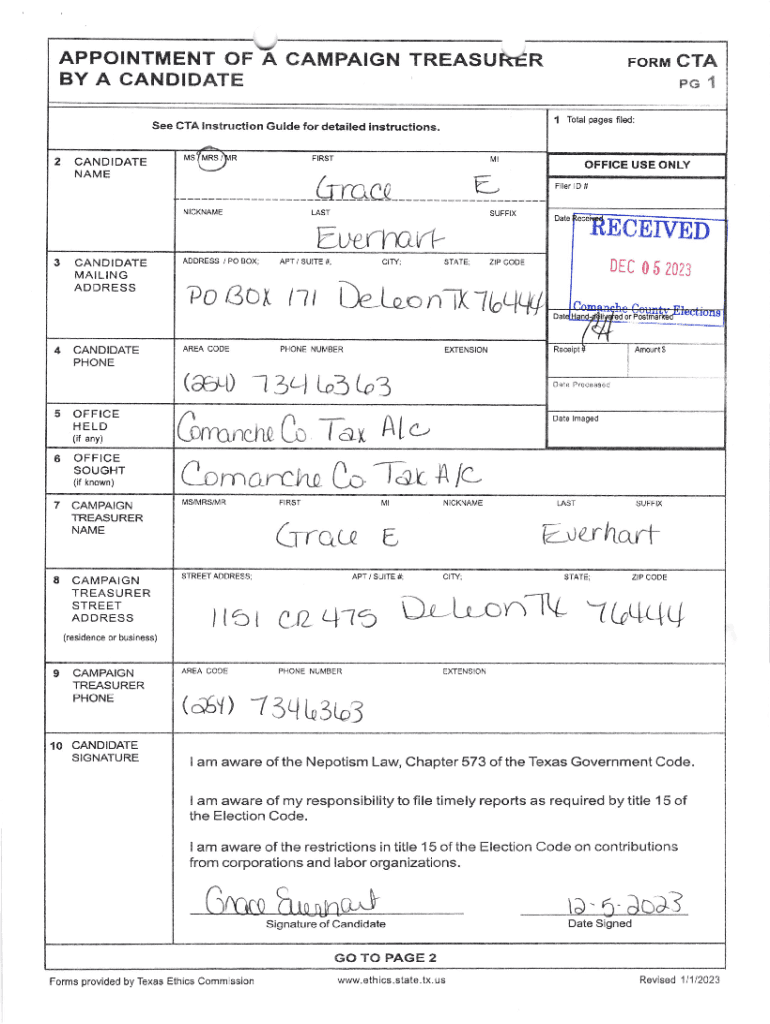

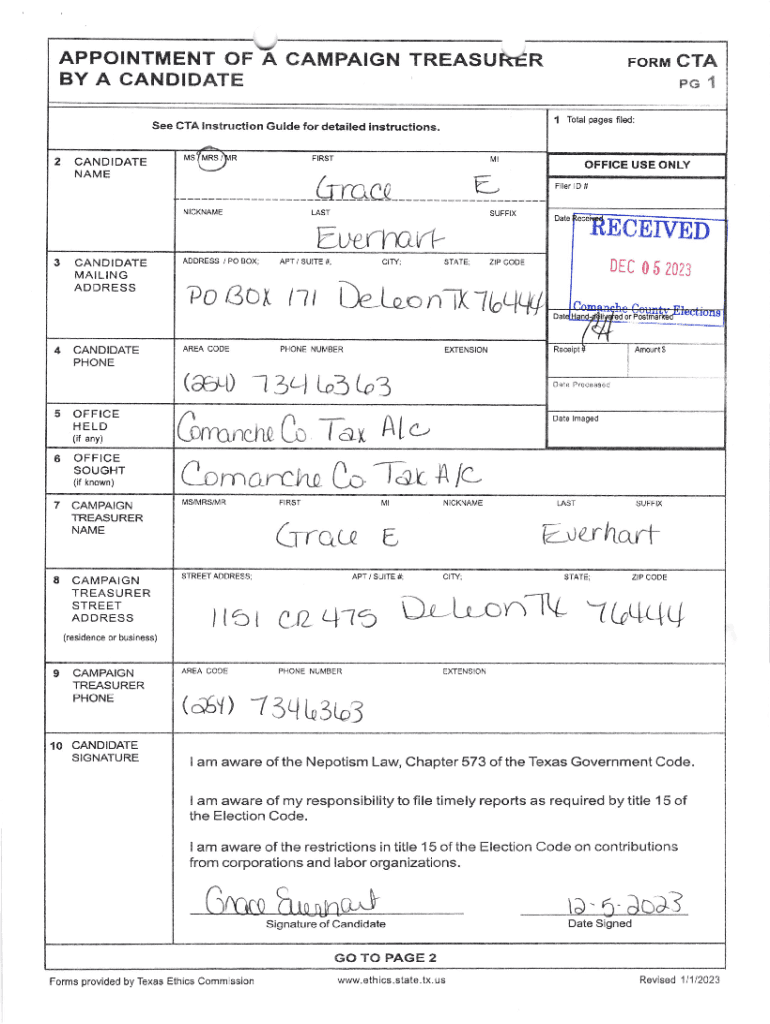

Get the free Tax Assessor-Collector - Comanche County, Texas

Show details

APPOINTMENT OF A CAMPAIGN TREASU RR BY A GANDIDATE 1See GTA lnstruction Guide for detailed Instructions2CANDIDATEMS(MRSIRFIRSTNAME3 CANDIDATE MAILING ADDRESS4CANDIDATE PHONE/POBOX;AREA CODE(aaLD 5OFFICE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax assessor-collector - comanche

Edit your tax assessor-collector - comanche form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax assessor-collector - comanche form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax assessor-collector - comanche online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax assessor-collector - comanche. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax assessor-collector - comanche

How to fill out tax assessor-collector - comanche

01

To fill out tax assessor-collector - comanche form, follow these steps:

02

Start by entering your personal information such as your name, address, social security number, and contact details.

03

Provide details about your income sources, including employment income, investments, and any other sources of income.

04

Calculate and enter your deductions, such as mortgage interest, property taxes, and medical expenses.

05

Verify if you are eligible for any tax credits or exemptions, such as child tax credit or earned income credit, and provide the relevant information.

06

Review your form for any errors or missing information, and make necessary corrections.

07

Sign and date the form to certify the accuracy of the provided information.

08

Attach any required supporting documents, such as W-2 forms or 1099 statements.

09

File the completed form with the tax assessor-collector - comanche office either electronically or by mail.

10

Keep a copy of the filled-out form and all supporting documents for your records.

11

If needed, follow up with the tax assessor-collector - comanche office to ensure your form is processed correctly.

Who needs tax assessor-collector - comanche?

01

Anyone who owns property or pays taxes in Comanche County needs the services of the tax assessor-collector - comanche. This includes:

02

- Homeowners

03

- Business owners

