Get the free Business Account and Banking Service Agreement

Show details

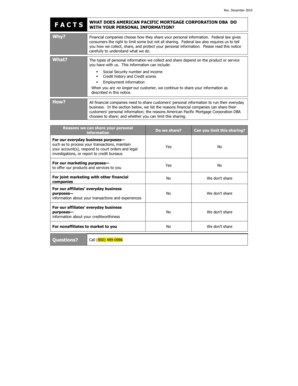

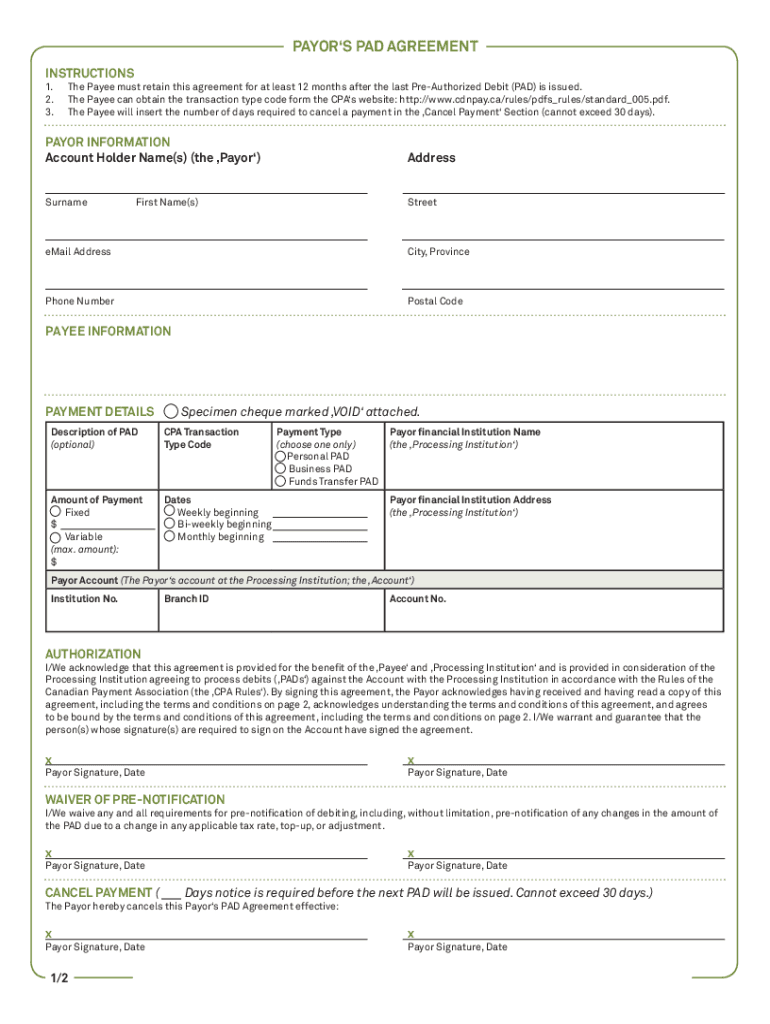

PAYORS PAD AGREEMENT INSTRUCTIONS 1.2.3.The Payee must retain this agreement for at least 12 months after the last PreAuthorized Debit (PAD) is issued. The Payee can obtain the transaction type code

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business account and banking

Edit your business account and banking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business account and banking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business account and banking online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business account and banking. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business account and banking

How to fill out business account and banking

01

Step 1: Gather all necessary documents required to open a business account, such as business registration documents, identification proofs, and proof of address.

02

Step 2: Research different banks and compare their business account offerings, fees, and benefits.

03

Step 3: Choose a bank that aligns with your business needs and preferences.

04

Step 4: Visit the chosen bank branch or access their online banking platform.

05

Step 5: Fill out the application form for a business account, providing accurate and complete information.

06

Step 6: Submit the application along with the required documents.

07

Step 7: Wait for the bank to review and approve your application.

08

Step 8: Once approved, follow the bank's instructions to deposit initial funds into the business account.

09

Step 9: Set up online banking access and any additional features or services required.

10

Step 10: Familiarize yourself with the bank's policies, fees, and account management tools.

Who needs business account and banking?

01

Businesses of all sizes and types require business accounts and banking services.

02

Entrepreneurs starting a new venture need a business account to separate personal and business finances.

03

Established businesses use business accounts to manage cash flow, track expenses, and facilitate financial transactions.

04

Businesses that want to accept electronic payments or process credit card transactions need business banking services.

05

Professional service providers, such as doctors, lawyers, and consultants, benefit from business accounts for invoicing and financial management.

06

Non-profit organizations and community groups rely on business accounts to manage donations and funds.

07

Business owners looking to build credit history and establish relationships with financial institutions need business accounts.

08

Overall, any individual or entity engaged in business activities can benefit from having a dedicated business account and banking services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in business account and banking without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit business account and banking and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out the business account and banking form on my smartphone?

Use the pdfFiller mobile app to complete and sign business account and banking on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit business account and banking on an Android device?

With the pdfFiller Android app, you can edit, sign, and share business account and banking on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is business account and banking?

A business account and banking refers to the financial services offered to businesses, which includes opening a business bank account and managing banking transactions such as deposits, withdrawals, and payments related to business operations.

Who is required to file business account and banking?

Businesses, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs), are generally required to file business account and banking depending on their revenue, structure, and local regulations.

How to fill out business account and banking?

To fill out a business account and banking, gather necessary financial documents, such as income statements and expense reports, then accurately complete required forms provided by the banking institution or regulatory body, ensuring all information is truthful and current.

What is the purpose of business account and banking?

The purpose of business account and banking is to manage a business's financial transactions effectively, separate personal and business finances, maintain accurate records for tax purposes, and facilitate business growth through better cash flow management.

What information must be reported on business account and banking?

Information that must be reported on business account and banking typically includes gross income, expenses, net income, any changes in ownership or structure, and relevant financial statements as required by the banking institution and tax authorities.

Fill out your business account and banking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Account And Banking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.