create a structured RFP document that includes sections such as an introduction, background information about your organization, scope of work, requirements, and evaluation criteria.

05

Provide a clear and concise overview of your organization, including its size, industry, and any specific challenges or complexities related to tax management.

06

Clearly state your objectives and the goals you aim to achieve with the tax management system. Specify any specific functionalities or integrations you require.

07

Outline the key requirements you have for the tax management system, such as compliance with tax laws and regulations, ease of use, scalability, reporting capabilities, and integration with other systems.

08

Include a section on pricing and licensing, specifying whether you prefer a one-time payment or a subscription model. Request detailed information on costs, implementation timelines, and ongoing support and maintenance.

09

Specify the evaluation criteria you will use to assess the proposals, such as vendor experience, technical capabilities, customer references, and the overall fit with your organization's requirements.

10

Set a deadline for vendors to submit their proposals and provide contact information for any clarifications or additional information they may require.

11

Review and evaluate the received proposals based on your predetermined evaluation criteria. Shortlist potential vendors for further discussions or demonstrations.

12

Conduct vendor presentations or demonstrations to assess their systems' capabilities and suitability for your organization's needs.

13

Request any necessary clarifications or additional information from the shortlisted vendors.

14

Make a final decision and notify the selected vendor. Negotiate the terms and conditions, including pricing, implementation timelines, and support services.

15

Create a contract or agreement outlining the terms and conditions of the engagement with the chosen vendor. Ensure it includes key elements such as service level agreements, confidentiality provisions, and dispute resolution mechanisms.

Who needs tax management system rfp?

01

Tax management system RFPs are typically required by organizations that are in need of a comprehensive tax management solution.

02

This may include corporations, businesses, non-profit organizations, government agencies, and other entities that have complex tax-related requirements.

03

Organizations that handle large volumes of financial transactions, have multiple tax obligations, or operate in multiple jurisdictions often benefit from implementing a tax management system.

04

Tax management system RFPs help these organizations identify and select the most suitable vendor or provider to meet their tax management needs.

05

By issuing an RFP, organizations can ensure they receive proposals from qualified vendors and make an informed decision based on their specific requirements and evaluation criteria.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax management system rfp in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing tax management system rfp and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit tax management system rfp on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing tax management system rfp, you need to install and log in to the app.

Can I edit tax management system rfp on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign tax management system rfp right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is tax management system rfp?

A tax management system RFP (Request for Proposal) is a formal document that organizations use to solicit proposals from vendors for tax management solutions. It outlines the requirements and expectations for the desired system.

Who is required to file tax management system rfp?

Generally, organizations seeking to implement a new tax management system or upgrade their existing systems are required to file an RFP. This includes businesses of all sizes, as well as governmental and non-profit entities.

How to fill out tax management system rfp?

To fill out a tax management system RFP, organizations should clearly define their requirements, goals, and preferences. They should include sections detailing the scope of work, timeline, budget, and evaluation criteria for vendor proposals.

What is the purpose of tax management system rfp?

The purpose of a tax management system RFP is to communicate the needs of an organization to potential vendors, enabling them to submit proposals that detail how they can meet those needs with their solutions.

What information must be reported on tax management system rfp?

The RFP must report information such as project objectives, required features and functionalities, compliance requirements, budget constraints, timelines, and evaluation criteria.

Fill out your tax management system rfp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Management System Rfp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.