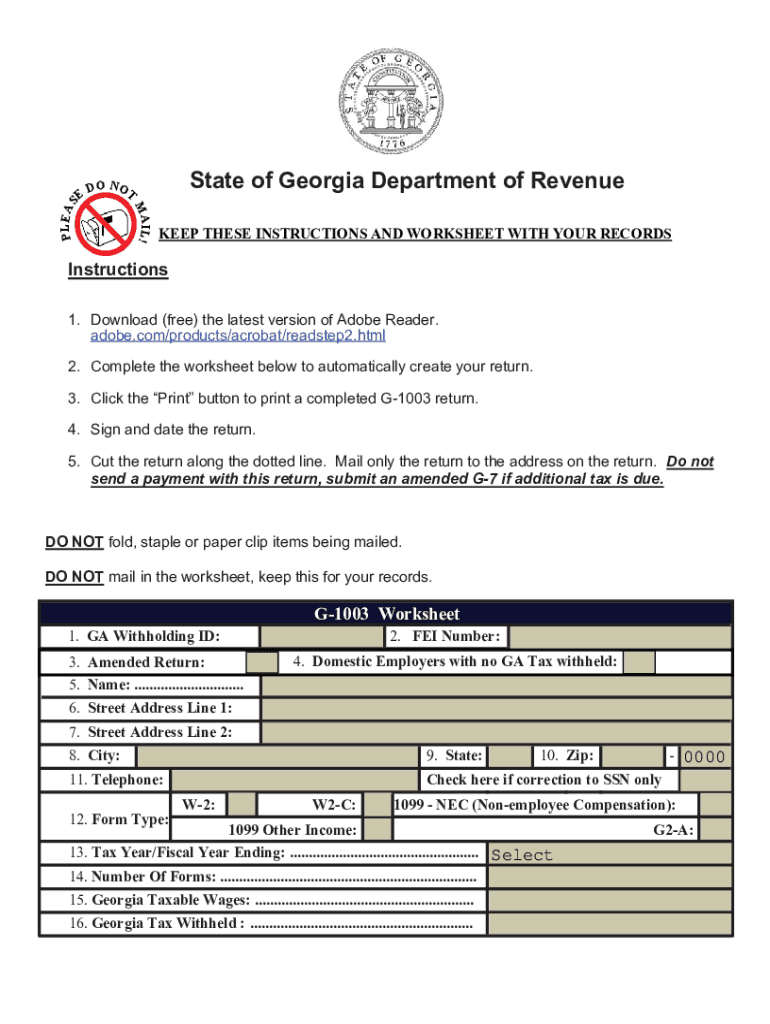

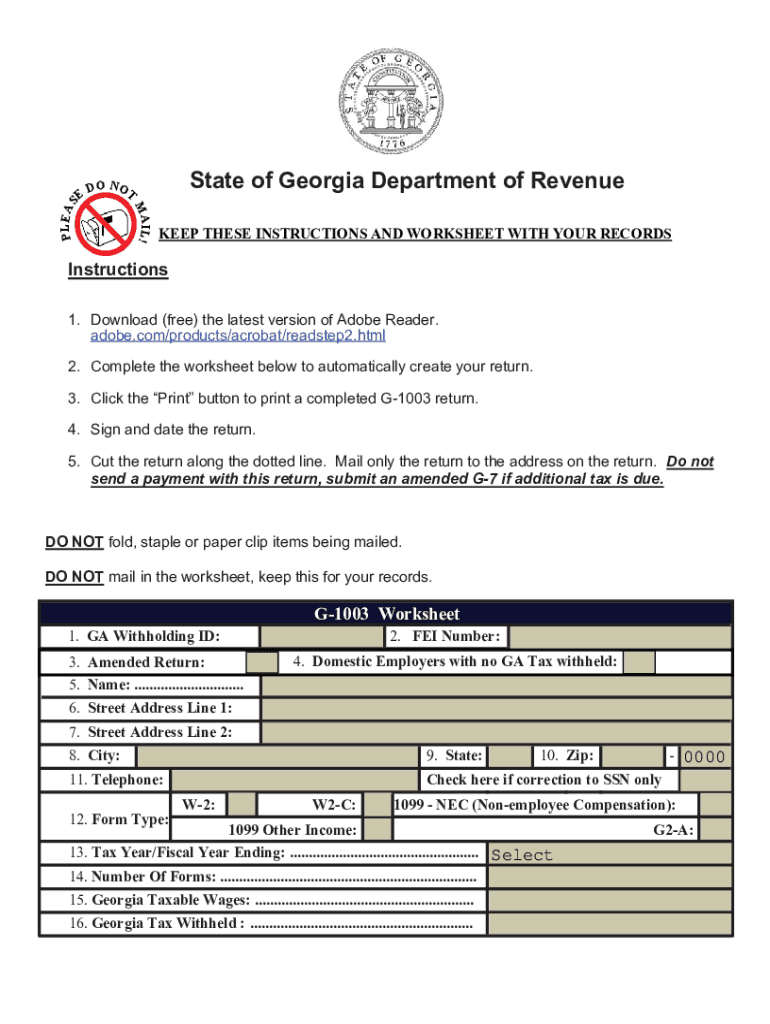

GA DoR G-1003 2023 free printable template

Get, Create, Make and Sign g 1003 fillable form

Editing georgia g 1003 statement pdf online

Uncompromising security for your PDF editing and eSignature needs

GA DoR G-1003 Form Versions

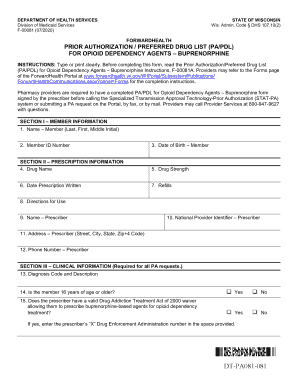

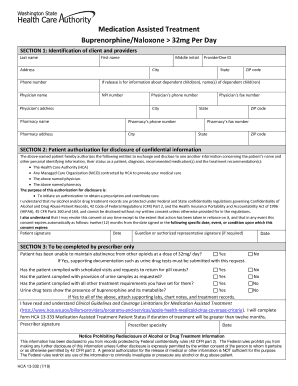

How to fill out form g 1003

How to fill out GA DoR G-1003

Who needs GA DoR G-1003?

Video instructions and help with filling out and completing 1003 form

Instructions and Help about ga dor g 1003 statement form

Phone 1003 yes from 1003 also known as uniformed residential loan application good low it is, and it is really an important form if you want to apply for a mortgage lets learn the part of this form the new form according to Fannie Mae it is a 10 as it is a 9 pages form on which initial 5 pages are asking about the details of borrowers and other four pages contains instructions lets start at the beginning you need to fill borrower and Cooper horse name in first block section type of mortgage and terms of loan you need to define which kind of mortgage you are taking agency case number and the number interest this will be done by the lender property information and purpose of loan the property you are seeking loan for you need to provide information and which kind of loan you are looking the purpose of loan because in you in the US you have the refinancing option you have our newly purchased is option section 3 contains borrowers information section 2 was related with property information now here on the left side you need to provide borrowers information on the right-hand side you need to provide Co borrowers information barbers in for a name social security number and personal information now section full contains the employment information yes it is really an important thing as it is going to show you show