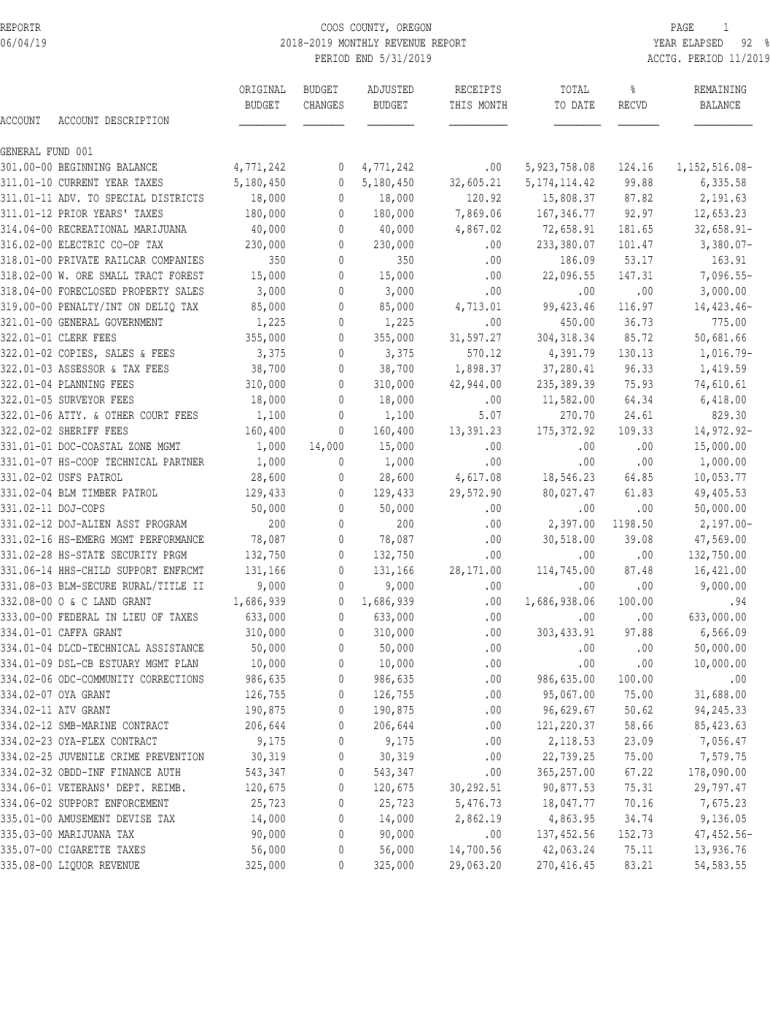

Get the free Revenue Report - Coos County Oregon

Show details

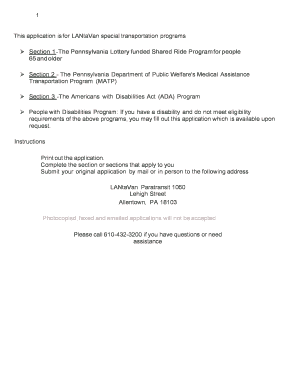

REPORT

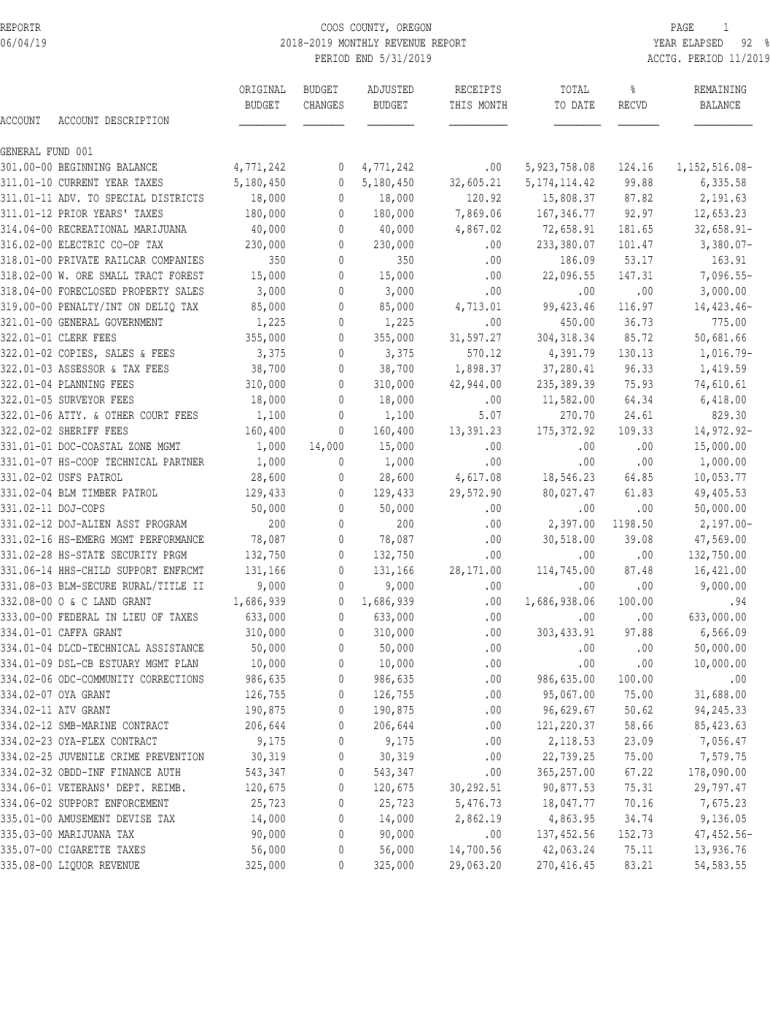

06/04/19ACCOUNTCOOS COUNTY, OREGON

20182019 MONTHLY REVENUE REPORT

PERIOD END 5/31/2019ACCOUNT DESCRIPTIONGENERAL FUND 001

301.0000 BEGINNING BALANCE

311.0110 CURRENT YEAR TAXES

311.0111 ADV.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue report - coos

Edit your revenue report - coos form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue report - coos form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revenue report - coos online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit revenue report - coos. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue report - coos

How to fill out revenue report - coos

01

To fill out a revenue report for coos, follow these steps:

02

Gather all necessary financial documents, such as sales invoices, receipts, and bank statements.

03

Identify the time period for which the revenue report will be prepared.

04

Calculate total sales revenue by adding up the amounts from all sales invoices within the chosen time period.

05

Deduct any sales returns or discounts given to customers during the same time period.

06

Include any additional revenue sources, such as interest income or rental income, if applicable.

07

Subtract any expenses directly related to generating revenue, such as cost of goods sold or advertising expenses.

08

Calculate the net revenue by subtracting all deductions from the total revenue.

09

Format the revenue report in a clear and organized manner, including headings, subtotals, and a final total.

10

Review the report for accuracy and make any necessary adjustments.

11

Submit the revenue report to the relevant stakeholders or authorities as required.

Who needs revenue report - coos?

01

Coos typically needs a revenue report for various purposes, including:

02

Internal financial analysis: Coos might need the revenue report to analyze its sales performance, identify trends, and make informed business decisions.

03

Tax compliance: Coos may be required to submit the revenue report to fulfill tax obligations and provide a transparent overview of their financial activities.

