Get the free Notes to Financial Statements - Coos County Oregon

Show details

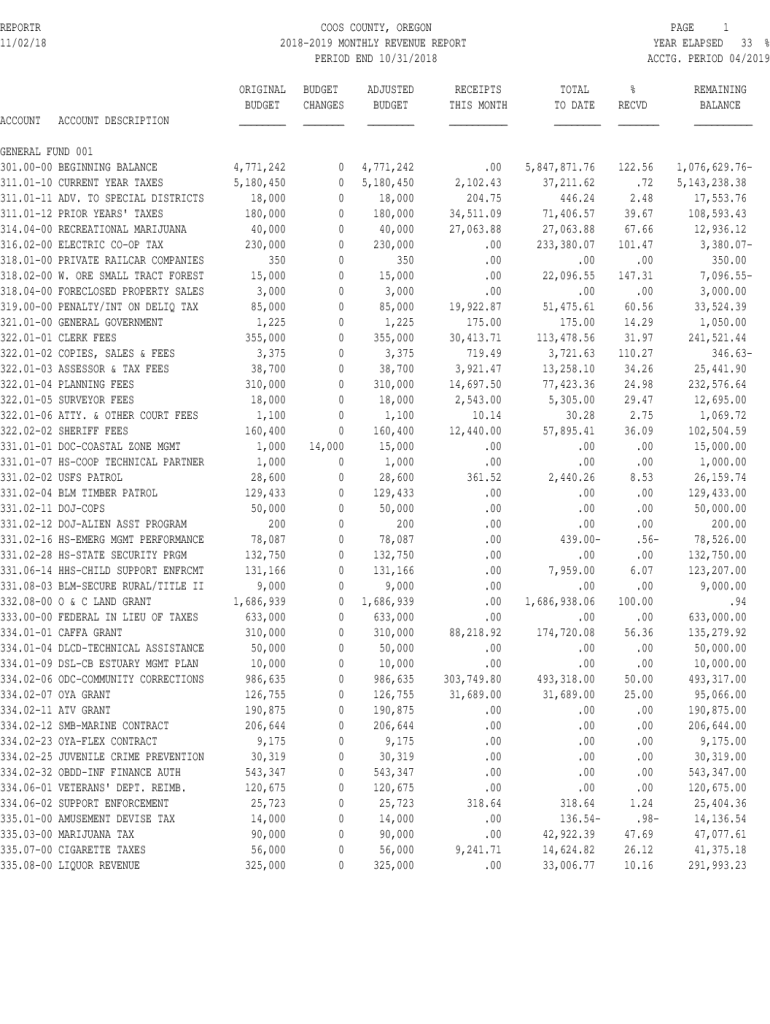

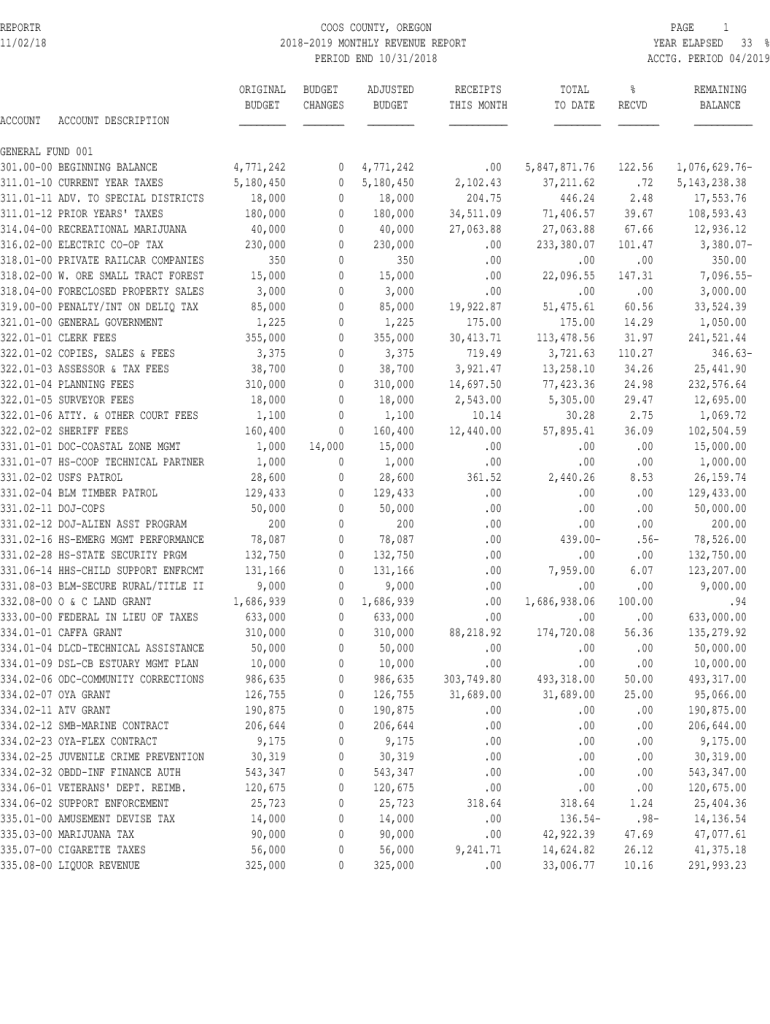

REPORTR 11/02/18ACCOUNTCOOS COUNTY, OREGON 20182019 MONTHLY REVENUE REPORT PERIOD END 10/31/2018ACCOUNT DESCRIPTIONGENERAL FUND 001 301.0000 BEGINNING BALANCE 311.0110 CURRENT YEAR TAXES 311.0111

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notes to financial statements

Edit your notes to financial statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notes to financial statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notes to financial statements online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit notes to financial statements. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notes to financial statements

How to fill out notes to financial statements

01

To fill out notes to financial statements, follow these steps:

02

Start by gathering all relevant financial information and documents, including balance sheets, income statements, and cash flow statements.

03

Review the financial statements and identify any items or transactions that require additional explanation or disclosure.

04

Organize the notes in a logical and systematic manner, ensuring that each note provides relevant and useful information to the readers of the financial statements.

05

Clearly label and number each note for easy reference.

06

Provide detailed explanations for any significant accounting policies, principles, or estimates used in preparing the financial statements.

07

Disclose any contingent liabilities or commitments that may have a material impact on the financial position of the entity.

08

Include information on related party transactions, if applicable.

09

Present any subsequent events that occurred after the balance sheet date but before the financial statements were authorized for issue.

10

Ensure that the notes comply with applicable accounting standards and regulations.

11

Review and edit the notes for accuracy, clarity, and completeness before finalizing and submitting them with the financial statements.

Who needs notes to financial statements?

01

Notes to financial statements are needed by various stakeholders, including:

02

- Investors and shareholders who rely on the additional information provided in the notes to make informed decisions about their investments.

03

- Lenders and creditors who use the notes to assess the creditworthiness and financial health of the entity.

04