the inability of the borrower and area of work and where he is employed the nature of work if he's self self-employed then they need to provide information monthly income and this is section five that contains monthly income and calm white housing expenses whatever the income they're getting coal or borrower and how much expense they do number six contains the asset and liabilities so yes they need to provide whatever that they own and liabilities they have such as credit card some other loans in Section seven and section 8 there are details of transaction if they have done something and some declaration about like some cases against the borrower Captors bankruptcies they have file, so you declare that section 9 C is the agreement acknowledge you need to say this is the whatever the clause is you need to and there is an in you need to sign that whatever the terms the blenders are giving you to sign on they form the 1003 form is used when you are interested to taking mortgage at initial level and after that some verification of the information you have provided lender also create a final 1003 that will be very that contains verified information and that well show the land our that information can be taken for the decision purpose, so we come to know about the basic idea of 1003 from universe uniform residential loan application according to Fannie Mae thank you for listening and watching

People Also Ask about ga form 1003

What is form G2 FL?

What is form g2a?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form g 1003 2023 from Google Drive?

Can I create an eSignature for the ga g 1003 return form fillable in Gmail?

How do I edit georgia g 1003 form on an Android device?

What is GA DoR G-1003?

Who is required to file GA DoR G-1003?

How to fill out GA DoR G-1003?

What is the purpose of GA DoR G-1003?

What information must be reported on GA DoR G-1003?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.