04

External stakeholders: Shareholders, investors, or lenders may request the revenue report to assess the financial health and profitability of Coos before making investment or lending decisions.

05

Regulatory authorities: Governmental agencies or regulatory bodies may demand the revenue report to ensure compliance with financial reporting standards and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the revenue report - coos in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out revenue report - coos using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign revenue report - coos and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete revenue report - coos on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your revenue report - coos, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is revenue report - coos?

A revenue report - coos is a financial document that outlines the income generated by a company or organization, typically detailing revenue streams, sources, and overall financial performance.

Who is required to file revenue report - coos?

Organizations and businesses that generate revenue are typically required to file a revenue report - coos, including corporations, partnerships, and certain non-profits depending on jurisdiction and regulations.

How to fill out revenue report - coos?

To fill out a revenue report - coos, gather financial data including sales figures, income sources, and expenses. Follow the provided format or template, inputting data accurately, and ensure all necessary documentation is attached.

What is the purpose of revenue report - coos?

The purpose of a revenue report - coos is to provide a clear and detailed overview of an organization's income, helping stakeholders assess financial health, make informed decisions, and comply with regulatory requirements.

What information must be reported on revenue report - coos?

The information required on a revenue report - coos typically includes total revenue, breakdown of income sources, expenses, net profit, and may also request specific details about fiscal operations.

Fill out your revenue report - coos online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Report - Coos is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.