- Regulators and government agencies who require the notes to ensure compliance with accounting standards and regulations.

05

- Analysts and financial professionals who analyze the financial statements to evaluate the performance and prospects of the entity.

06

- Management and internal stakeholders who use the notes to gain a deeper understanding of the financial position and results of operations.

07

- Auditors who review and assess the completeness and accuracy of the financial statements, including the notes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get notes to financial statements?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the notes to financial statements in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in notes to financial statements without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing notes to financial statements and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the notes to financial statements in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your notes to financial statements and you'll be done in minutes.

What is notes to financial statements?

Notes to financial statements are additional disclosures that accompany a company's financial statements, providing further detail and context to the figures presented in the main statements.

Who is required to file notes to financial statements?

Public companies and some private companies, particularly those that are required to follow Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), are required to file notes to financial statements.

How to fill out notes to financial statements?

To fill out notes to financial statements, gather relevant financial information, including significant accounting policies, explanations of line items, and any commitments or contingencies, and present them in a clear and organized manner that enhances the understanding of the financial statements.

What is the purpose of notes to financial statements?

The purpose of notes to financial statements is to provide transparency and additional information to stakeholders, helping them to understand the financial position and performance of the company in greater detail.

What information must be reported on notes to financial statements?

Information that must be reported includes accounting policies, details about assets and liabilities, contingencies, commitments, legal proceedings, and any changes in accounting estimates or principles.

Fill out your notes to financial statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notes To Financial Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.