04

- Landlords

05

- Vehicle owners

06

The tax assessor-collector - comanche is responsible for assessing and collecting property taxes, processing vehicle registrations and titles, and handling tax-related inquiries. It is essential for individuals and businesses in Comanche County to interact with the tax assessor-collector to fulfill their tax obligations and obtain necessary documentation related to property and vehicle ownership.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax assessor-collector - comanche for eSignature?

Once your tax assessor-collector - comanche is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get tax assessor-collector - comanche?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the tax assessor-collector - comanche in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the tax assessor-collector - comanche electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your tax assessor-collector - comanche in minutes.

What is tax assessor-collector - comanche?

The tax assessor-collector in Comanche is an official responsible for assessing property values for tax purposes and collecting property taxes.

Who is required to file tax assessor-collector - comanche?

Property owners in Comanche are required to file with the tax assessor-collector to report their property and pay the corresponding taxes.

How to fill out tax assessor-collector - comanche?

To fill out the tax assessor-collector paperwork in Comanche, you should provide your personal information, property details, and any relevant documentation requested in the forms.

What is the purpose of tax assessor-collector - comanche?

The purpose of the tax assessor-collector in Comanche is to accurately assess property values, facilitate tax collection, and ensure funds are allocated for local government services.

What information must be reported on tax assessor-collector - comanche?

Information that must be reported includes the property owner's name, address, property location, property dimensions, and any exemptions for which the owner may qualify.

Fill out your tax assessor-collector - comanche online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Assessor-Collector - Comanche is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.